United Parcel Service (UPS) After two quarters of explosive demand […]

Transportation Company Comparison $UPS $FDX

Transportation Company Comparison $UPS $FDX

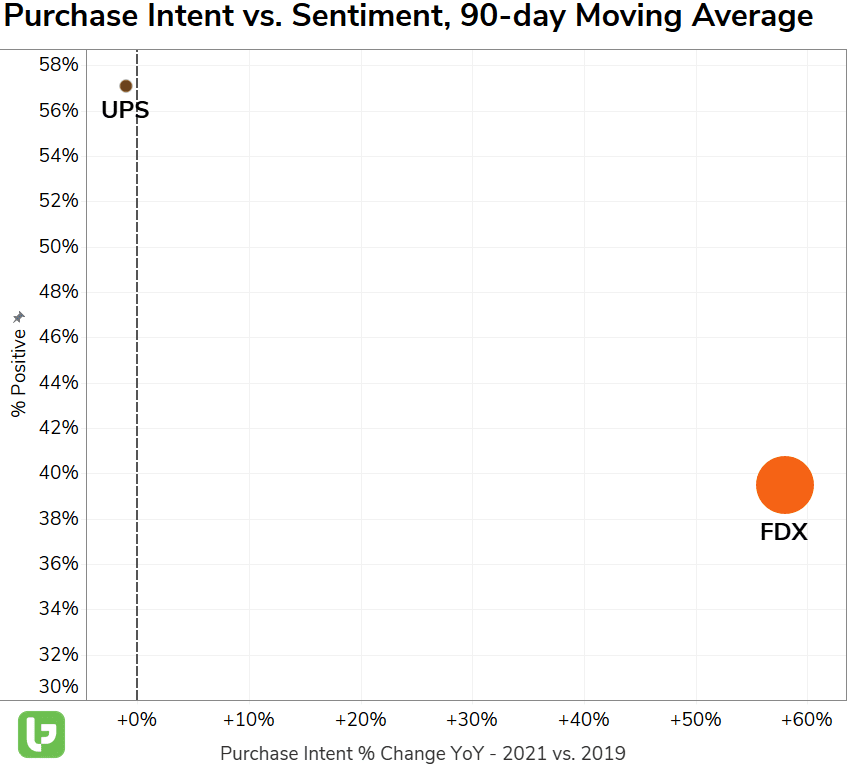

Shipping/transportation companies like United Parcel Service (UPS) and FedEx (FDX) have been huge beneficiaries of the necessary rise of eCommerce -- Is one of these companies maintaining an edge as the U.S. economy returns to normal? It's a matter of perspective. We're already seeing a major pullback in Purchase Intent Mention volume for both names, but FDX is holding on to an edge in terms of lasting growth. FDX Purchase Intent Mentions are trending +58% vs. 2019 (90-day moving average), while UPS has seen PI return to its pre-COVID levels.

However, UPS still has an obvious edge: Consumer Happiness.

At 57% positive, UPS Happiness is nearly +20% higher than that of FDX, and we've seen them maintain that edge over time.

Both companies have seen experienced phenomenal share price growth, but we're expecting to see a slowdown as operations temper in the coming year.