Special Report: Top 3 Consumer Trends

Did you know it’s possible to apply LikeFolio’s proprietary earnings signal calculations to consumer macro trends, too?

By understanding how mentions are shifting, we can spot major shifts in momentum and understand which topics matter most to the average Joe.

Here’s a run-down of the top trends weighing on consumer minds (and ultimately wallets) this week:

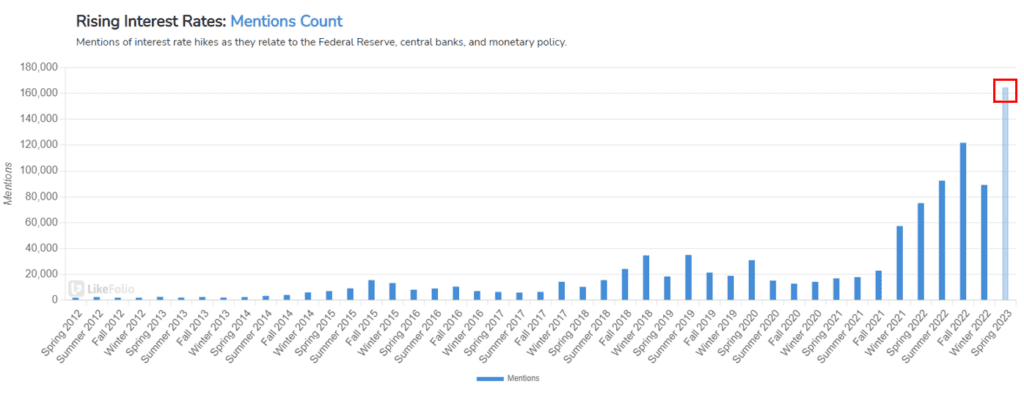

#1: Rising Interest Rates

Consumer concerns related to high interest rates logged the highest behavior “score” across our universe yesterday, at +82.

You can see a surge in Spring 2023 as consumers feel the ripple effects of persistent Fed rate increases.

Last month the Fed announced a 0.25 percent rate hike, bringing the target range for the federal funds rate to the highest level since 2007.

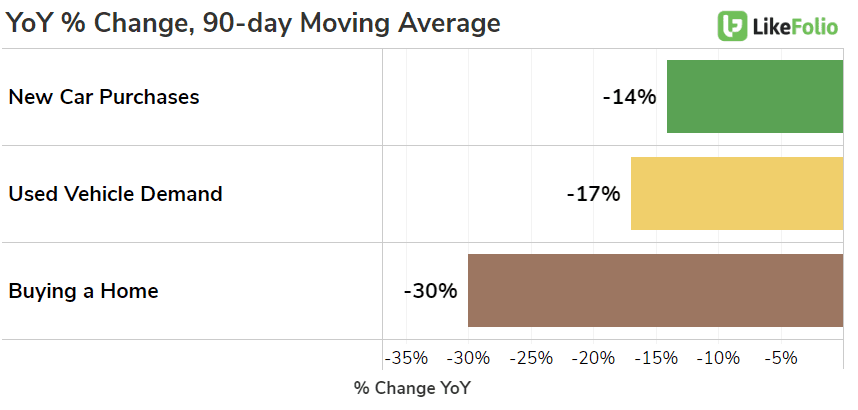

This policy is intended to combat persistent inflation by making it more expensive for consumers to borrow money. You can see the effects in real-time in consumer intent to buy a new home or vehicle.

We’ll be monitoring consumer demand for companies operating in each of these segments for potential opportunities for investors to the upside and downside.

In the meantime, keep an eye on Tesla. The company is bucking macro trend pressures and sparking consumer demand through price cuts. The company announced its 5th round of price reductions last week, most recently slashing the Model 3 sedan by $1,000, Model Y by $2,000, and Models S and X by $5,000.

In 2023, price cuts have dropped the base price for the Model 3 by 11% and Model Y by 20%.

Mentions have risen in tandem alongside each cut, currently pacing +7% higher YoY.

While price cuts may hamper near-term margins, they also present an opportunity to TSLA to gain further market share in the EV and luxury vehicle space.

