Tiffany's (TIF) will report quarterly earnings Wednesday prior to the […]

Surprising early data from LULU 👀

The analysts are counting LULU out, looping the high-end retailer in a no-longer-cool club with fallen sneaker king, Nike.

Jeffries: "We suspect the company has maximized its core category total addressable market and is attempting to find growth in other areas, but it isn't working."

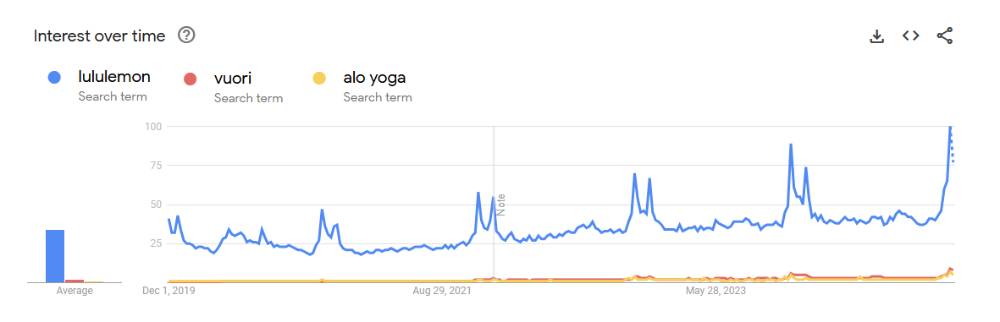

Naysayers cite growing competition from smaller, newer brands like Vuori and Alo, pointing out that about 90% of Vuori stores and 84% of Alo stores are located within half a mile of a Lululemon location across the United States.

This is when it's important to listen to what the consumer is saying.

Malls were absolutely packed on Black Rriday and consumer spending surged -- we saw this first hand. Lines spilling out of lululemon. Bodes well for in-store purchases.

Consumer searches show that while both Vuori and Alo Yoga are growing, they still have a way to go to catch up to Lululemon...which also looks like it had a solid holiday shopping weekend (highest on record):

If you zoom out on the entire athleisure picture, you can see LULU is actually beating many other brands.

For reference, we don't traditionally cover Alo Yoga but if it were on this chart, it would be below Lululemon at +23% YoY.

Lululemon is also working to expand its international exposure. A month ago Alibaba called out strength in LULU specifically on its annual Singles' Day. Last quarter international sales were a bright spot, jumping +29% YoY.

Now, the market will be looking for signs of improvement domestically -- especially after a botched product launch weighed on consumer sentiment and headlines this summer.

Here's how we're playing earnings...

This section is restricted to LikeFolio Pro Members only.