Carvana Demand Approaching All-Time Highs LikeFolio published a Bullish alert for Carvana […]

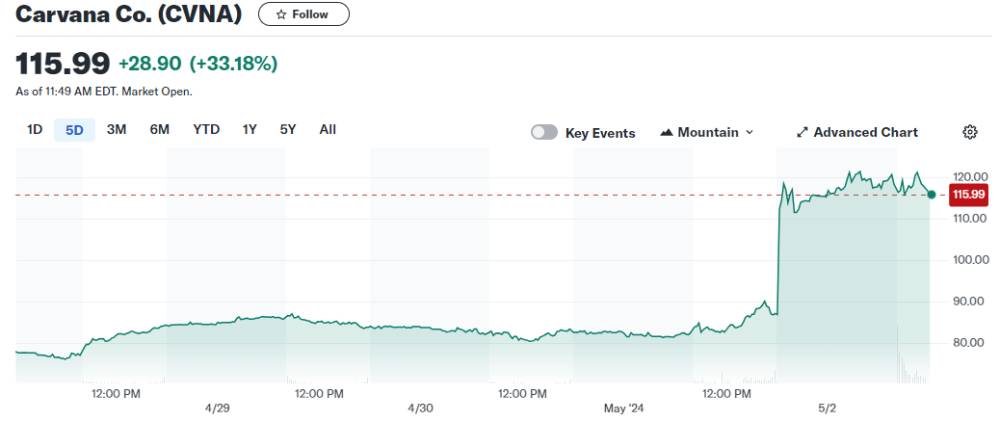

Carvana (CVNA) shares are off to the races

Carvana's Q1 earnings report just sent its stock soaring.

The company turned a profit for the second consecutive quarter and posted revenue north of $3 billion vs. $2.67 billion expected.

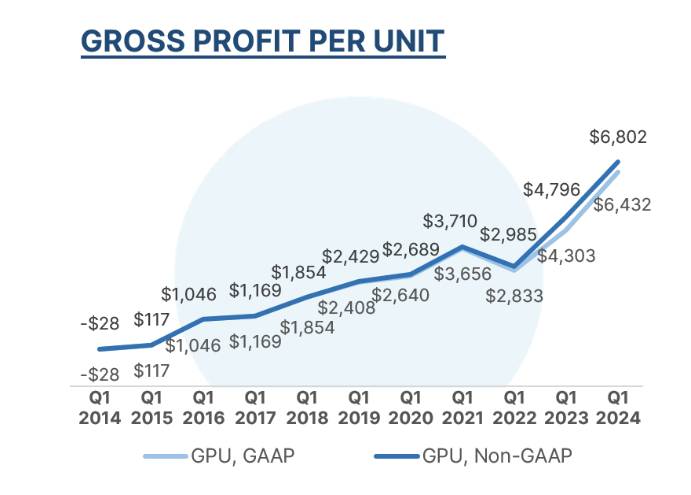

It also continued to improve its Gross Profit Per Unit thanks to a myriad of cost cutting measures (we'll get into that later).

LikeFolio's recommended earnings trade is on track for a max gain.

If traders took the recommended “very bullish” trade and did the 99/100 spread it will net a max gain of +233%, assuming the stock stays over $100 to end the week.

But we are most proud of how we made this call.

Here's how we did it.

Last earnings season, Carvana got the best of us. (We wrote about it here).

The Cliff Notes version: Carvana trimmed down the time its own employees spent per sale, lowered the average days-to-sale significantly, and reduced the non-vehicle cost of a sale by $900 per unit.

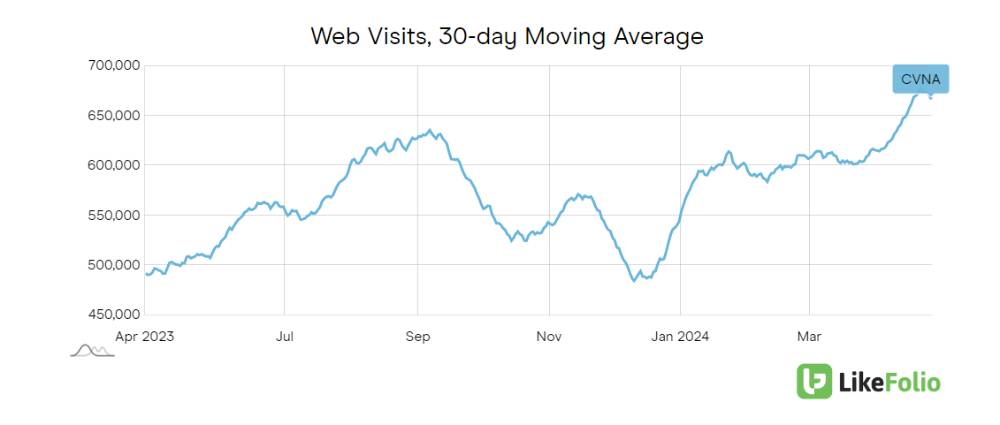

We knew that if Carvana could maintain the operational efficiency it has achieved, web visits would prove extremely valuable to watch to better understand how many cars are changing hands.

And web visits weren't just up, they were accelerating -- pushing +36% higher on a YoY basis (up from +15% YoY in March).

This ability to key into exaclty what matters makes this win extra special. We will continue to monitor traffic moving forward -- but for now expect continued momentum in this name.