A pan-selloff has taken place over the past 2 trading […]

Investor Wellness Check: Buying the Dip?

Investor Wellness Check: Buying the Dip?

Two weeks ago, the financial markets hit a new all-time high…Since then, the bears have been in charge, with a blanket pullback affecting all sectors. Small caps took the hardest hit, with Russel 2000 down nearly -10% from the recent ATH.

The market had been grinding higher for several months, so a correction wasn’t unwarranted. But, in these uncertain times, many pundits are quick to label any move lower as the start of “the big crash.” So, how are individual investors holding up in the face of a potential doomsday scenario?

LikeFolio data suggests they’re not particularly phased.

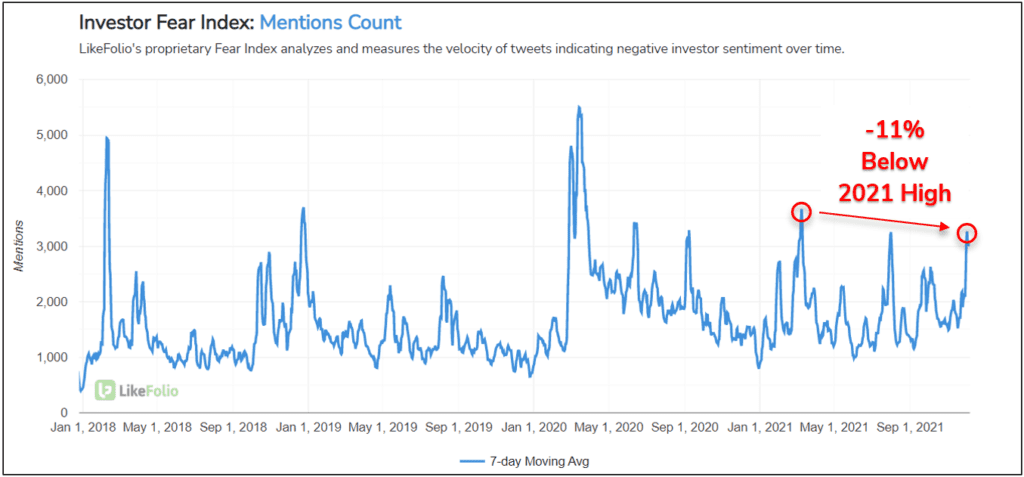

The Investor Fear Index, LikeFolio’s proprietary index which measures the velocity of tweets indicating negative investor sentiment, shows that the recent dip inspired some panic —However, the peak on the 7-day moving average came in -11% below the highest level seen in 2021, a peak corresponding with the large stock pullback in February.

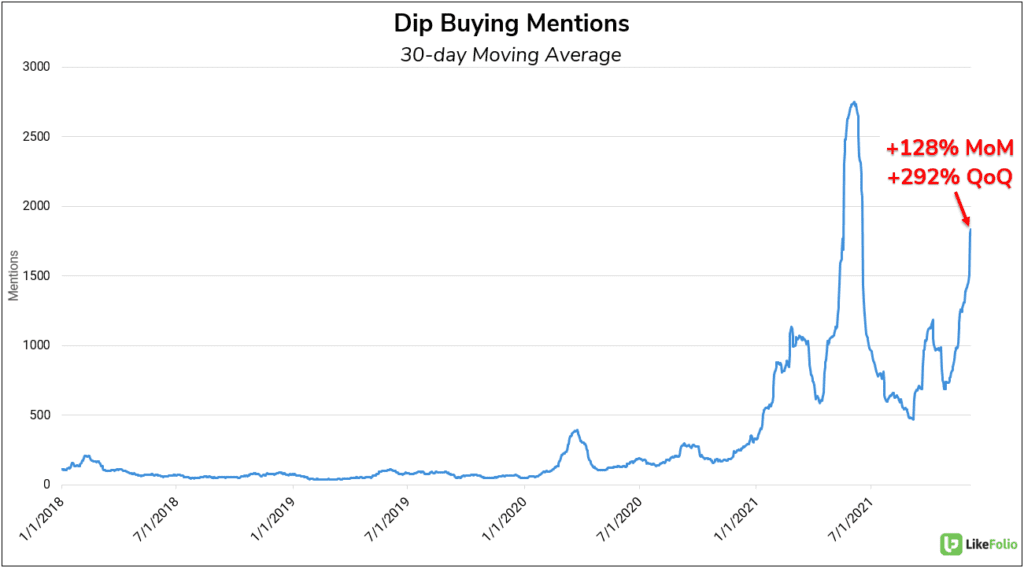

Furthermore, the incidence of investors talking about “buying the dip” is on the rise.

Dip buying Mentions have surged while equities have plunged lower, trending +128% MoM and +292% QoQ on a 30-day Moving average.

This chart reveals another interesting phenomenon…The act of “buying the dip” has seen rapid adoption amongst cryptocurrency investors, as evidenced by the ATH on the chart coinciding with the -50% crypto market pullback in May.