Snapchat's IPO timing was...well... incredible. They literally took the company […]

Snapchat Screen Time is Slipping

Snapchat Screen Time is Slipping

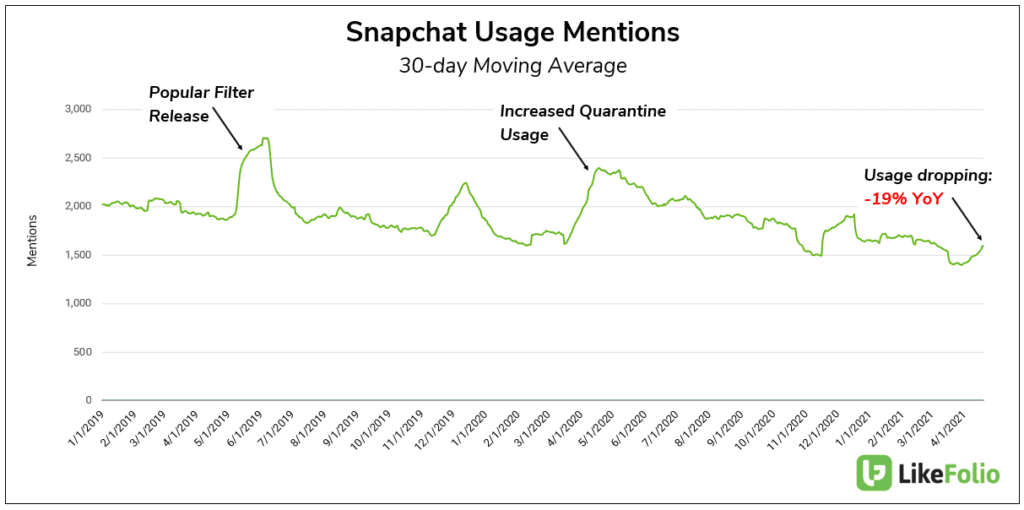

Snapchat is the first social media name to report Q1 earnings, and investors are watching closely... how are advertisers spending in 2021? Last quarter, SNAP revenue increased +62% YoY. More importantly, the company was much better at monetizing users: average revenue per user (APRU) increased +33% YoY. While we can't track ad placements, we can track eyeballs on screens. LikeFolio data suggests time spent on the platform is lower vs. 2020: usage mentions fell -19% YoY.

We are seeing some traction in its TikTok clone 'Spotlight' section, but so far these mentions haven't been enough to move the needle when it comes to comprehensive demand. Overall, user growth is slowing down (at least among English-speaking users). Total SNAP demand fell -28% YoY in the quarter being reported. In addition to user growth, we'll be listening for advertising-related kinks on this report:

- Snapchat noted a 2-week interruption in January following demonstrations at the capital when advertisers paused campaigns.

- The company is also anticipating negative ramifications from an AAPL privacy update: iOS 14.5 launches next week and requires opt-in for activity tracking. This is how companies like Snapchat serve users with highly targeted ads. You can imagine, SNAP is apprehensive..and definitely uncertain of the total impact this will have on its advertising efforts.

SNAP reports 21Q1 results on April 22 after market close.