This week's Sunday Earnings Sheet is off to a good […]

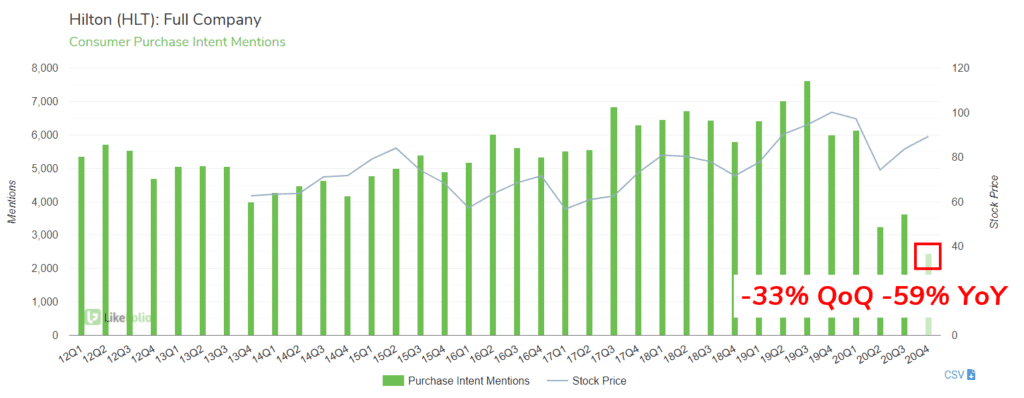

Hilton Worldwide is really TRYING to recover

Hilton Worldwide (HLT)

In news to no-one, fewer consumers are booking hotel rooms this year vs. last year.

Hilton 20Q3 Purchase Intent exhibited some recovery during Summer "high season" ( +12% QoQ) and is now trending lower.

Peers Marriott (MAR) and Hyatt (H) are exhibiting similar softening of demand as we enter a typical "low season" for lodging groups.

But stand-alone, peer-to-peer units don't appear to be as severely impacted.

HLT's outlook is grim. Last quarter the market had a muted response (-2%) to a big earnings miss.

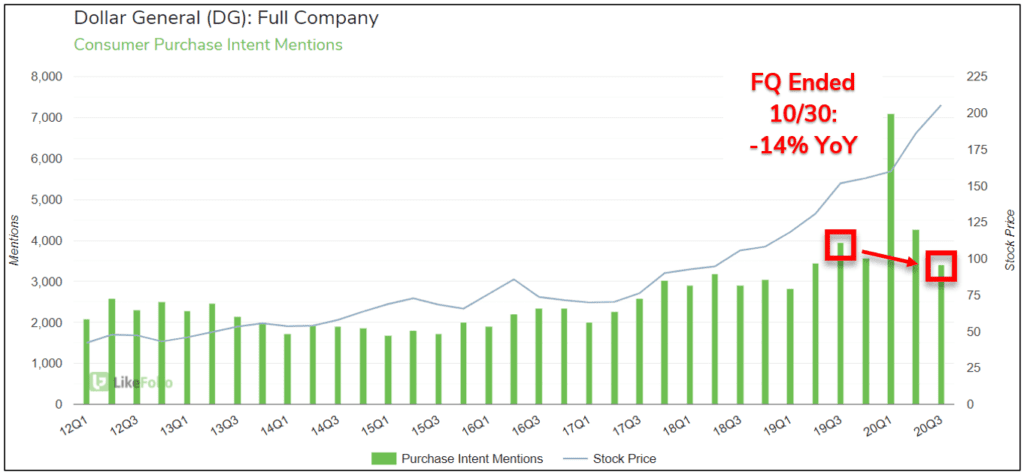

Dollar General (DG)

Dollar General has added more than $20B to it's market cap since March, with shares up roughly +35% YoY. LikeFolio data clearly demonstrates the surge in demand which brought about these gains, but it also shows a troubling slowdown in the recently ended quarter...Purchase Intent down -14% YoY.

DG reports earnings in late November. Will it be able to turn things around before then?

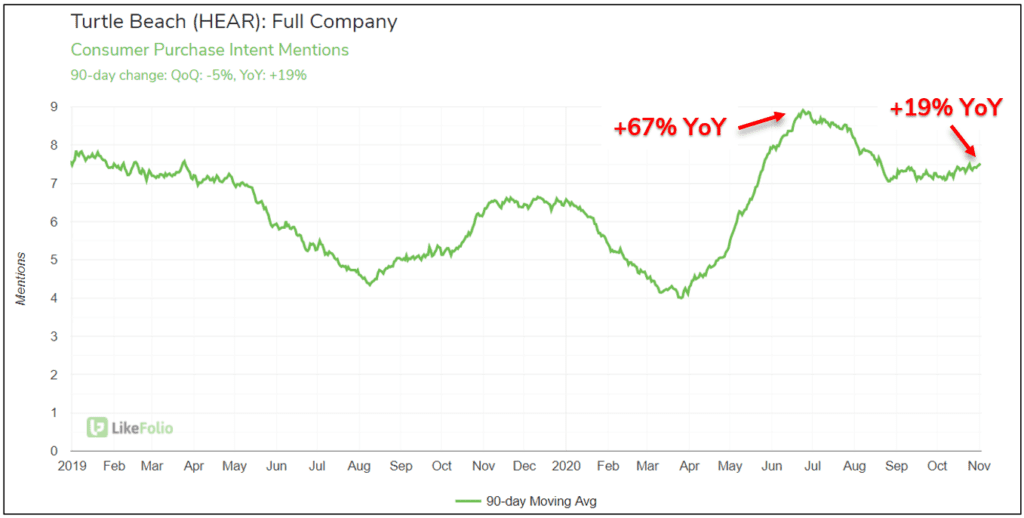

Turtle Beach (HEAR

Turtle Beach shares are trading higher today after Wedbush upgraded the stock ahead of its 20Q3 earnings release (Thursday after market).

Although Purchase Intent mentions remain elevated on a YoY basis, growth has slowed significantly from the boom seen earlier this year. With the next generation of gaming consoles set to release next week, we'll be watching this name intently in the coming months.