Macy's reports earnings on August 15th. The stock has run from $17 to nearly $42 since late 2017. Is there more in the tank, or is the stock ready for a breather?

Macy's Set the Bar High for Nordstrom (JWN)

Macy's Set the Bar High for Nordstrom (JWN)

Last quarter, JWN shares tumbled (-7%) post-earnings when the retailer posted net sales -13% lower vs. the same quarter in 2019, and a wider than expected loss with nods to elevated labor and shipping costs, and supply chain constraints.

These lower-than-2019 results were present in the full price Nordstrom and discount Nordstrom Rack brand. While Nordstrom Rack sales remained -13% lower vs. 2019, TJX and ROST returned to pre-pandemic levels. Ouch.

Heading into Earnings, what does LikeFolio data reveal?

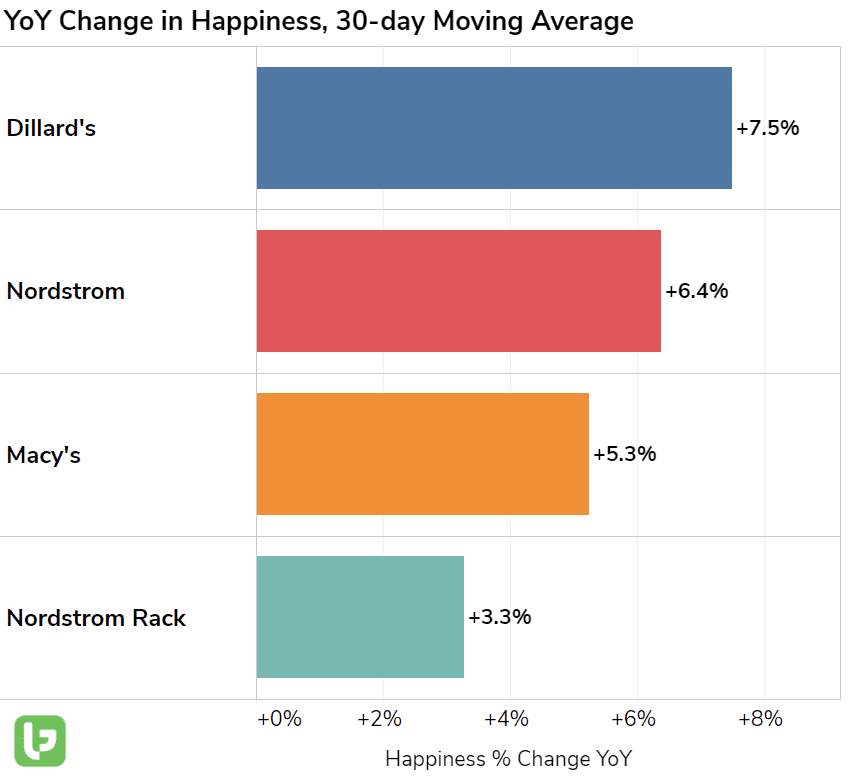

Nordstrom is well-known for its exemplary levels of customer service and in-store experience (like tailoring, and a customer-first attitude). This has translated to high and rising levels of consumer sentiment.

Nordstrom is also being bolstered by reopening trends.

- As many employees return to work (and some to school), there's an increased need for new clothes.

- Mentions of buying new clothes +11% YoY, returning to the office +37% QoQ, back to school shopping +97% YoY

- Nordstrom noted: "In the past few months, Nordstrom.com has seen a +165% increase in searches for "work clothes" as people gear up for the office.

- A growing social calendar is also a driver for Nordstrom, as consumers need options other than loungewear and wardrobes are falling out of style.

But Nordstrom's Anniversary sale mentions came in a bit weak on our end, registering lower vs. 2019. In addition, outperformance from Macy's last week sets a high bar.

Landon talked about this in detail today on the TD Ameritrade Network.

Nordstrom reports 21Q2 Earnings on August 24 after the bell.