LikeFolio's Consumer Happiness data on Papa John's has been incredible […]

Fast-Casual Recovery Heightened vs. Fast-Food Peers

June 15, 2021

Fast-Casual Recovery Heightened vs. Fast-Food Peers

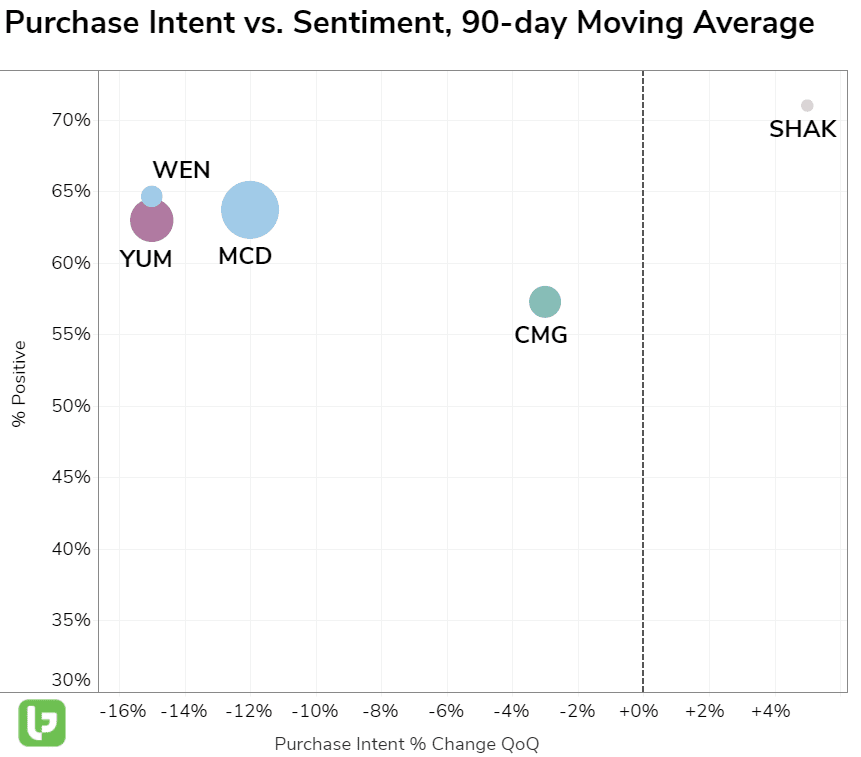

LikeFolio Data reveals a near-term demand recovery advantage for fast-casual chains vs. traditional fast-food restaurants. This mirrors external research findings.

Fast Casual chains were impacted more significantly vs. traditional "quick-serve" restaurants because they weren't as equipped to transition to carry out, drive-thru, etc. and relied more heavily on dine-in. And now things are shifting. Key Takeaways:

- Chipotle and especially Shake Shack are benefitting more as consumers resume the dine-in experience.

- Chipotle pivoted extremely well to digital ordering, but growth is waning. On its last report, online orders more than doubled and accounted for more than half of total sales. Now LikeFolio data shows signs of slow down: CMG digital order mentions have fallen -12% QoQ.

- Shake Shack is gaining traction as localities reopen. Shake Shack Purchase Intent Mentions have increased +5% QoQ, and digital mentions are actually up 1% QoQ, a stark difference vs. CMG.

- Shake Shack consumer happiness sits significantly higher vs. all other peers, as many consumers applaud elevated food quality.

- McDonald's is outperforming traditional fast-food chains YUM (Taco Bell, KFC) and Wendy's, but is lagging fast-casual competitors. On its last report, Mcdonald's confirmed a strong recovery in the US: Rev +9% YoY, driven by increased ticket size (visits still negative, which is what we're picking up on).

Shake Shack plans to expand massively in the next 2 years and to open 90 new restaurants through 2022. We'll be watching to see how much this moves the needle for $SHAK.