Costco Demand & Renewal Mentions Show Retention We've been officially Bullish […]

Is Costco (COST) the Next E-Commerce Holiday Winner?

It's no doubt that Costco (COST) has had a phenomenal year, with it's shares rallying 52% YTD.

But how can Costco maintain this robust growth?

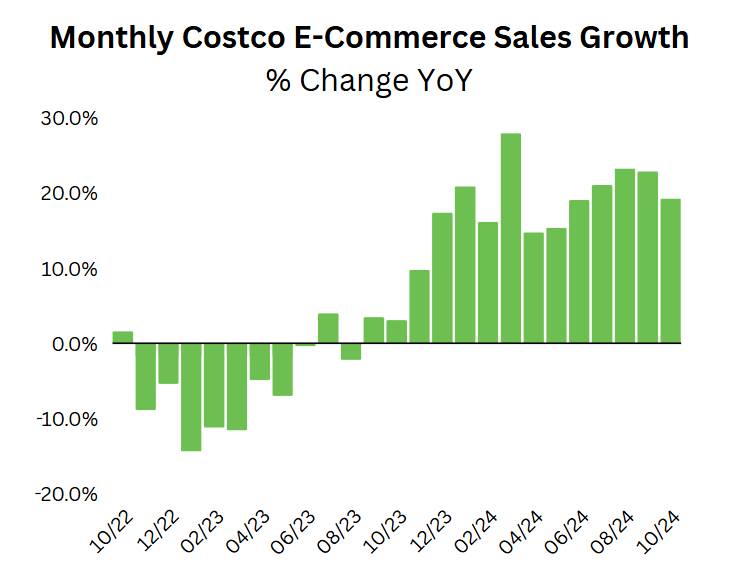

One major growth driver is E-Commerce:

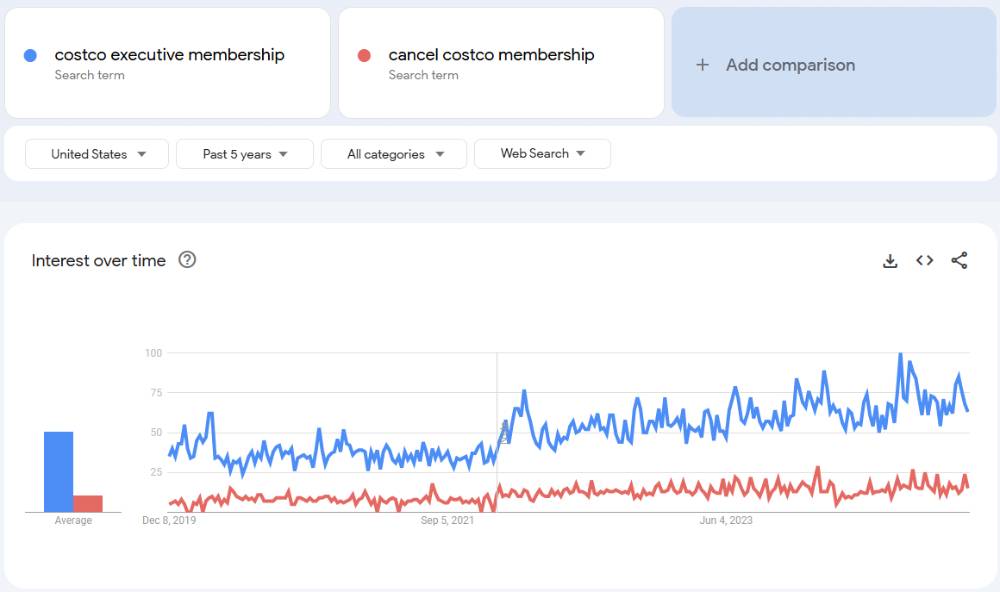

Another is growth in its premier membership:

Consumer interest in its executive membership tier (which comes at a heftier price tag) shows consistent expansion while cancellation searches remain flat.

Strong performance in both of these categories -- ecommerce and premium membership growth -- could help boost the stock in the long-run.

Near-term, we've got a bit less of a trading edge. Costco reports sales on a monthly basis.

Here's what we know heading into the bulk retailers next earnings report:

November Sales Impacted by Holiday Timing

“E-commerce sales in November were negatively impacted by an estimated 15 percentage points due to Thanksgiving, Black Friday and Cyber Monday occurring a week later this year versus last year,” Costco leadership noted.

Part of the holiday shopping weekend spilled over into December -- this could come into play during today's results.

