Call it narcissism, or call it knowing exactly what you […]

Home Improvement has Near-Term Staying Power

June 22, 2021

Home Improvement has Near-Term Staying Power

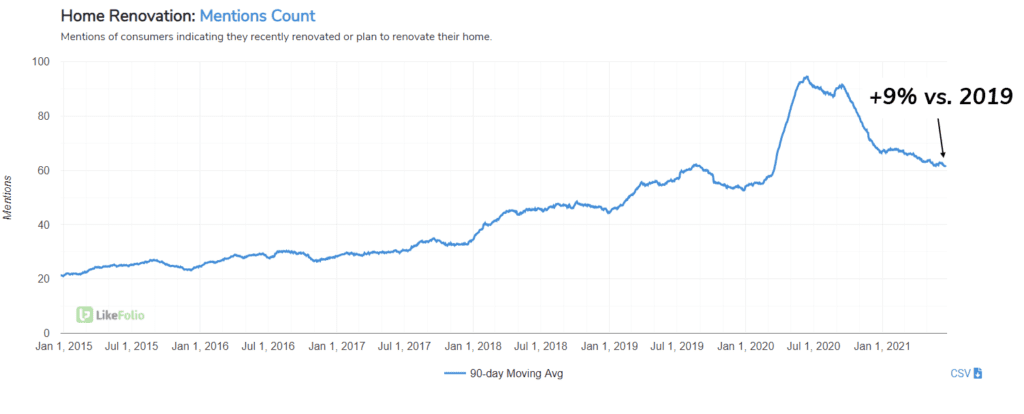

Home Improvement is waning, but settling higher vs. pre-covid levels: +9% vs. 2019.

This is in line with other trends we track, exhibiting significant increases vs. 2019:

- Refinancing: +70%

- Urban Exodus: +20%

- Buying a Home: +20%

- Building a Home: +18%

In fact, mentions of Urban Exodus (leaving the city for a more rural area) are showing momentum, increasing +7% QoQ. All of these trends serve as tailwinds for companies selling home goods. From a company perspective, there are a couple of interesting things happening.

Key Takeaways:

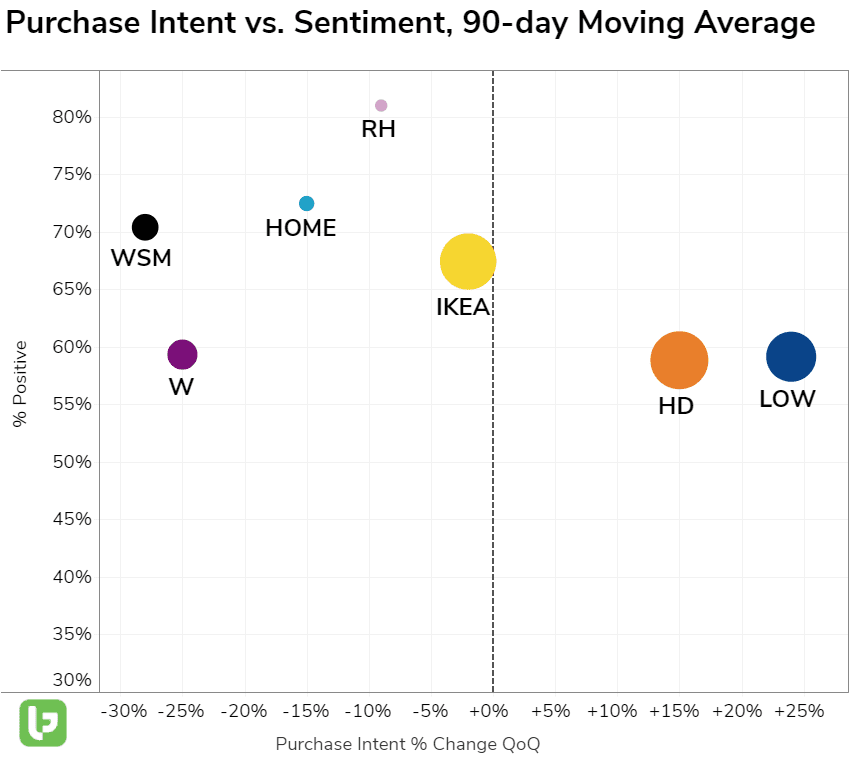

- Last year, we recorded massive upticks in demand for digital-heavy home goods providers: Wayfair, IKEA, and even HOME who deployed a well-received Buy-Online-Pickup-In-Store strategy.

- As localities reopen, we're seeing significant strength out of Home Depot and Lowe's specifically. The omnichannel approach is working, and the expansive physical presence is now working to each company's advantage.

- Wayfair demand growth is slipping. While International sales are increasingly important for the company, domestic sales comprise the largest percentage of revenue.

- Williams-Sonoma Demand is waning on a QoQ basis, but it is gaining in Consumer Happiness levels. Sentiment has actually improved +6% QoQ.

- From a Happiness perspective, Restoration Hardware stands far above peers. Sentiment is more than 80% positive and +9% higher YoY. This company provides a superior experience for its key segment of loyal consumers.

- IKEA and HOME are relatively neutral. We would like to see demand a bit stronger out of HOME, considering they DO boast an omnichannel strategy and are severely underperforming Lowe's and Home Depot.

We've got a close eye on this trend and the relevant players in the space beyond the seasonal summer months.