A Promising Public Offering: DUOL Duolingo, a provider of language […]

Early New Year Resolution Winner

Many consumers are getting an early jump on New Year's Resolutions.

Others have been on this particular train for some time now.

What train are we talking about? Learning a new language.

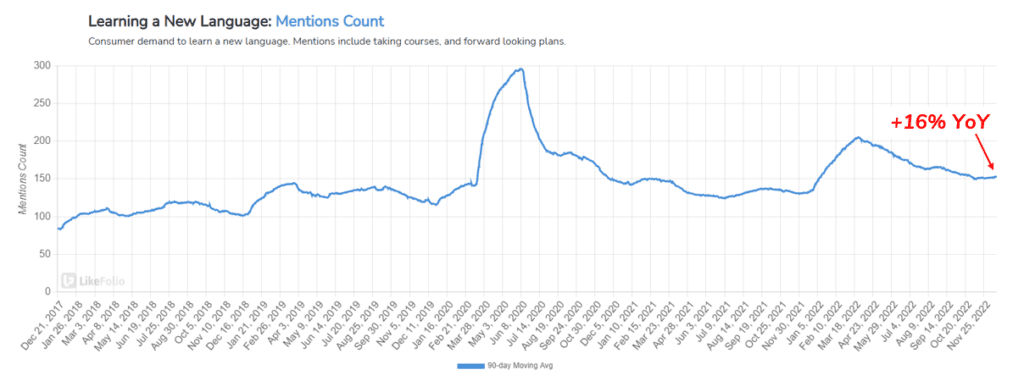

Consumer mentions of learning a new language are ticking up at the end of the year, currently pacing +16% higher vs. 2021 levels.

And this growth is expected to continue…especially among digital tools.

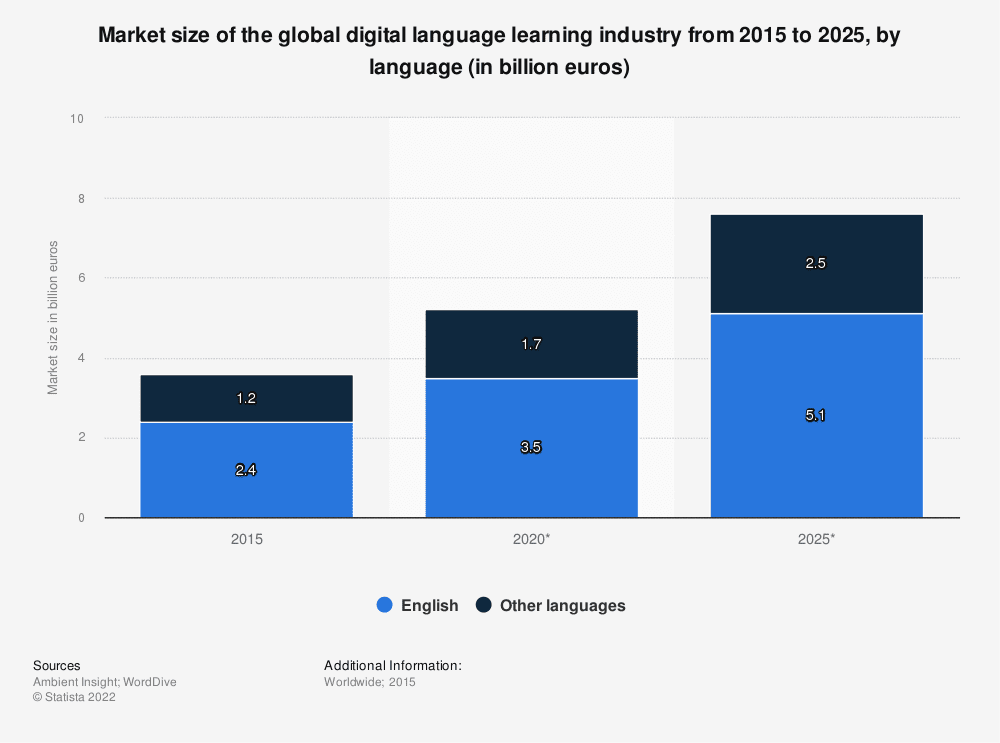

The global digital language learning industry is expected to exceed $7.5 billion (in euros) by 2025.

Duolingo (DUOL), a gamified language learning app may be best positioned to take advantage of this growing market.

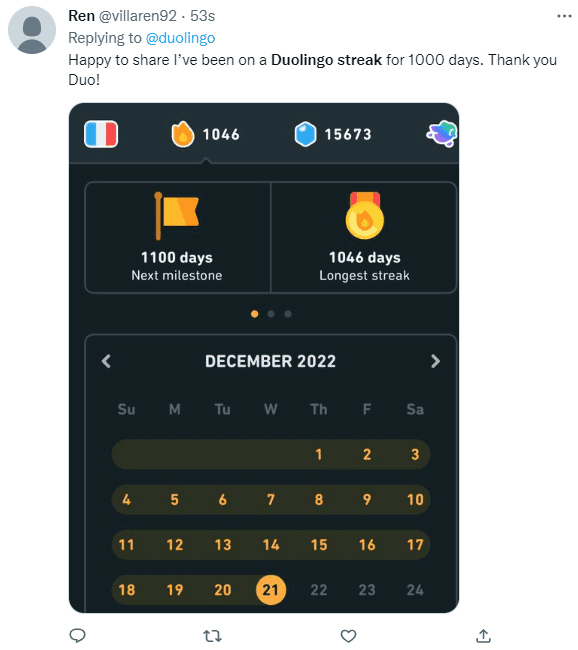

The platform is addictive, according to users, with many reporting multi-year streaks of daily engagement.