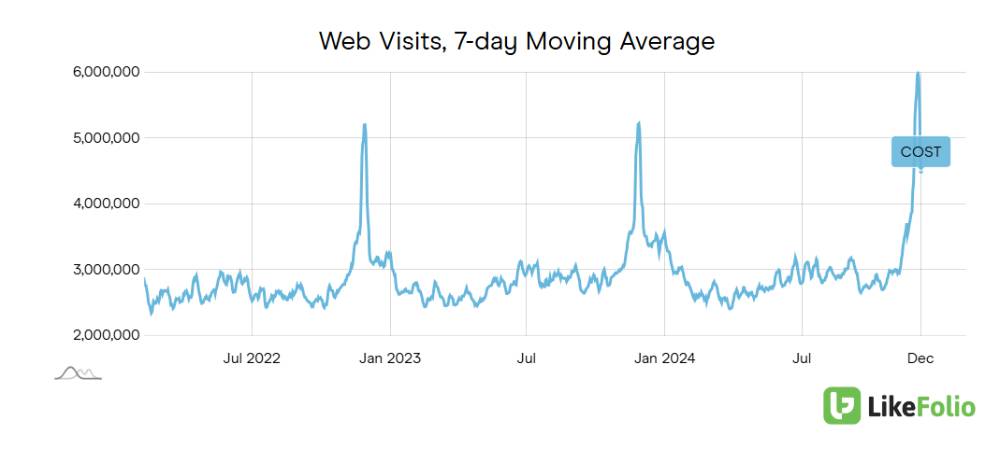

LikeFolio data shows a significant jump from peak-holiday shopping in 2023 -- a nice nod ahead of this earnings report.

Previous Quarter Results

Costco’s previous quarterly report closed out its 2024 Fiscal Year.

Sales grew 5.4% YoY in the last quarter, though it missed revenue estimates. Earnings however, beat estimates at $5.15 per share, reflecting a 6% YoY growth.

Other notable details from the previous report include:

- Total cardholders grew 7% YoY

- In store traffic grew 6.4%

- E-commerce sales rose 19% YoY

- 30 total new warehouse locations were opened during FY24

A week after its report, shares had dropped a total of 2.8%, but are now up 14% since then.

One of the most significant factors from its latest quarterly report and subsequent monthly sales reports since then, has been the robust e-commerce sales. September and October both saw roughly 20% YoY growth in e-commerce sales.

November's e-commerce sales saw a decrease of roughly 3% YoY. However, this was largely due to the Thanksgiving holiday falling later on the calendar this year, pushing Cyber Monday into December.

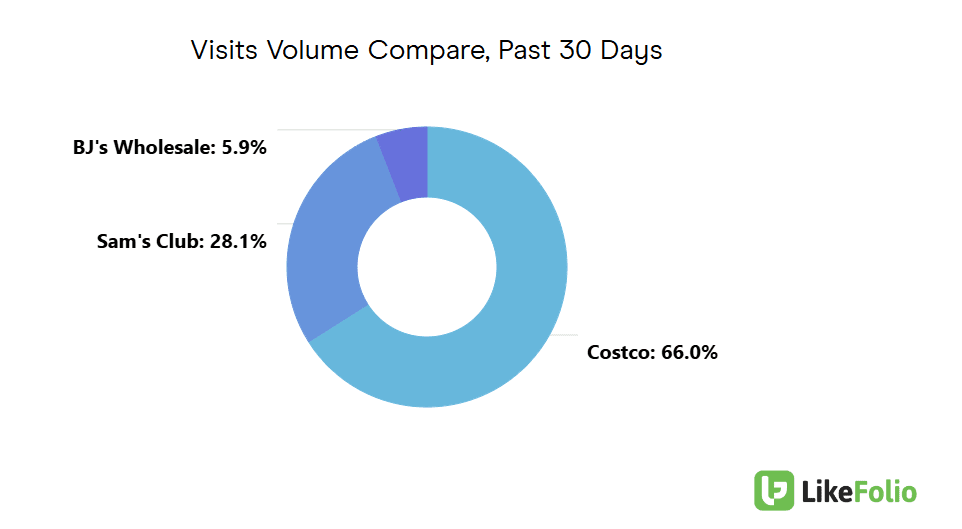

Costco has also grown its significantly larger share of web traffic data over its primary competitors Sam's Club and BJ's Wholesale, from 63% to 66% over the past quarter.

Other Costco Successes

It's not just e-commerce growth that points towards a successful holiday season for Costco.

Costco also increased annual membership prices in early September from $60 to $65 and $120 to $130 for its Gold Star and Executive memberships respectively. This is the first time Costco membership prices have increased in over 7 years.

Fortunately, these increases don't seem to have damaged consumer sentiment.

Costco’s happiness levels sit at a solid 70% too, which is an improvement of 4 percentage points over the past quarter. This strong sentiment is also evident in Costco's membership retention rate of over 90%.

In person consumers spend more time in Costco as well, with an average dwell time of 37 minutes, compared to Walmart (31 minutes) and Target (28 minutes).

Costco has had global success in its stores, with international sales growth outperforming U.S. locations in September and October.

Costco’s expanded product line of Gold bars has been a very popular addition, with 77% of locations being sold out as of the first week of October despite recent shipments. Costco even recently added platinum bars to its inventory of goods.

Bottom Line

Costco has had all around success with continued top line growth, solid consumer sentiment, and a strong global presence, which all makes sense for its significant growth in share price in the long run.

In addition, a nice surge in traffic and consumer interest might be enough to send shares higher after earnings on a better than expected report. Bullish.