PayPal (PYPL) Last week we touched on a huge crypto […]

PayPal (PYPL) is building a Super App

PayPal (PYPL) is building a Super App

PayPal vs. Square is reminiscent of a David and Goliath story.

While PayPal's market cap is more than double that of Square ($339 billion vs. $122 billion), in the past 2 years we've watched SQ growth soar.

Last quarter, Square revenue increased +143% YoY (+87% YoY excluding Bitcoin), and the company has plans to strengthen further integrations between its seller and Cash App ecosystem through the acquisition of Afterpay and empower small businesses via Square Banking.

But LikeFolio data shows that PayPal is stepping up to the plate.

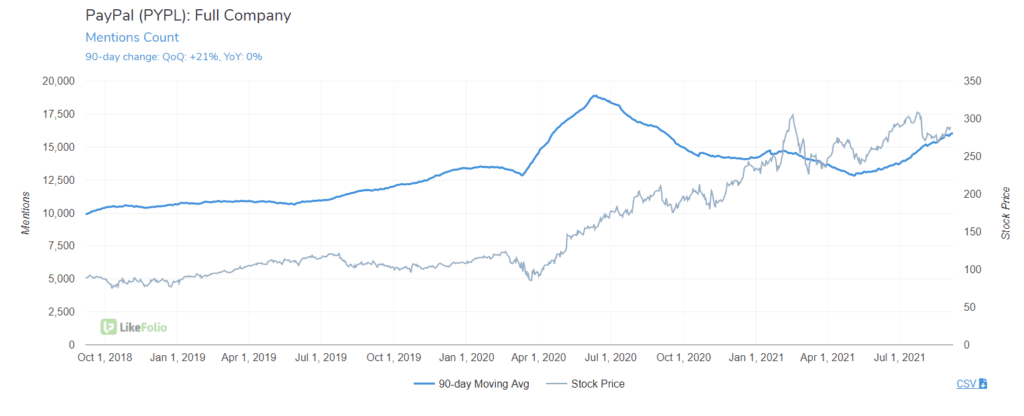

Recently, PayPal mention volume growth has surpassed Square's: +21% QoQ (flat YoY, which is impressive considering the environment last year), vs. +18% QoQ, -1% YoY.

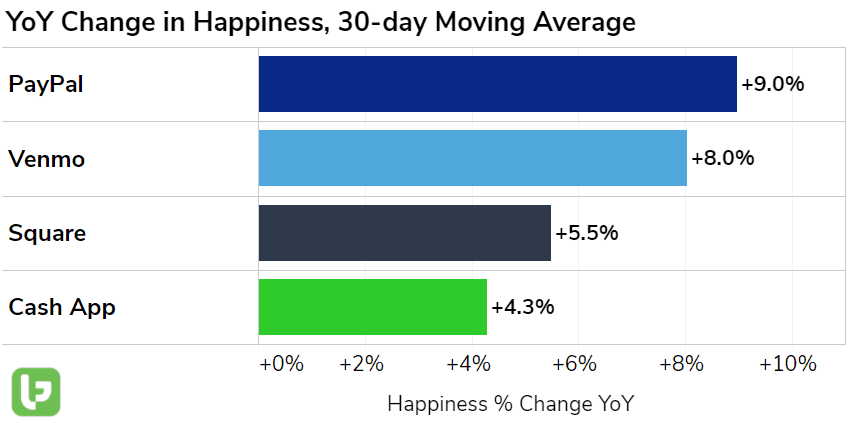

More impressive: PayPal's consumer happiness across its entire suite of apps is rising in tandem.

What is PayPal doing right?

The company is successfully transitioning to a "Super App" and proving it's more than its eBay payment history.

Last quarter, eBay transactions only represented 4% of PayPal's payment volume as PayPal's core business volume grew (non-eBay payment volume increased +48% YoY).

And the company wants to keep this core base around. It invested $2.6 billion in 2020 to develop new features from QR contactless checkout to actual payment via cryptocurrency.

Speaking of cryptocurrency...this technology is driving renewed interest in its peer-to-peer wallet, Venmo. Venmo only comprises ~4% of PayPal's revenue but crypto could serve as a major catalyst for growth.

LikeFolio data shows that cryptocurrency engagement mentions on PayPal and Venmo are +91% higher YoY.