Tesla reports earnings after the bell on Wednesday. After last […]

The Truth About Tesla

The Truth About Tesla

As we head into Tesla (TSLA) earnings tonight, a lot is already known.

The company already reported record deliveries in Q4 and the full year of 2021, making it much easier for Wall Street to “price in” the expected revenue numbers.

What’s unknown is 1) how much Tesla spent to make that revenue (i.e. what were profits?), 2) how much can production ramp up from here, and how quickly? and 3) most importantly, what’s the company’s outlook for 2022 and beyond? We can’t answer the first two. But we can get a huge edge on Wall Street by looking at consumer insights data to better understand the demand trends that will help drive Tesla’s thinking about the future.

I’m focused on three key LikeFolio insights: 1. Electric vehicle (EV) demand is booming EV’s used to be a joke. Small, low-performance vehicles that almost seemed like gimmicks.

Now, thanks especially to Elon Musk’s bold strategy of starting at high-end performance and working his way down to mass production… all that has changed.

EV’s are faster, quieter, and more fun to drive.

It also doesn’t hurt that gas prices are squeezing consumer wallets while EV’s tend to cost less than $10 to “fill up” at the plug.

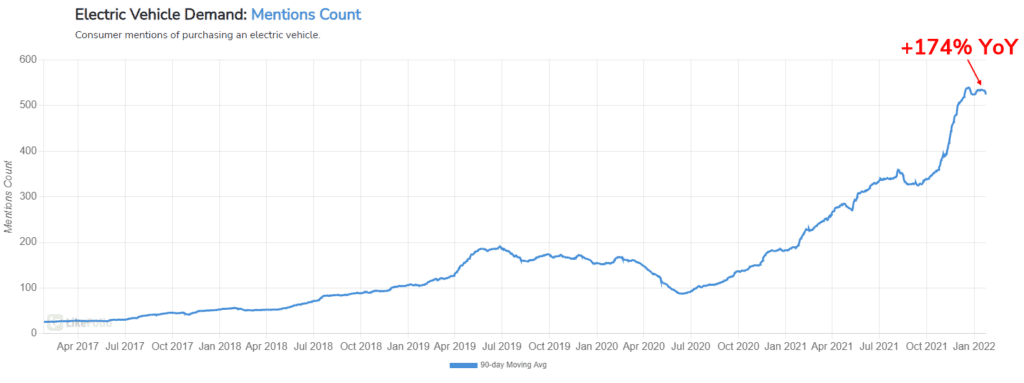

All of these factor into a big acceleration in overall electric vehicle demand, which you can see very clearly from this Likefolio Insights chart of the macro trend:

Impressive!

We have no doubt that Tesla is seeing nothing but “green lights” when it comes to the overall demand for electric vehicles.

2. Tesla is increasing its brand dominance in the full automobile sector

From a competitive standpoint, the EV demand boom is proving true as well.

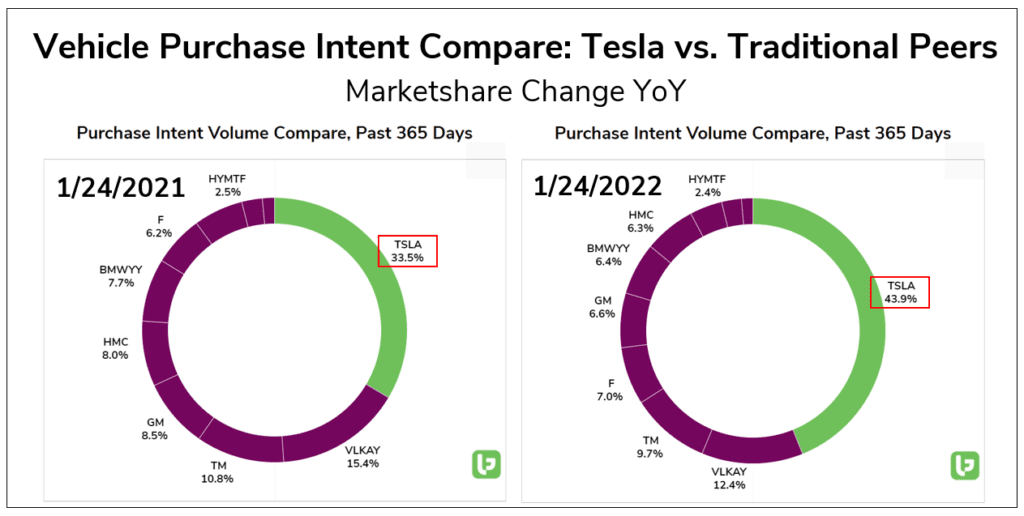

Here’s what happens when we plot Tesla’s consumer demand levels against traditional automakers:

Two things jump out at me about this chart combination

- Tesla is absolutely dominating consumer mind-share, with a shopping 43.9% of all purchase intent mentions

- That mind share has increased by more than 10% over the past year, meaning that Tesla’s dominance is growing

The growth in mind-share dominance for Tesla is likely attributable to two things.

