Trend Watch: Silver Investing Recently, we’ve been tracking elevated consumer […]

Consumer shipping demand is normalizing...

United Parcel Service (UPS)

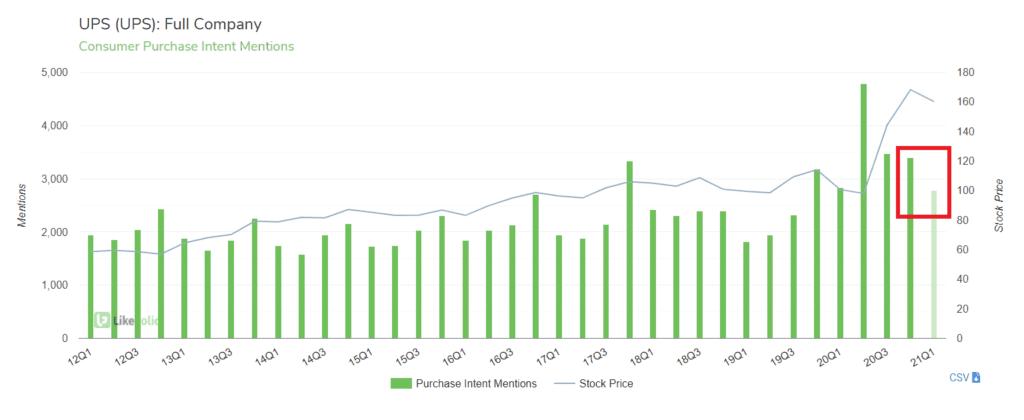

After two quarters of explosive demand growth, UPS Purchase Intent mentions are normalizing.

Consumer mentions of sending or receiving a package via UPS increased 7% YoY in 20Q4.

This is lower than the previous quarter growth rate of +50% YoY. Mentions in 21Q1 are currently exactly flat YoY.

Last quarter, UPS reported revenue growth of +16% YoY, noting a COVID shift in B2B and B2C activity: "While our commercial business remained under pressure due to the economic downturn, during the quarter, we began to optimize our network and captured share in SMB, or small and medium-sized businesses. As a result, we saw revenue per piece improved sequentially in the U.S."

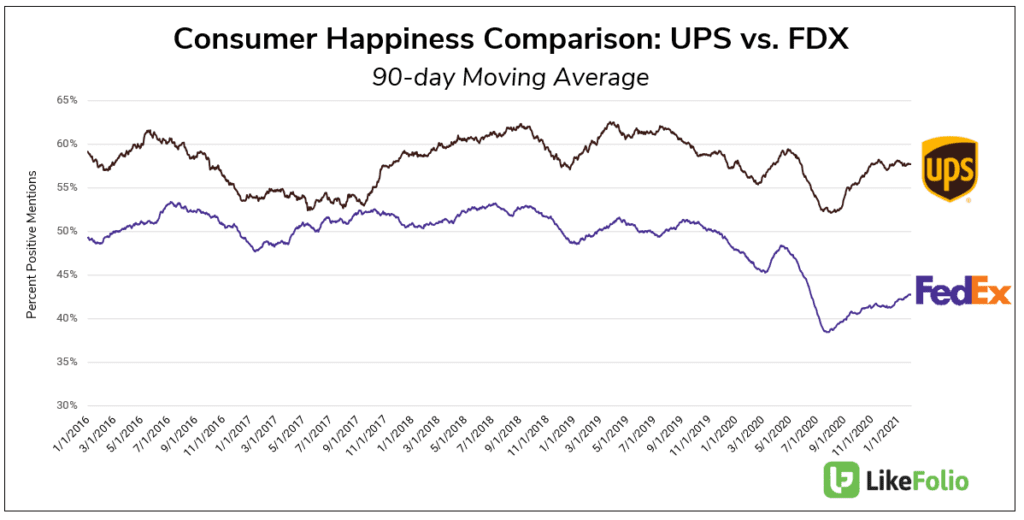

From a consumer preference perspective, UPS maintains a significant edge vs. peer FedEx.

elivery speed is the main differentiator in sentiment, as consumers increasingly demand faster, free shipping.

Other factors to consider ahead of earnings:

- UPS is expected to play a major role in the global distribution of vaccines (an element that is unlikely to show up in social media mentions).

- UPS is divesting its Freight business.

Trend Watch: Silver

Last week, we saw coordinated buying efforts from retail investors on a unprecedented scale, and LF data shows that silver has become a target.

Mentions of investing in or purchasing silver are...