Celsius (CELH) Demand is Strong Ahead of Earnings Underlying consumer […]

Monday Preview ($CAR, $FVRR, $SHAK, $FNKO, $CELH)

August 1, 2022

A big earnings week is underway!

Here are 5 names that LikeFolio is watching for this week.

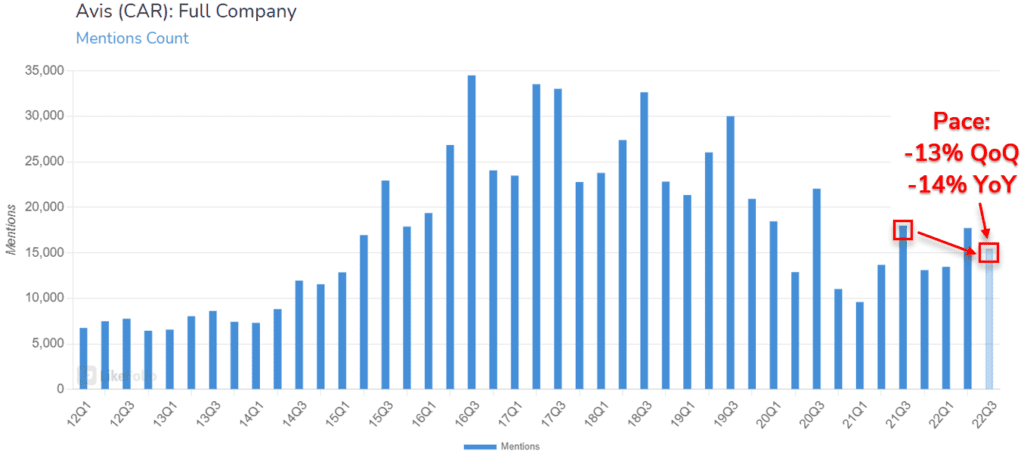

Avis (CAR)

- Last quarter, Avis Budget Group (CAR) reported a sizable revenue increase: +77% YoY and +27% vs. 2019.

- Macro tailwinds have also pushed CAR’s earnings to a new all-time high. Rising demand for rental cars and favorable shifts in the used car marketplace resulted in a whopping +2272% YoY EPS gain in Q1’22.

- Shares of CAR have benefited from the company’s recent outperformance, gaining nearly +450% in 2021 and maintaining a higher level in 2022.

- Total Mentions for the car rental company show a slowdown in the current quarter, with Mention volume on pace for a quarter-over-quarter and year-over-year decline in the period ended 9/30.

- Key trends which helped push CAR shares above $500 last year are slowing. Consumer mentions of rental vehicles being unavailable or out of stock are trending -14% YoY on a 90-day moving average.

- Avis Budget Group is set to report earnings results for Q2’22 today after the close, and Wall St. expects to see record-high EPS and revenue.

Fiverr (FVRR)

- Remote work has become increasingly common in the wake of the pandemic. Mentions of working remotely are up +52% YoY and more than +200% above pre-COVID levels (90d MA).

- This trend has been incredibly beneficial for freelancers — Mentions of hiring a freelancer are up +46% YoY and mentions of working as a freelancer are up +28% YoY.

- Demand for companies that connect freelancers with potential employers is rising. Fiverr (FVRR) serves as a prime example, with company PI at an all-time high level: +32% YoY on a 90-day moving average.

- Fiverr has secured double-digit revenue growth in every quarter since its 2019 IPO, with revenue up +27% YoY in the recently reported Q1’22.

- Fiverr has also maintained profitability, posting positive EPS results on 7 of its past 8 quarterly earnings reports.

- FVRR reports earnings later this week (Thursday before market). We’re hoping for a more positive reaction than that seen for rival Upwork (UPWK) last week.

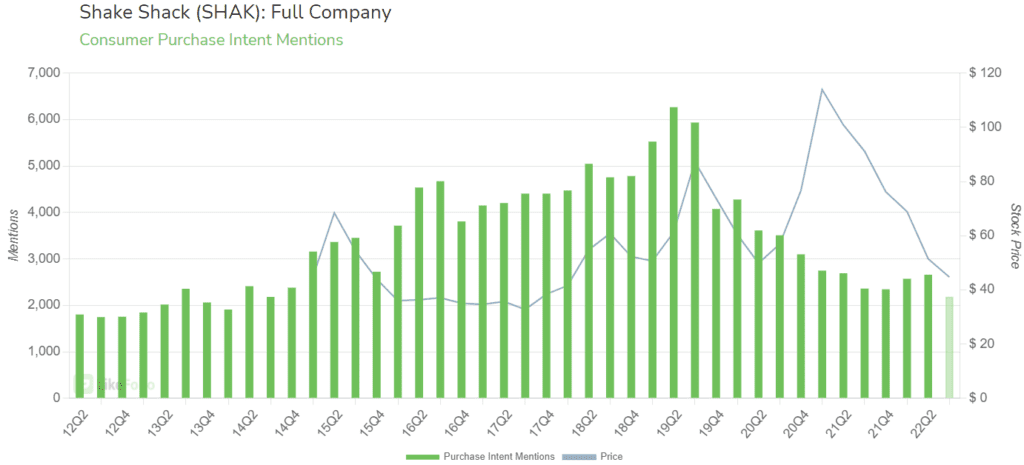

Shake Shack (SHAK)

- Shake Shack (SHAK) is a surprisingly high-growth name in the restaurant industry, with double-digit sales improvements in the past 4 quarters.

- The impressive rate of growth has come at a high cost. SHAK posted positive EPS for 2 consecutive quarters in 2021, but since then, SHAK’s bottom line has deteriorated, with the company reporting a net loss in the past 3 quarters.

