Carvana Demand Approaching All-Time Highs LikeFolio published a Bullish alert for Carvana […]

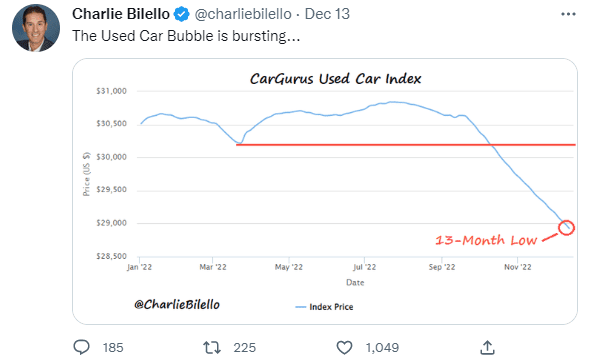

This Bubble is Bursting…But Are Consumers Buying?

Only one core CPI item's prices are down year-over year. Used vehicles.

The latest inflation reading showed that pre-owned cars and trucks cost 3.3% less than they did a year ago.

With airline tickets and gasoline more expensive, a transportation sector that has taken strapped consumers for a ride is finally slowing down.

It’s a welcomed sign for car buyers that have faced unprecedented sticker shock in the form of used cars that actually appreciate in value. At the height of the craze, the prices on some models soared above fresh-out-of-the-factory prices.

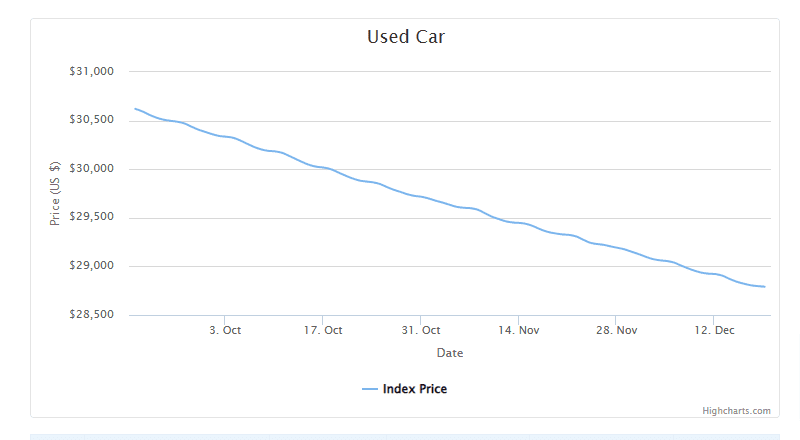

Today, used car prices are at a 13-month low.

The used car bubble is not just bursting, it’s reversing fast.

Three months ago, the average used car went for $30,634. Today, $28,846 is the average going rate. A 6% decline since late September means the price decline is accelerating heading into the new year.

With the exception of convertibles, the prices on all used vehicle body styles have decreased over the last 90 days.

Since gas prices have moderated, used EVs and hybrids have seen some of the sharpest declines. The average pre-owned Tesla price is under $55k compared to almost $65k just three months ago.

Consistent with what we’re seeing in other high-end market segments, luxury brands like Ferrari and Lamborghini are still going up in price. Prices on practically every other used car brand are heading downhill.

Meanwhile, new car prices are still up about 7% YoY.

So that must mean consumers are shifting into high gear to take advantage of lower prices on used wheels.

Not so fast.

There is another force at play.

