Nike reported an awesome quarter Tuesday evening. The stock is […]

Covid Fitness Habits Die Hard: PTON, NLS, NKE: BRK.B

Covid Fitness Habits Die Hard: PTON, NLS, NKE: BRK.B

U.S. consumers didn’t succumb to lethargy when gyms and fitness classes temporarily shuttered last year – They adapted.

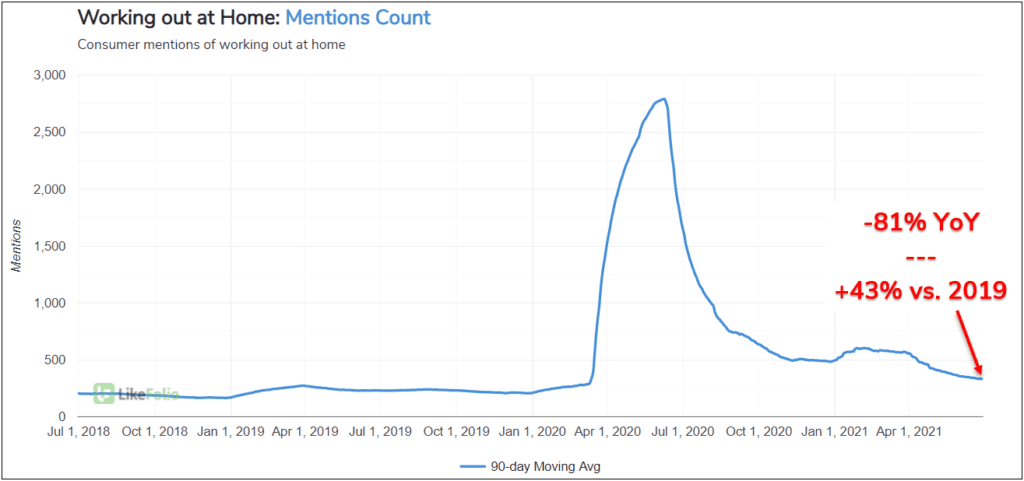

At the outset of the lockdowns, we saw a massive increase in mentions of working out at home, exemplified by the meteoric rise of home fitness names like Peloton ($PTON) and Nautilus ($NLS).

Although these Mentions have experienced significant normalization (down -81% YoY), they are showing lingering strength relative to pre-COVID levels: +43% vs. 2019 on a 90-day moving average.

.

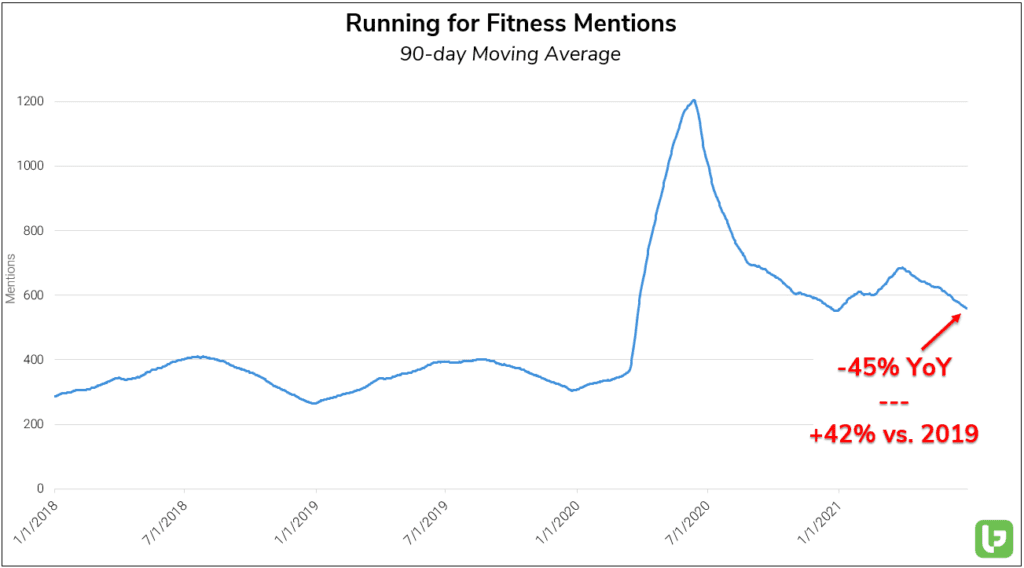

The number of consumers talking about running for fitness, which also spiked to record levels during the pandemic, has demonstrated similar staying power, trending +42% vs. 2019 on a 90-day moving average.

The continuation of this trend has been a boon for brands selling running shoes, such as Nike (NKE) and Brooks (BRK.B). In fact, the CEO of Brooks Running recently commented that the company is experiencing a “secular running boom.” The stickiness of these behaviors suggests that consumers have gotten hooked on new types of exercise and that traditional gyms might have a slow recovery ahead of them.