What is the September Slump?

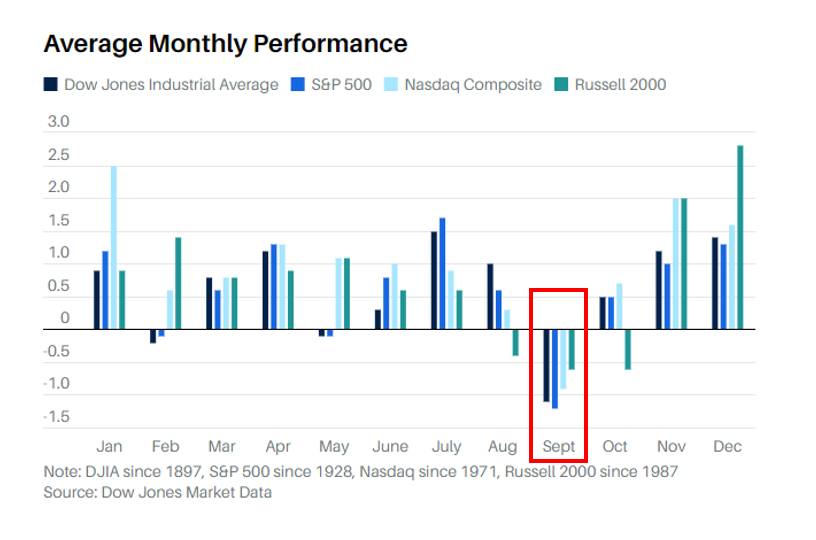

Historically speaking, the month of September isn't great for stocks (or bonds for that matter).

You can see the average monthly performance for the 4 main indexes above.

Some say traders are sad to return from summer vacations. Other say firms are taking profits ahead of end-of-the-year statements.

But the trend is one traders should be aware of, regardless.

We've already seen a significant pullback in Nvidia post-earnings, despite today's small rally.

The upcoming jobs report could be very telling, and give us a better idea of if/when/how much the Fed may cut rates.

Early reports (JOLTS) are a bit weaker than expected.

US job openings fell to 7.673 million in July, below the expected 8.090 million, showing fewer opportunities for job seekers as the labor market slows.

In times of uncertainty, it's nice to have your research ready to roll to capitalize on any pullbacks.

We're putting together a watchlist of some of our highest conviction names, bolstered by strong consumer sentiment and macro trends.

Stay tuned...