Interest Rates are Climbing

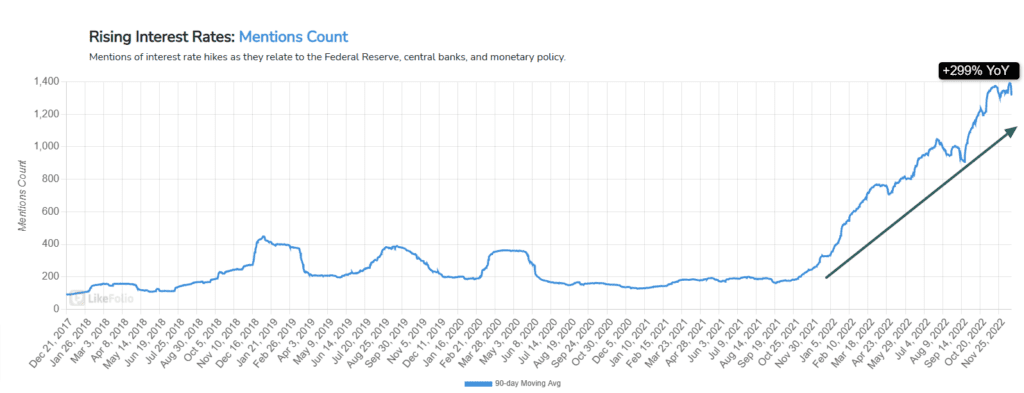

Consumers are increasingly concerned about rising interest rates.

The Fed’s latest rate hike of 0.5% brought the benchmark interest rate to its highest level in 15 years—and was accompanied by a signal that rates are headed higher in 2023.

Since this is expected to have major ripple effects on the economy, interest rate jitters are climbing.

LikeFolio consumer mentions of interest rate hikes have quadrupled YoY!

Many social media discussions revolve around how difficult it is becoming to take on debt with rates as high as they are.

We learned from Q3 bank earnings that credit loss provisions are up and loan originations down as consumers and businesses feel the pinch.

Fed 1. Lending activity 0.

Rates on mortgages, personal loans, and credit cards are not just weighing on Americans’ minds, they’re impacting purchase decisions. The used vehicle market is no exception.

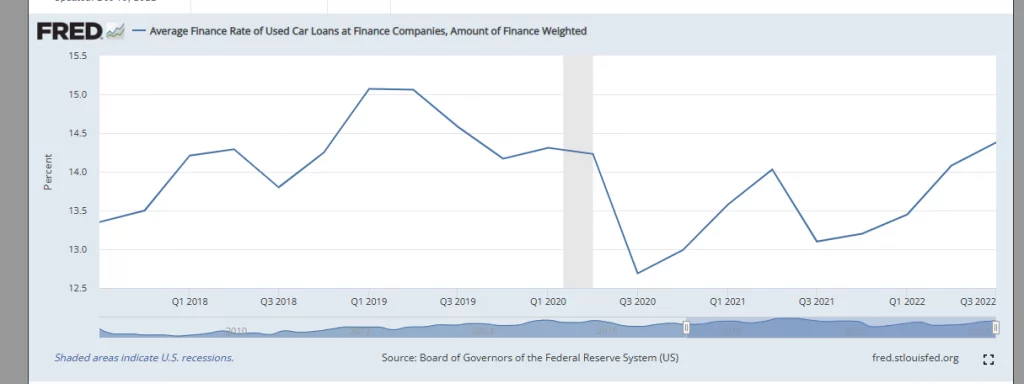

The average used car loan rate is 14.4%, the highest in 3 years.

That makes the annual interest payment alone on a $28k used car more than 4 grand! On a 60-month loan, it equates to a monthly car payment of about $700, a hefty amount for most households already dealing with higher grocery and utility bills. Add in the insurance and maintenance and owning a used car is still a very costly undertaking.