- Consumer Demand for SHAK is showing weakness in the current quarter — After rallying higher at the start of 2022, PI Volume is on pace to decline -18% QoQ and -7% YoY in the quarter ending 9/28.

- Shake Shack’s premium price point could become a detriment, as inflation causes consumers’ preferences to shift towards lower-cost alternatives.

- Does SHAK have the pricing power? Shake Shack’s CEO noted a menu price increase of “6% to 7%” on the company’s latest earnings conference call. It remains to be seen if they can maintain their customer base while raising prices, like Chipotle (CMG).

- SHAK reports earnings on Thursday morning before market.

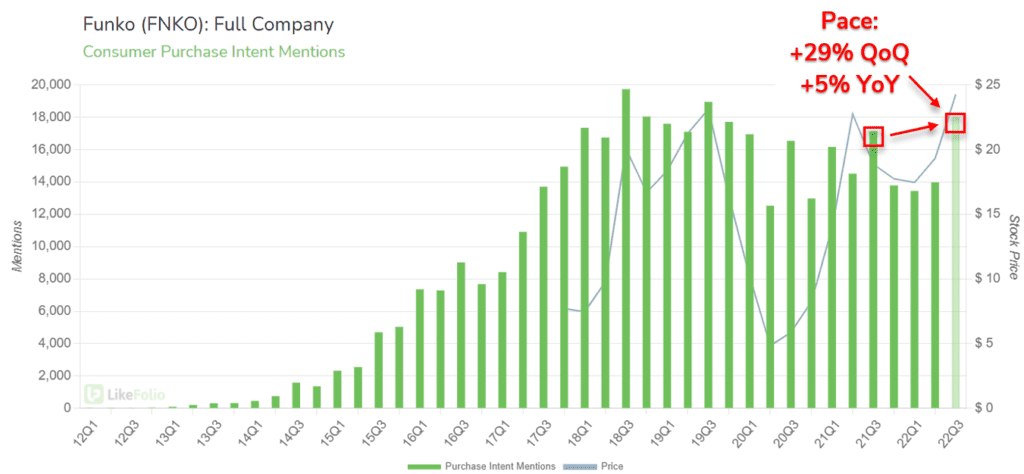

Funko (FNKO)

- Consumer Demand for Funko (FNKO) is holding at an extremely high level, trending +29% QoQ and +5% YoY in the current quarter (ending 9/30).

- FNKO’s sales have surged higher with underlying Demand — Average revenue growth for the past 4 quarters: +73% YoY.

- Funko’s recent success is backed by prevailing trends in consumer behavior. Consumer Mentions of buying toys/collectibles made for adults are near an all-time high level in Summer 2022, on pace to increase +26% YoY.

- Last quarter, the LoungeFly brand boasted triple-digit year-over-year sales growth. Consumer Mentions of Loungefly have continued to rise since then, up +51% YoY on a 90-day moving average.

- Strong bottom-line improvements have helped Funko’s stock outperform the market in recent months. FNKO reported EPS up +200% YoY on its most recent earnings release.

- FNKO shares have gained approximately +45% YTD, nearing the historic ATH price.

- The company is set to report earnings for the second quarter of 2022 after the bell on Thursday.

- We’re positioning for another surprise to the upside, and a potential new ATH for shares on Friday.

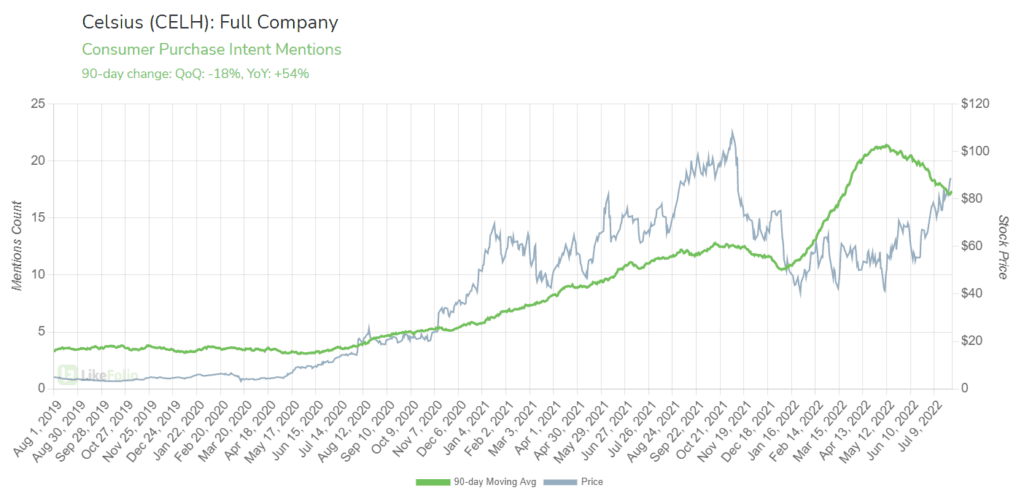

Celsius Holdings (CELH)

- CELH shares surged today (+12%) after PepsiCo (PEP) announced a $550 million investment in the energy drink brand.

- The investment will give PEP an 8.5% stake in Celsius, and includes a distribution partnership that will help the smaller retailer expand into more independent stores and gas stations.

- This investment comes as no surprise to LikeFolio followers. Celsius has been a LikeFolio favorite for years now – in fact, we recently highlighted ongoing strength at the end of July, noting the company was just getting started.

- To understand the major health and wellness trends driving Celsius's success, revisit this weekend’s research desk spotlight.

- Looking ahead, we’re remaining Bullish. Celsius continues to outperform peers and PepsiCo support could spark an acceleration in brand discovery.