Despite recent market volatility and some arguing for a bear […]

Did Robinhood Miss its Chance to Cash in on Meme Magic? ($HOOD)

Did Robinhood Miss it's Chance to Cash in on Meme Magic? ($HOOD)

The upstart online brokerage, Robinhood Markets, Inc., officially filed for an IPO yesterday.

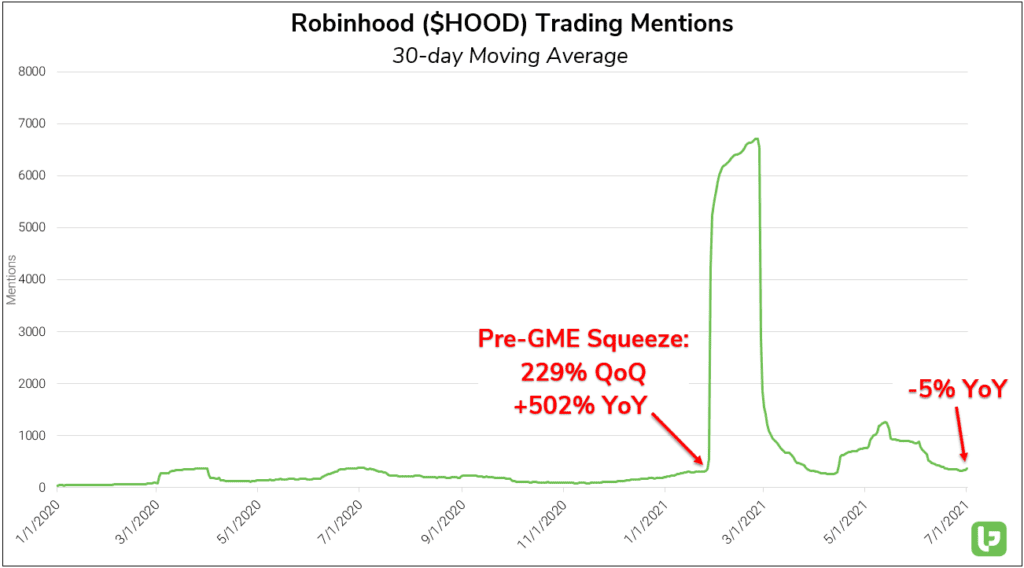

The company has been toying with the idea of a public offering for more than 2 years…Its situation has changed radically since then (improved or worsened, depending on your viewpoint). Beginning at the start of the COVID lockdowns and continuing throughout 2020, more and more Americans began to enter the financial markets for the first time -- Robinhood became the de-facto trading platform for a new breed of retail investors…Investors who have since drawn national attention with their paradigm-shattering antics. The collective force of these new traders bears out in the online brokerage’s underlying Mentions. Even before the $GME squeeze, an event that cemented Robinhood and the WallStreetBets apes in the annals of financial history, the number of individual investors talking about trading on Robinhood was trending +229% QoQ and +502% YoY on a 30-day moving average.

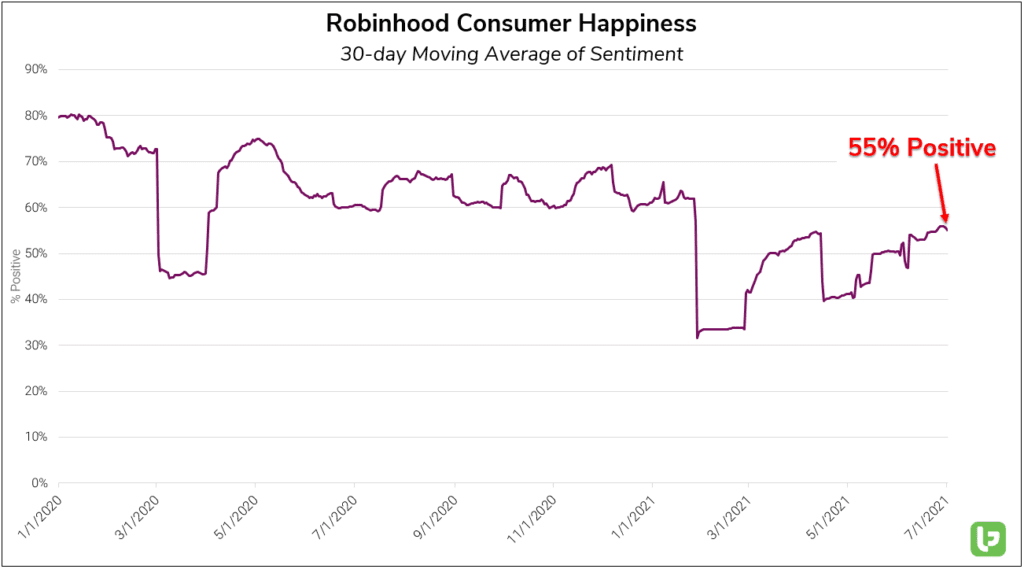

The explosion higher seen on the trendline above mirrors the remarkable growth stats seen in the company's IPO filings. However, retail investment mentions have to halt in recent months: -5% YoY. Looking at the underlying Sentiment Mentions, it's clear that Robinhood's actions during the $GME squeeze engendered a sizable amount of animosity in the same group of traders responsible for the platform's meteoric rise.

Robinhood's success has come at a steep price. The company is facing multiple class-action lawsuits and a regulatory probe. Additionally, the company disclosed that 34% of its cryptocurrency trading revenue in Q1 was attributable to Dogecoin ($DOGE-USD), a digital asset that has outpaced the market in terms of recent losses.

There's a lot of black clouds circling above this pending IPO, but RobinHood's decision to reserve 35% of its IPO shares for platform users could help stimulate the wild-card element that has brought the company so much success in the past.