Sonos Crushed 2020, but Can its Growth Continue? SONO shares […]

Is Sonos (SONO) Losing Steam?

Is Sonos (SONO) Losing Steam?

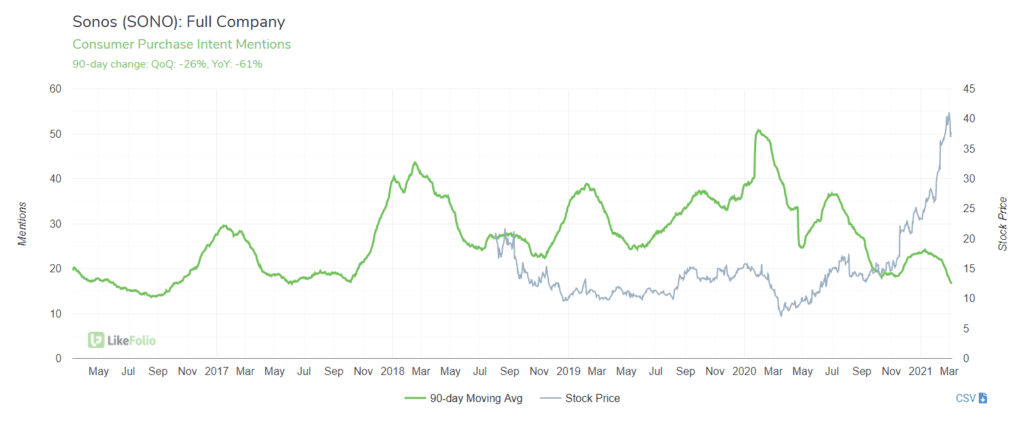

SONO has been on quite a run. Data tipped us off last Summer, as soon as an uptick in consumer demand was underway. We featured SONO in our Sounds of Summer MegaTrends Report, and shares have rallied more than 150% since then. Now our data suggests it may be time for a breather. After a noticeable Covid/Home Reno demand surge, SONO Purchase Intent mentions are falling: -61% YoY.

One caveat to consider from its last report: Sonos increased total revenue, but total units sold actually fell -- this showcases the impact of product mix, and suggests (at least a temporary) consumer preference for more expensive models. Demand for Sonos upscale products (including its arc, sub, and home entertainment sets) continues to outperform other product categories, currently pacing: +7% YoY. But this is a slow down from the +21% recorded in the prior quarter. Sonos is hosting a Virtual Investor Event after market close today, and is expected to announce a new portable Bluetooth speaker: Sonos Roam. We'll be tracking new products as they hit the market, but want to be sure to call attention to the current shift in trajectory underway.