When social-data and stock price are moving sharply in opposite […]

Streaming Update: Netflix ($NFLX) Earnings Preview

Streaming Update: Netflix ($NFLX) Earnings Preview

Be honest, how many streaming subscriptions do you have in your household?

Chances are, a couple. Streaming is the new normal, and consumers have more add-on choices than ever.

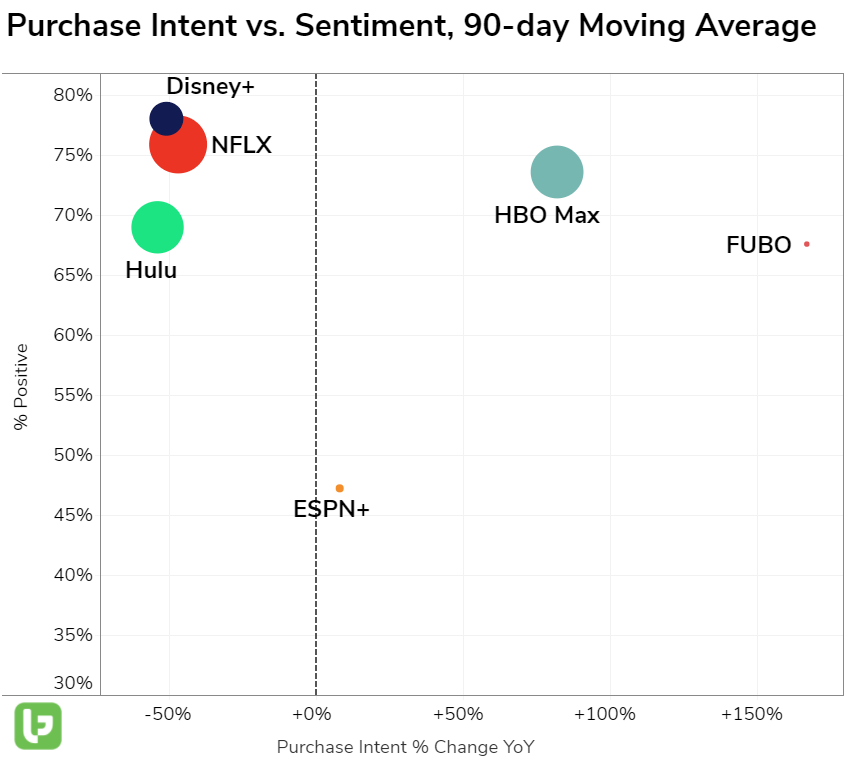

We're tracking the major players in the space. Here's how they stack up:

Key takeaways:

- Happiest Customers: Disney+ and Netflix (more than 75% positive). Disney+ with a slight edge.

- Content Drives Happiness and Retention: Ted Lasso (AppleTV+) actually takes the cake when it comes to a single show at more than 90% positive, but Disney's Mandalorian and WandaVision and Netflix's The Crown recorded high levels of consumer happiness and the largest streaming mention volume.

- Streaming Content is Big Time: Emmy nominations were posted last week and Disney+ and Netflix cleaned up. The Mandalorian season 2 and Netflix's The Crown earned 24 nominations, the most nominations of any series this year. WandaVision earned 23, Ted Lasso raked in 20, and Netflix's The Queen's Gambit received 18.

- LiveSports and Theatrical Releases are driving growth for FUBO, HBO Max. Q3 was Fubo's strongest quarter to date: subscription revenue grew +64% YoY (455,000 paid subscribers), ad revenue grew +153% YoY. HBO Max has an exclusive deal with Warner Bros, who will release all of its 2021 movies simultaneously in theaters and on the streaming platform.

- Going to the movies still down -55% vs. 2019, meanwhile streaming theatrical releases is up +197% in the same time frame.

Now, what does this mean for Netflix EPS?

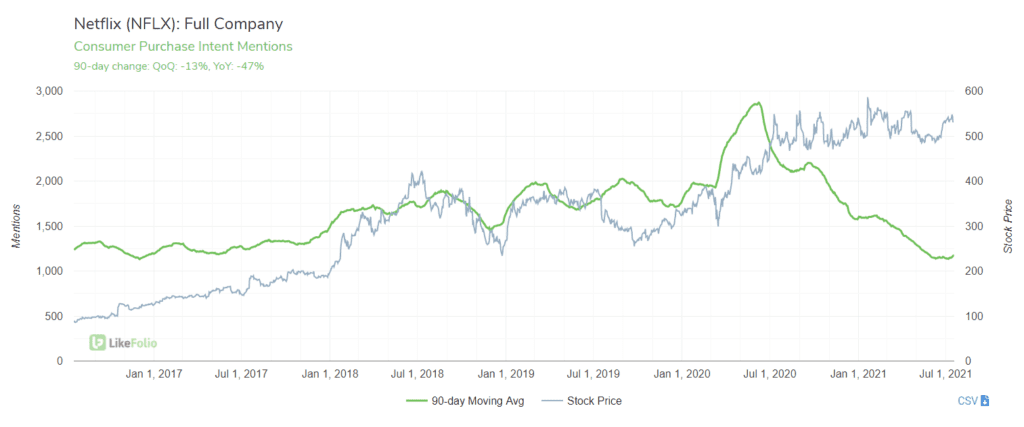

LikeFolio data reveals somewhat of a mixed bag.

Netflix Purchase Intent has dropped -47% YoY, and is actually lower vs. 2019. (These mentions are mostly download, sign up, but there is some streaming crossover).

LikeFolio doesn't show any signs of significant churn. Cancellation mentions are actually -40% lower YoY and -61% lower vs 2019.

However, new user growth is of concern: new subscriptions mentions are down -56% YoY. While we don't capture all international growth, the U.S. may be tapped out.

Last quarter, this was a kiss of death for short-term share price. NFLX shares fell as much as -11% after-hours trading after reporting a large miss in subscriber numbers: 3.98 million vs 6.2 million expected. Revenue still grew +24% YoY, and EPS beat handily $3.75, vs $2.97 expected.

Earlier this week, Netflix announced a foray into gaming. Interesting to see Netflix catching on to what we noted in our Screen Time megatrends report months ago...streaming competition expands beyond traditional screens.

Looking ahead: if investors are watching for new user growth, it's going to be tough. If investors are keyed into retention and pricing power, they may be surprised.