Tesla reports earnings after the bell on Wednesday. After last […]

$TSLA Earnings Cheat Sheet

Tesla (TSLA) reports after the bell Wednesday – here’s how we are thinking about this report, the company’s likely guidance, and how to play the stock (if at all) into the report:

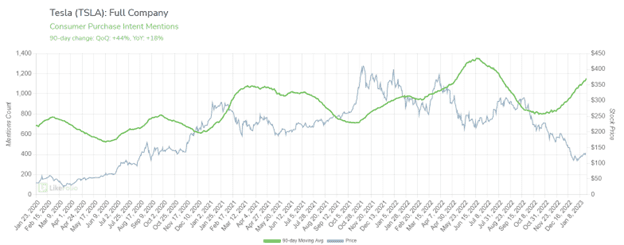

Demand for Tesla vehicles is on the rise again.

Consumer demand, as measured by purchase intent mentions, has reversed course and is now heading higher again.

Levels remain below what we saw during the Spring and Summer of 2022 when high gas prices were driving significant additional demand for electric vehicles.

Price cuts are spiking demand

You can see the full price reduction scope in the U.S. here.

The price strategy aims to:

- Boost demand in foreign and domestic markets

- Bolster Tesla’s position among rising competition

- Allow Tesla to qualify for more federal EV tax credits

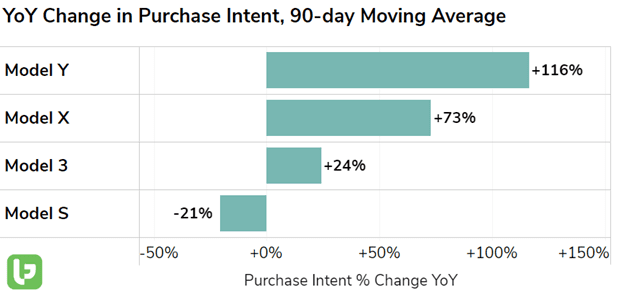

As a result, most Tesla models are seeing robust consumer demand increases.

So far, Musk’s plan appears to be working (in a big way) on the demand front.

Outlook optimism likely

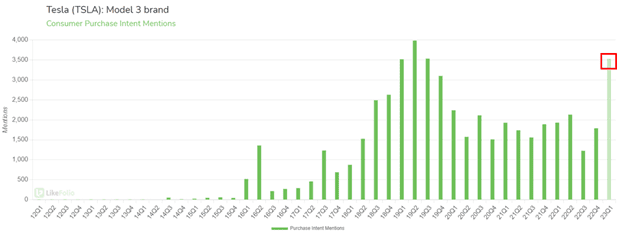

The current pace for Q1 demand of Tesla’s cheapest model (Model 3) is skyrocketing in reaction to the price cuts.

The best bet may be no bet…

Reasons to be bullish:

- Consumer demand for Tesla products continues to grow rapidly

- Full Self Driving capabilities are ramping up exponentially, expanding gap between the next-best tech

- Price cuts reflective of production efficiencies & allow expansion of dominant market share position in the fast-growing EV sector

- Stock down over 50% on shaky investor confidence in the rising rate environment

- Betting against Elon Musk has historically been a bad idea

Reasons to be bearish:

- Price cuts will put significant pressure on profit margins

- Stock up nearly 40% from lows a month ago

- Elon is distracted by multiple endeavors, not least of which is his polarizing acquisition of Twitter

- Gas prices are no longer a demand driver

As we head into earnings, it’s important to remember that NO TRADE is always an option, and often the best choice.

My strategy will be to remain directionally neutral (perhaps a small bullish bias), but to use short-term option spreads to bet that the expected post-announcement volatility ( + or - $13/sh) doesn’t come to pass.