United Parcel Service (UPS) After two quarters of explosive demand […]

Mining Stock Chatter Showing Signs of a Breakout ($SIL, $SILJ, $GDX, $GDXJ)

Mining Stock Chatter Showing Signs of a Breakout ($SIL, $SILJ, $GDX, $GDXJ)

Gold and silver mining stocks serve as leveraged plays on the price of the underlying assets, so rising metal prices inevitably lead to increased investment demand for miners.

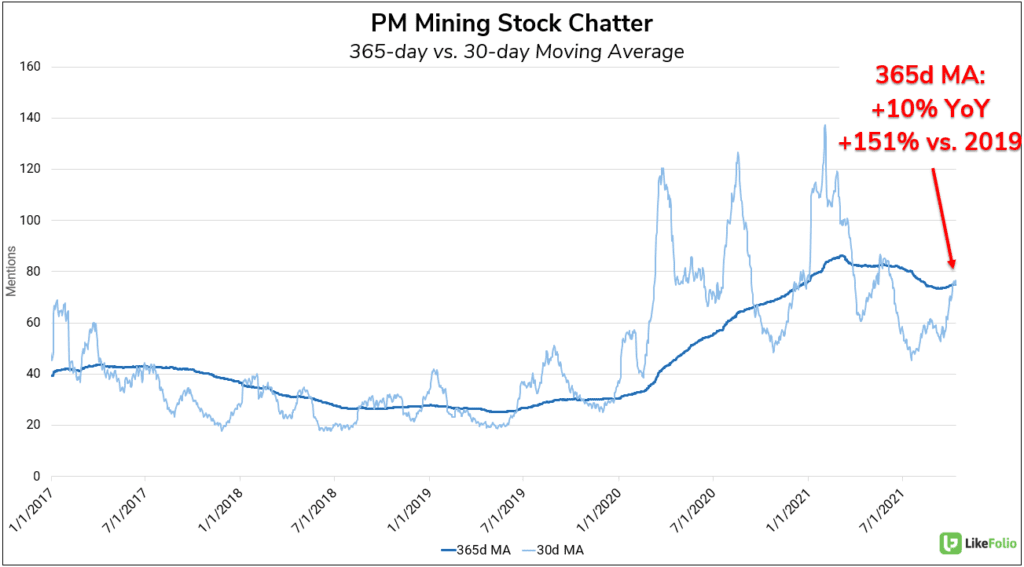

Investor chatter relating to precious metal mining stocks and ETFs has grown significantly over the past 2 years, trending +10% YoY and +151% vs. 2019 on a 365-day moving average.

Furthermore, the 30d moving average shows a near-term influx of investor interest in the PM mining sector. The battle for price discovery in the long-suppressed precious metals market is heating up. The 8 largest PM traders, bullion banks, still have a vested interest in lower prices near-term and the capital to influence the COMEX price. However, several notable miners recently announced plans to suspend sales during the current "market correction" -- Retail investors and producers are expecting higher prices soon.