Carvana Demand Approaching All-Time Highs LikeFolio published a Bullish alert for Carvana […]

This company claims 1% of a trillion dollar market

Last week Carvana surprised the market – and us!

The company reported its first ever annual profit.

At LikeFolio, we’re great at predicting revenue, but the internal workings of a company are out of our range.

But we can take a retrospective look back to see what we can learn – and how we can best play it from here.

Let’s start with the results:

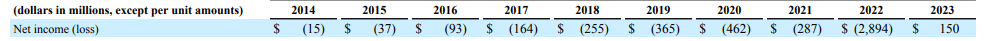

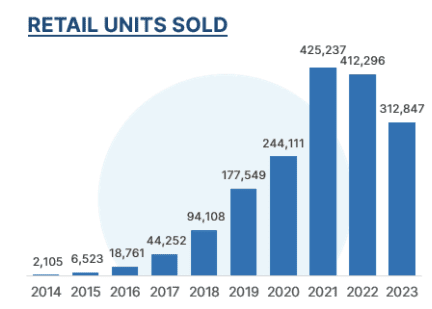

- Q4 Revenue: $2.42 billion (-13% YoY)

- Q4 Retail units sold: -6% YoY

- FY23 Net income: $150 million

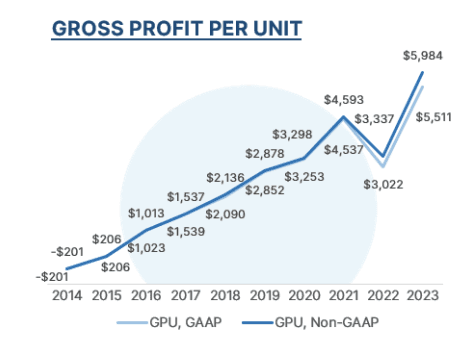

The third bullet is the major driver of investor optimisim, assisted by Carvana’s ability to generate a larger gross profit per unit than the year prior.

You can see the stark turnaround on the images below:

How is Carvana achieving this?

The company is effectively leveraging technology and streamlining its own internal processes. This allowed the company to:

- Trim down the time its own employees spent per sale by 40%

- Lower the average days-to-sale by ~70 days (from its peak in 2023)

- Reduced the non-vehicle cost of a sale by $900 per unit

Whew.

Bottom line: Carvana and its team are getting better at moving and selling vehicles – so even though the total number of units sold DID fall, operational improvements more than offset the weakness.

This ticks off Step 2 of Carvana’s 3 step plan (driving fundamental gains in GPU and operational efficiency).

Step 3: Return to Growth

What does LikeFolio data show?

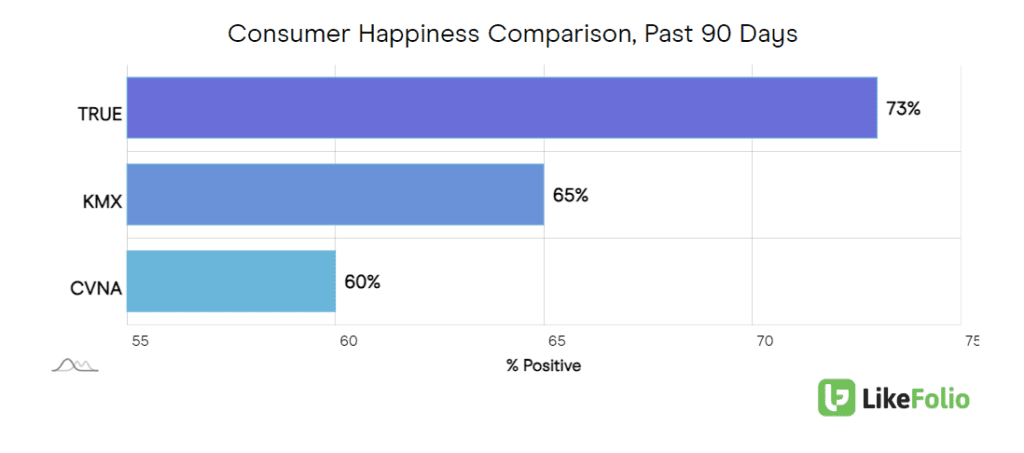

The company still has lots of room for improvement.

It sits at the bottom of the pack when it comes to happiness vs. other used vehicle peers, at 60% positive.

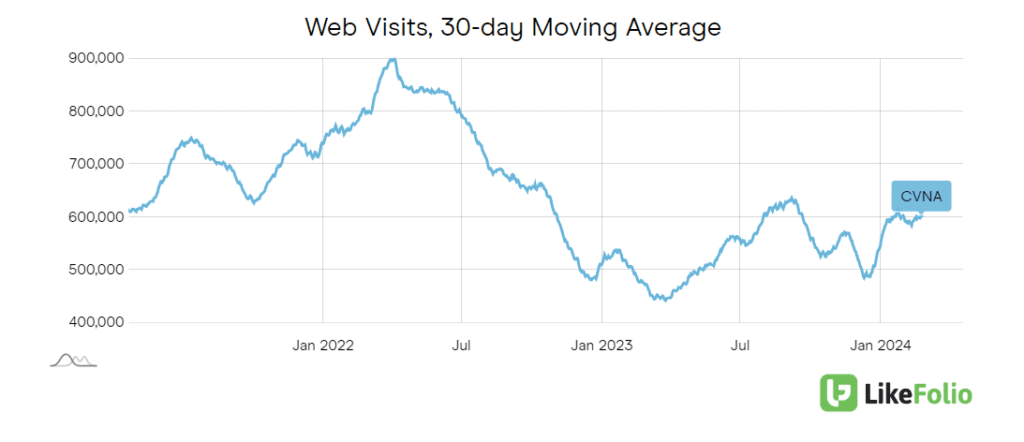

Web visits do show some near-term traction (up +15% YoY), but still runway to catchup to where it was a few years ago (-24% on a 2-year stack).

Assuming Carvana can maintain the operational efficiency it has achieved, web visits will prove extremely valuable to watch to better understand how many cars are changing hands.

After a sequential dip in volume, has the company maxed out its profit squeeze?

We’ll see.

For now, demand does suggest some improvement in volume for Carvana – an indicator of additional market share steal (Carvana claims 1% of a $1 trillion market).

Shares have plenty of room to catch up to 2021 highs – we expect continued momentum in this name.