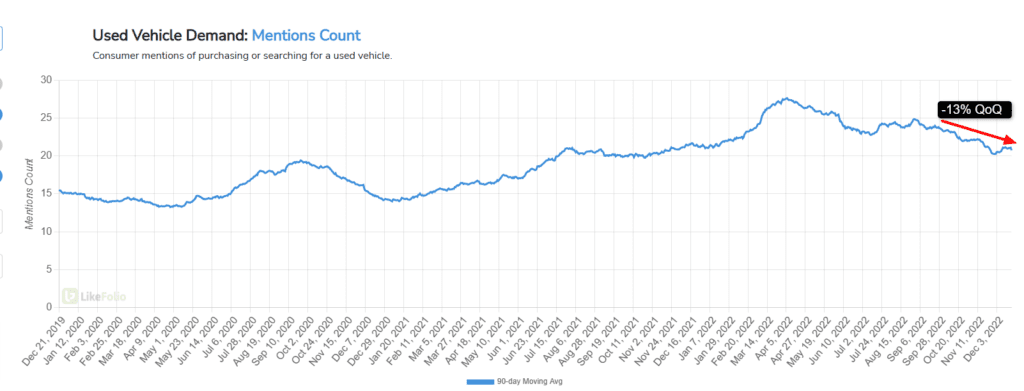

Used Car Demand is Down

During the early pandemic, automakers struggled to produce new vehicles due to supply chain constraints and semiconductor shortages. Dealer lots were bare and used car demand (and prices) soared.

Lately, supply chain pressures are easing and new auto inventories are improving.

Unfortunately, this is coming at a time when both new and used car loan rates are rising.

At least for now, high financing terms appear to be the stronger force when it comes to buying a used car.

Mentions of shopping for or purchasing a used vehicle are down -13% QoQ. Since their April 6th peak, they are down -25%.

We suspect there is another factor at play here. Inflation.

Inflation Fear mentions are up 215% YoY and have only moved higher since last quarter despite the lower recent CPI tape.

This tells us that consumers are still very worried about inflation’s impact on their budgets and about where the economy is heading in 2023.

“Seemingly everyone from small businesses to mega cap tech companies are laying off workers. Will I lose my job?”

“Hmm, maybe now is not the best time for a big ticket purchase.”

“Sure, interest rates may only be heading higher but does taking on a big monthly bill make sense right now? And besides, used car prices while down from last year are still up a lot from a few years back.”

Free oil changes and doughnuts may not be enough for used car dealers to attract buyers. Because of rates and inflation, prices are probably going to have to go much lower.

J.P. Morgan sees used car prices dropping another 10% to 20% next year.

Assuming they do, which used car retailers are in the best position to win?

Carvana is a Big Wreck

Frankly, Carvana may not even be in position to do business.

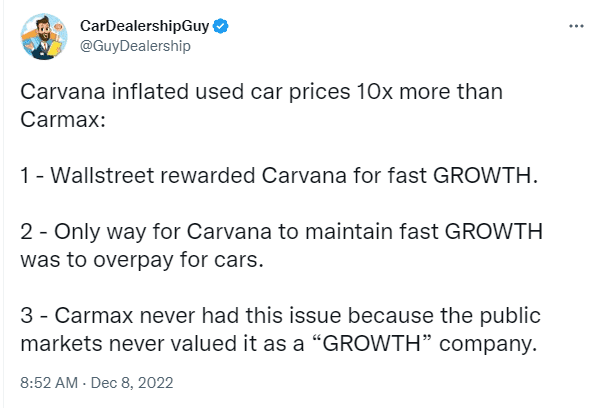

The auto dealer appears headed toward bankruptcy following a series of missteps that have led to huge losses.

Pressured by Wall Street to deliver high growth, Carvana stocked up on used cars to fill its vending machines and lots. Problem is, it paid car owners too much. Then paid even more to refurbish vehicles and tried to ride the used car boom by marking up used 2014 Chevy Malibus.

Now prices are crashing down and with it perhaps Carvana’s business.

In Q3, CVNA reported its first YoY revenue decline and a wider-than-expected $2.67 per share net loss. Worse yet, a 95% debt-to-capital ratio in a period of rising rates makes for an uphill battle.

Management asserts that the company has “substantial liquidity” and is “singularly focused on executing on the plan to profitability”. The market thinks otherwise.

Nearly $44 billion has been slashed from Carvana’s market cap this year amid the stock’s 98% plunge.

