Lululemon (LULU) As we prepped this chart for send today […]

Does GME still have Magic left in the Tank?

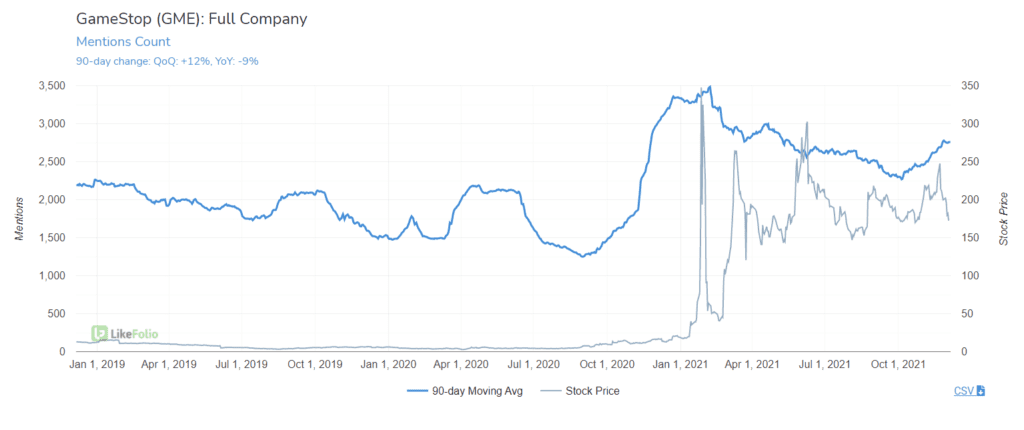

GameStop changed the game in 2021. The trading game, at least. Trader mentions of GameStop's ticker symbol $GME have increased more than 2,000% in 2021 vs. 2020. And we're talking a LOT of mentions. Mention volume exceeded 135,000 on a single date in January earlier this year in response to a Reddit-driven phenomenon pitting "average" investors vs. behemoths of Wall Street, who were betting on GameStock going to $0. But what does this mean for GameStop, the company? 1. The GameStop brand received a massive boost to consumer awareness levels. Just check out GameStop's consumer-based mention volume.

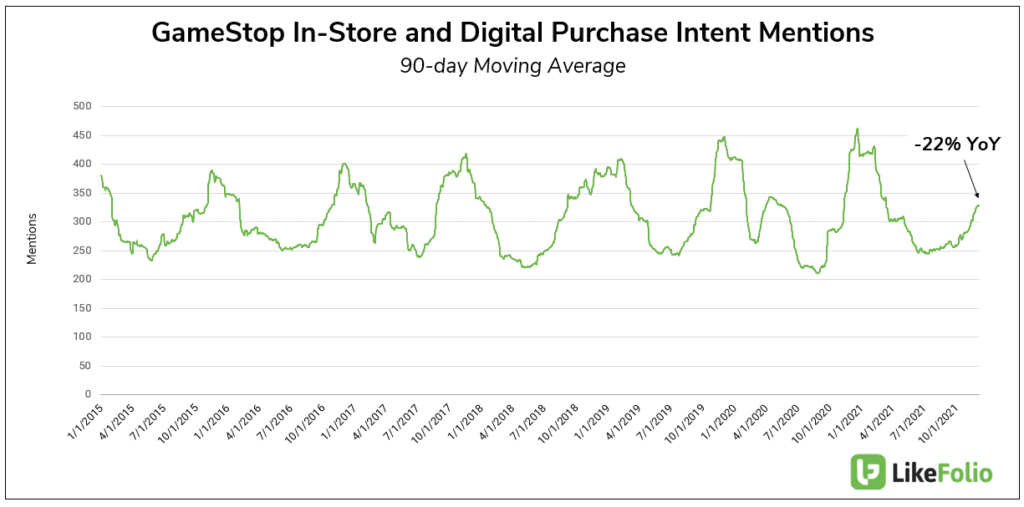

While levels have tempered vs. the pinnacle of 2021 madness, these remain +73% higher vs. 2019. 2. This brand awareness has not led to a long-term shift in consumer purchasing behavior. Last quarter, GameStop shares traded down -7% following the company's report due to wider than expected losses. While the company touted investments in its digital footprint (including the lease of a 530,000-square-foot fulfillment center in Reno), LikeFolio data does not show meaningful traction -- or at least enough to offset the in-store weakness. Comprehensive mentions of purchasing something in GameStop or from GameStop have dropped -22% YoY.

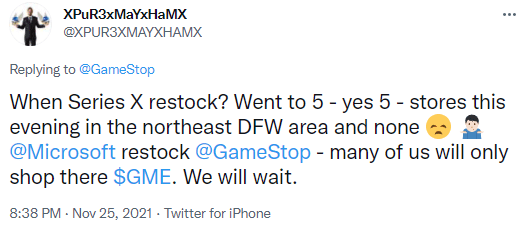

Much of this is due to the popularity surrounding new gaming console launches a year ago. 3. GameStop's remaining consumer base appears loyal. As mention volume tapers, consumer demand has rebounded above pre-WallStreetBets levels: +10% YoY. Tweets reveal a swath of consumers who state, they only shop at GameStop.

While it's important to support a loyal base of users, analysis suggests it may not be enough.