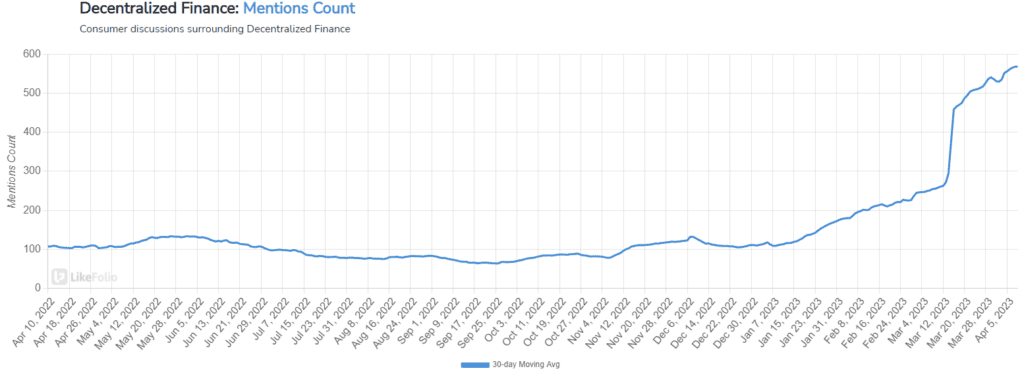

#2: Decentralized Finance

The recent banking crisis and speculation surrounding a central bank digital currency has catapulted decentralized finance to the front of consumer minds.

The ripple effects here can be seen in crypto-based trends.

Consumer mentions of investing in crypto currency have risen +12% on a YoY basis and mentions of trading cryptocurrency have risen by +8% in the same time frame.

Companies like Coinbase stand to benefit from rising consumer interest in cryptocurrency – keep an eye out here for an uptick in mention volume.

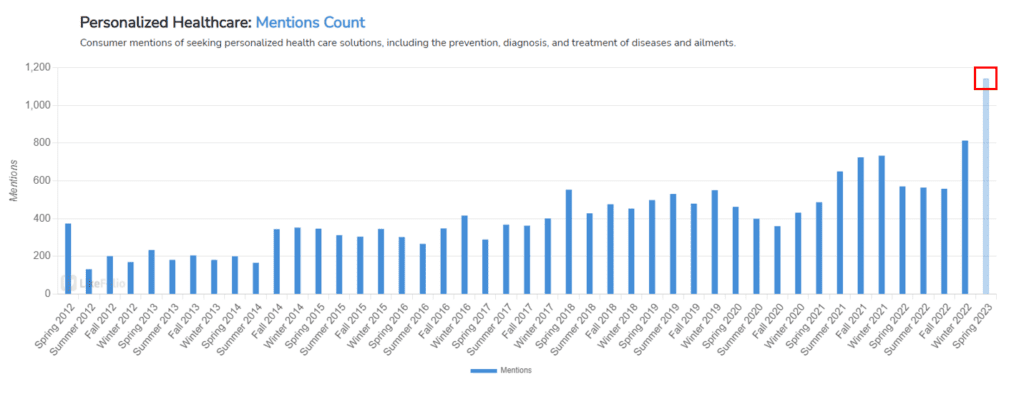

#3: Personalized Healthcare

Consumer interest in personalized healthcare is on pace for all-time highs this spring.

Ark explained this trend in its Big Ideas presentation, under the concept of precision therapies, explaining: “Precision therapies are patient-centric and target the root cause of disease, not symptoms.”

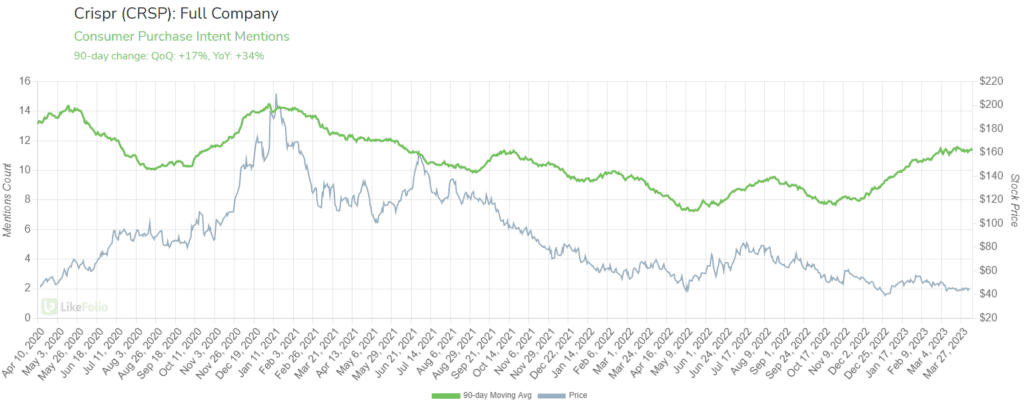

One innovator to watch in this arena is Crispr (CRSP), which specializes in gene editing.

Divergence is forming as chatter related to potential applications rise (like one related to a clinical trial for treating sickle cell disease) at the same time as shares drop in value.

This is an example of a company in the early stages of growth. After all, profitability isn’t expected any time soon. However, approvals and trial successes may serve as near-term boosts in share price, and some analysts tout the company’s acquisition potential.

The trend is certainly a tailwind.