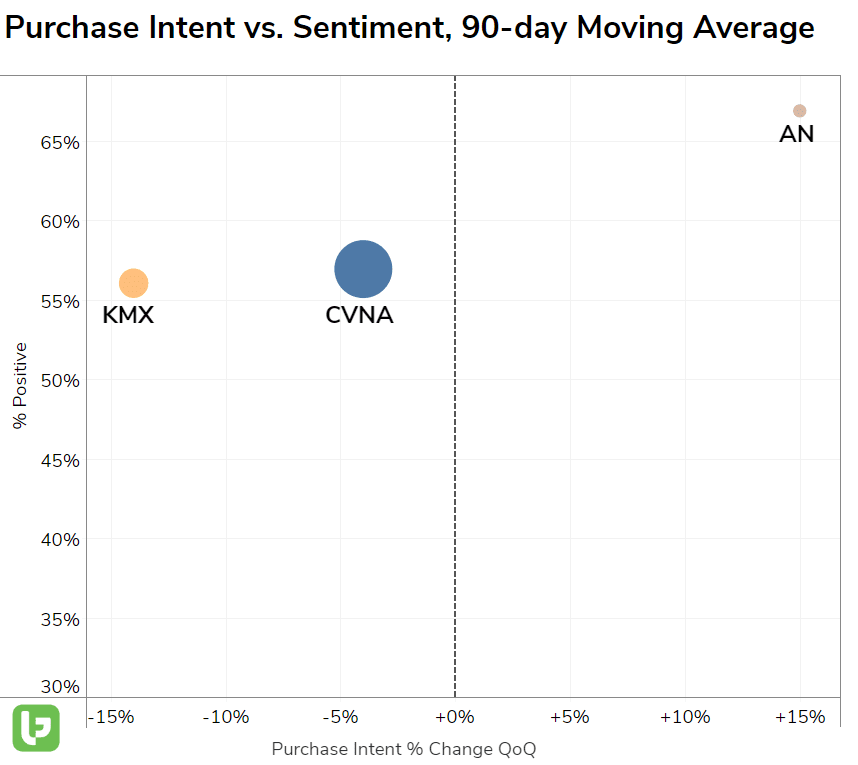

Yes, Carvana as a brand does have value. LikeFolio mentions exceed those of other used auto retailers by a mile.

However, there are two problems: 1) YoY consumer demand is as flat as a punctured tire and 2) Sentiment is low. Promises of hassle-free selling and buying have come with headache-full delivery delays and customer service.

Damage control is needed and a restructuring likely.

Whether or not this has a positive effect on brand image and demand remains to be seen.

AutoNation is a Big Winner

At the other end of the spectrum is AutoNation.

Purchase Intent Mentions are up 48% YoY on a 90-day average and Sentiment is 70% positive. Both metrics are crushing used car retail peers.

Car buyers love AutoNation’s one-stop shopping experience. At a time when consumers crave convenience, AN’s vehicle financing, insurance, repair, and maintenance services are a differentiator.

Similar to financial and health matters, people like having all of their auto-related needs handled by one company. Running all over town to meet with the insurance guy and then the collision shop is so 2019.

AN’s Q3 sales increased 4% and profits jumped 23%.

Granted, AN also sells over 30 brands of new vehicles, but the used car business is holding its own. Used vehicle sales grew 3% and accounted for 36% of total revenue. They are a major part of the growth strategy. The company is aiming to 10x its used vehicle store count to 130 by the end of 2026.

Whereas CVNA has tried to grow by acquiring vehicles, AN is acquiring dealerships and other areas of the vehicle ownership lifecycle. It just wrapped up the acquisition of auto finance outfit CIG Financial to help keep more customers under the AN roof.

AN’s omnichannel approach is working versus a sea of store-only and online-only car dealers. Already the largest auto retailer in the U.S., there is still plenty of room for growth in this highly fragmented market.

Investments in technology including self-service options that let customers get fast appraisals and financing offers fit nicely with broader DIY trends—and bode well for market share gains.

Regardless of where used car prices and interest rates go, AN looks to be in the driver’s seat for the future of used car buying,

In the immediate term, though, look for the tug-of-war between falling prices and rising rates to continue. For now, high rates are making used cars largely unaffordable.

Will there be a point where low prices offset high rates?

If so, will higher sales volumes come at the expense of lower margins and profits for used car companies?

Stay tuned…