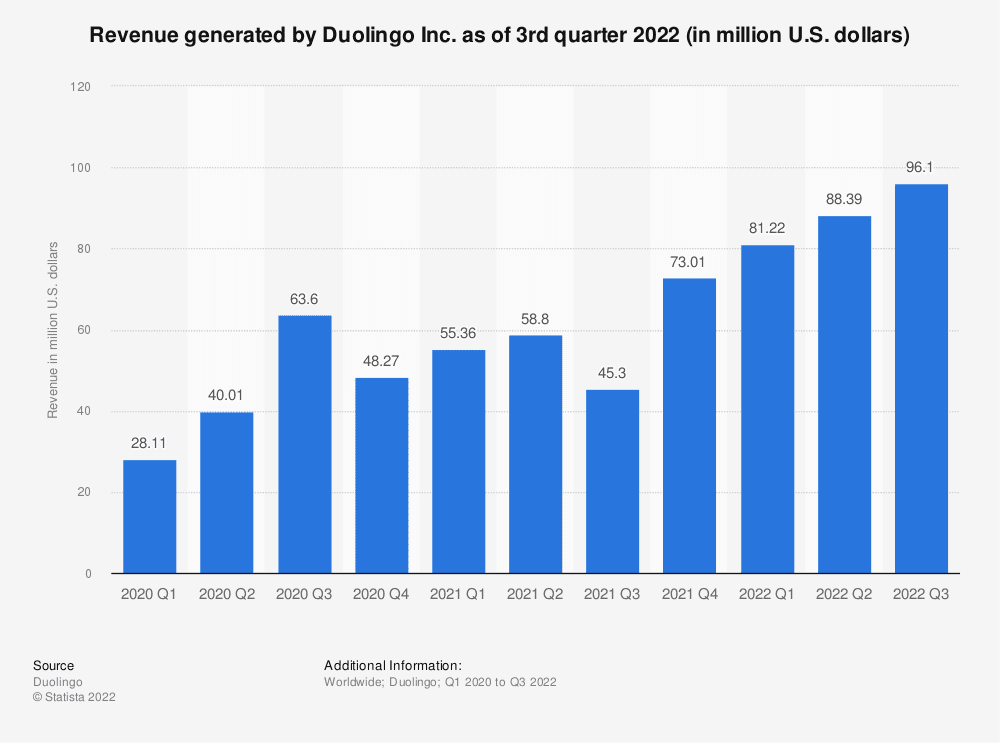

Despite more than doubling revenue on a YoY basis in the third quarter, DUOL shares have been punished of late as investors express concerns about profitability.

According to LikeFolio data, the app has plenty of runway for future growth.

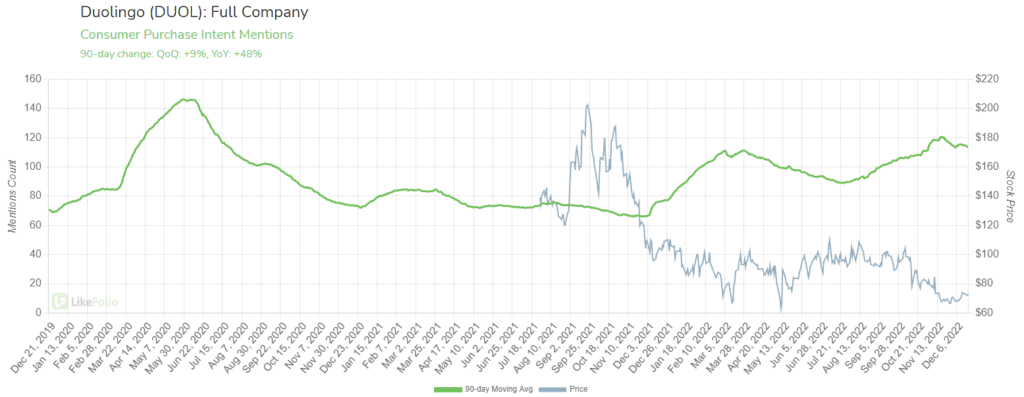

Demand mentions have jumped on a QoQ and YoY basis, maintaining prior levels of growth and besting overall macro trend growth – both positive signs long-term.

With DUOL shares trading -30% lower on a YoY basis, a classic divergence opportunity may be developing – this occurs when consumer demand growth is trending in one direction and the stock price is trending in the opposite way.

We’ll be monitoring this demand through the start of the New Year to confirm continued strength. If so (and if the company can execute internal plans to improve profitability) – the market may be in for a surprise.