First, they make awesome cars that people really want.

Secondly, they were actually able to produce and deliver new vehicles over the past year while their traditional competition sat around and waited for chips.

In any event, Tesla is clearly in the driver’s seat when it comes to creating a product and brand that resonates with consumers… especially when pitted against traditional rivals.

3. Competent competition is (finally) coming

When you’ve had as much success as Tesla has had (the stock is up over 1,700% over the past five years!)… competition is sure to follow.

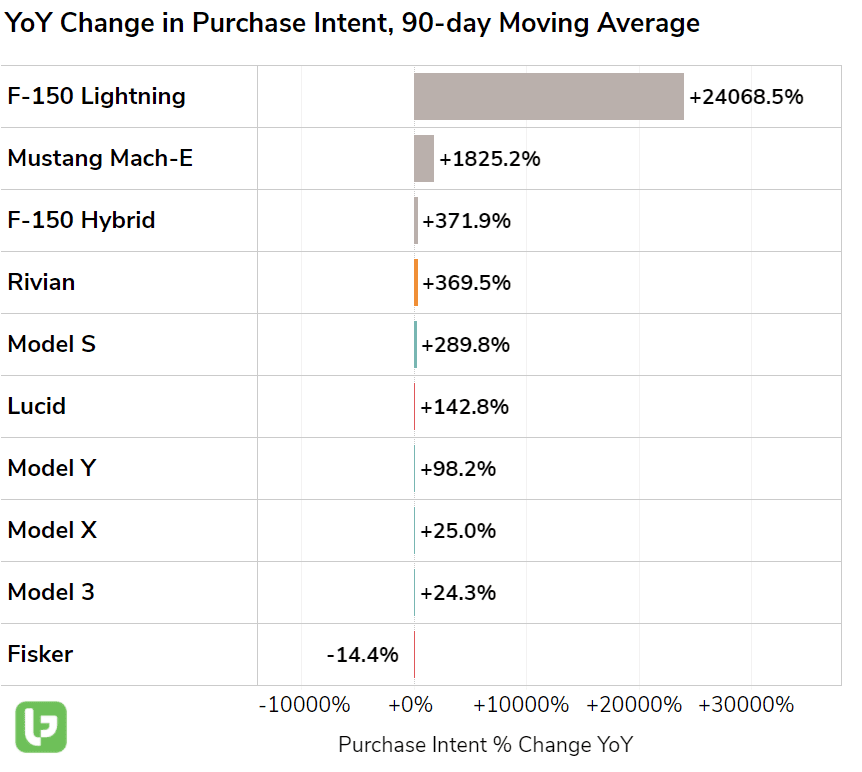

And based on growth rates in LikeFolio Consumer Demand data, that competition has finally begun to arrive:

Ford’s entry into the electric vehicle market has been impressive, to say the least.

The F-150 Lighting looks poised to become a runaway success, as the company has seemingly struck the perfect balance between “Ford Tough” and “Electric Cool.”

Pure EV companies like Rivian and Lucid are also making a splash. Each has created impressive vehicles in early production and demonstrated some capacity to scale.

On this, we think Tesla will likely acknowledge the growth of EV competition, but be able to accurately frame it as a positive signal for the industry that they currently dominate.

Bottom line: Volatility and Opportunity Abound

You’ve been hearing us talk more and more about the “EV Tipping Point” lately.

All of the consumer insights data we track tells us that our thesis is right on track: Within 2-3 years, the automotive industry is going to look very, very different.

In the meantime, we expect to see pure EV stocks like Tesla, Lucid, and Rivian experience extremely high volatility and continue to trade at “expensive” valuations compared to peers.

But as we’ve seen in the past with Amazon, Microsoft, and other groundbreaking tech companies – when you’re at the top of a rapidly growing industry, stocks can stay very very “expensive” for a long time.

I believe investors would be wise to continue treating large pullbacks in Tesla stock as an accumulation opportunity.