Tesla reports earnings after the bell on Wednesday. After last […]

Three Reasons to be Bullish on TSLA

The set up ahead of Tesla earnings (April 23 after the bell) is what dreams are made of for Tesla Bulls.

- TSLA shares are down more than -60% from 2021 highs.

- Short interest is the highest its been in 3 years.

- Perceived competition is mounting -- in China from BYD and domestically from electric players like RIVN and even traditional auto makers.

- The narrative surrounding CEO and Founder Elon Musk is somewhat skeptical, focused more on his compensation package than functional genius.

- The street is expecting a big move (9%)

- Most importantly: LikeFolio data is heating up...

The following three charts outline our Bullish thesis -- for TSLA earnings and beyond...

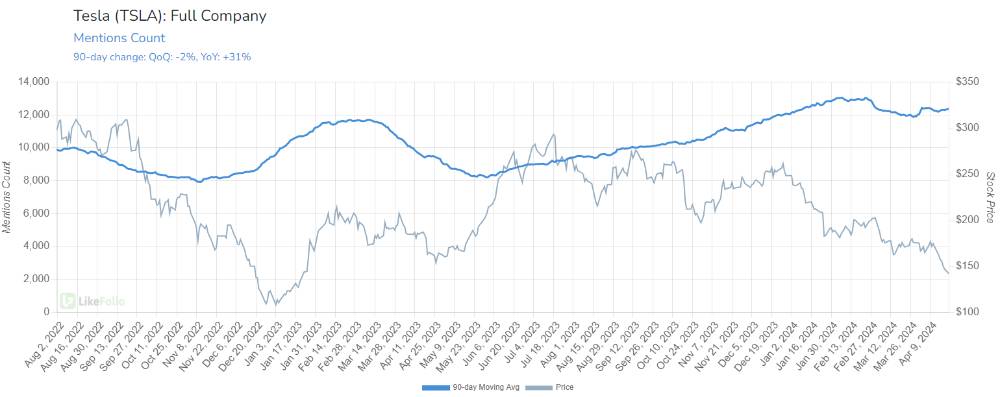

- Consumer mention buzz shows increasing divergence.

Divergence in this instance means mention buzz is heading higher (+31% YoY) while TSLA stock heads lower. This growing gap between stock price and mention volume is likely fill, and we are betting the stock will follow mentions higher.

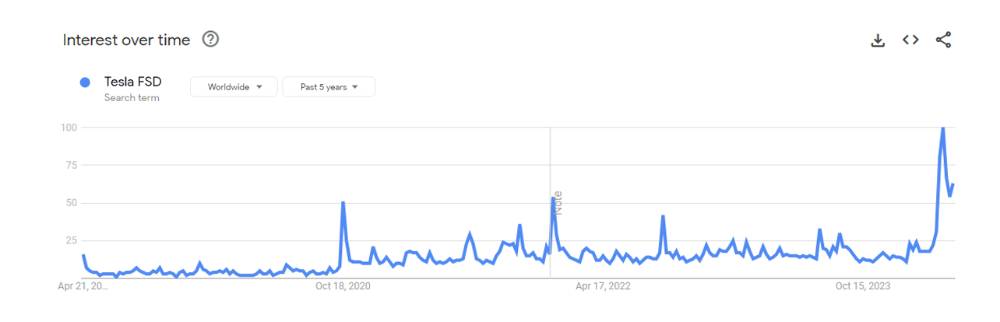

- Wide-spread Full Self Driving (FSD) adoption

Consumer searches for Tesla FSD hit all-time highs last month as Tesla pushed updates and improvements to its self-driving platform and dropped the price of a monthly subscription. It's important to note that during this massive adoption of a new and futuristic technology, Tesla sentiment only moved by -3 points -- impressive considering the mention buzz growth displayed above. This bodes well for future FSD upgrades down the road.

And most importantly...