Tesla reports earnings after the bell on Wednesday. After last […]

Post-Election Cheat Sheet

November 6, 2024

What a night!Here's a cheat sheet for the overall market reaction following Trump’s 2024 victory:

- Stock Market Surge: Financial markets surged following Trump’s projected win, with S&P 500 and Dow Jones futures both gaining over 2% and small-cap stocks (Russell 2000) jumping 5%. Investors are anticipating business-friendly policies, potential tax cuts, and deregulation that could drive economic growth and lift corporate earnings.

Rising Treasury Yields: U.S. government bond yields rose as investors prepared for increased government spending and potential tax cuts, which could lead to higher inflation and larger government debt. This movement suggests inflationary concerns and a potential increase in borrowing costs.

- Currency Strength: The U.S. dollar appreciated against several major currencies due to expectations of stronger economic growth and potentially higher interest rates under Trump’s administration.

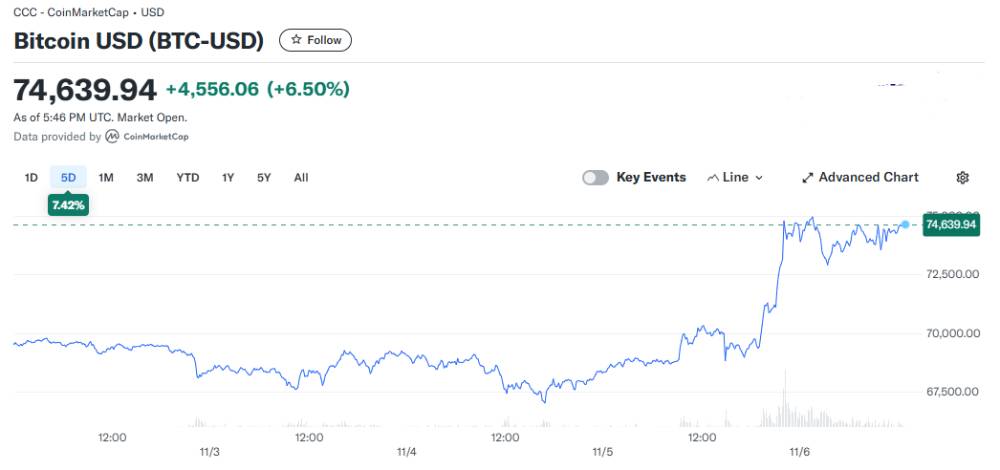

- Crypto Boom: Bitcoin surged close to $75,000, driven by market optimism about the potential for lighter regulatory oversight under Trump’s leadership. Investors are speculating that the administration will create a friendlier regulatory environment for digital assets, spurring further growth and adoption.

- Tech Stocks Rise: Technology companies, including major names like Nvidia and Tesla, posted significant gains as markets anticipated supportive policies fostering innovation and expansion in the tech industry.

- Nvidia’s Growth Potential: NVDA stock is up +3% on the strength of its AI and semiconductor offerings, especially in the wake of a Trump administration that wants to continue growing chip manufacturing here in the US.

- Tesla’s Ongoing Momentum: Tesla shares surged even higher, up +13%, reflecting expectations of policy support for U.S. manufacturing and potential tariffs on Chinese EVs. Trump's victory could also streamline regulatory approval of Tesla's autonomous driving technology, which is an enormous catalyst for the company's growth prospects and long-term valuation.

- Alphabet's Brightened Prospects: Alphabet Inc. (GOOGL), Google's parent company, saw its stock rise by about 3.5% this morning. This uptick is attributed to investor optimism regarding a potential easing of antitrust pressures under the new administration, which may lead to a more favorable regulatory environment for the company.

In summary, markets have responded positively to expectations of pro-business policies under Trump’s administration.

Here are 2 major winners we see moving forward...

This section is restricted to LikeFolio Pro Members only.