Which wireless stock has the best signal?

Cell phone service is an essential purchase but that isn’t stopping consumers from seeking out the best deal.

With Americans in search of savings anywhere they can get it, mobile phone plans are becoming a popular target for budget cutbacks.

In turn, competition among wireless carriers is as intense as ever.

Companies are pulling out all stops to get consumers to switch and stay—lower prices, flexible family plans, free smartphones, and free earbuds. Proudly displaying colorful U.S. coverage maps is simply less effective these days.

One year removed from President Biden allocating $65 billion for broadband, the nation’s 5G buildout is ramping fast—even as the economy slows. AT&T, Verizon, and a host of challengers are scrambling to secure bandwidth to spread affordable connectivity across the country.

This has upped the game for wireless providers to offer more than just reliable mobile service. ‘Bundles’ that include high-speed internet are now commonplace.

So, with the nation full speed ahead on the digital transformation, we thought we’d pause to see which companies are winning.

What features are attracting new customers?

What is causing people to switch carriers?

Will the corny TV ads ever end?

Let’s dial into three of the names we’re following:

1. U.S. Cellular (USM)

| Like with cars and eBay merchandise, auctions are the mechanism by which wireless companies acquire spectrum. U. S. Cellular’s 5G growth strategy is to acquire low, mid, and high band spectrum at FCC auctions. This allows it to cover most of its subscribers with 100+ Megahertz mid-band and deploy lower band spectrum to underserved rural areas as set forth in the Infrastructure Bill. The company now offers wireless services and equipment to 5 million residential, business, and government customers across 21 states. Its sights are set on nationwide expansion to provide vital connectivity for remote work, education, and health care. In Q3, USM added 107,000 handsets and 44,000 other devices to its postpaid base. Net additions decreased but improved sequentially for the second straight quarter. Net prepaid additions, on the other hand, were positive for the first time since 3Q21. This tells us that budget-conscious consumers are embracing USM’s prepaid plans. They like the peace of mind that comes with a consistent monthly payment—and avoiding accidental overages. Prepaid plans are also relevant in this inflationary environment because they: |

- Offer Flexibility: Current devices can be converted to prepaid, or customers can pick from a lineup of affordable devices.

- Don’t Require a Contract: People don’t want to be locked into a long-term contract when job and economic uncertainty are high.

- Don’t Require a Credit Check: Prepaid can be a solution for those with poor or no credit history.

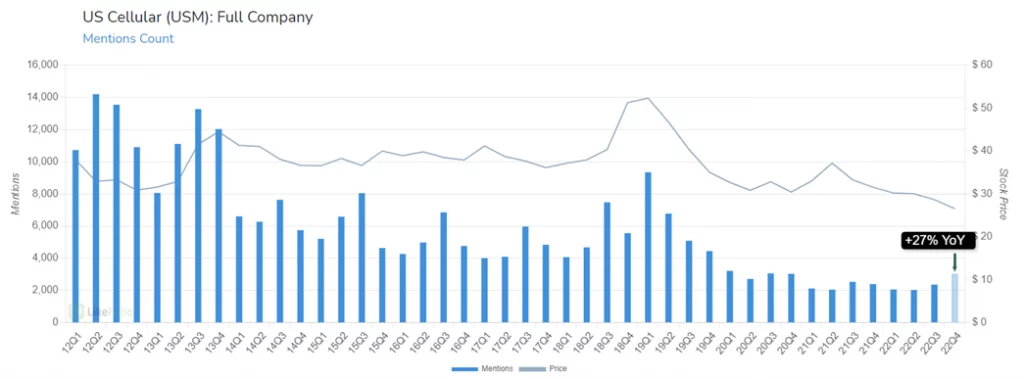

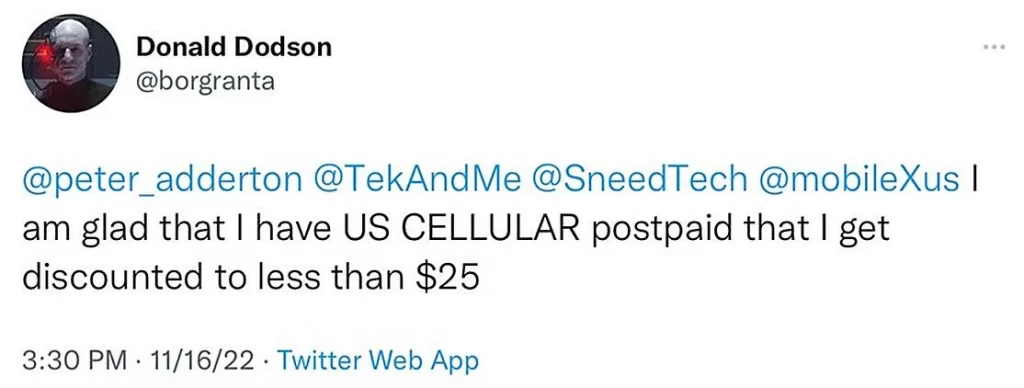

| The budget-friendly nature of prepaid alternatives is driving an uptick in consumer chatter around the U.S. Cellular brand. In Q4, total mentions are tracking +27% above last year. Consumer sentiment is also trending higher. What are retail customers happy about? $25 a month for unlimited talk and text is a crowd-pleaser. Even more so after U.S. Cellular sweetened the offer with 2GB of data. |

| Customer service is huge in this industry, and USM is faring well in this department too. |

Another common thread is parents getting their children a prepaid phone as their first phone. This allows them to monitor usage and teach responsible budgeting. Beats the heck out of forking over a cool grand for the latest iPhone!

Overall, there is good buzz around U.S. Cellular heading into the holiday shopping season. The stock got clobbered on Q3 earnings but rising consumer interest could lead to a better demand/stock connection ahead.

For its increasing relevance in a pricey economy, we give U.S. Cellular 3 out of 4 bars.

| LikeFolio Strength Signal: |

2. Verizon (VZ)

| Verizon is proof that wireless competition is fierce. In Q3, the company suffered 189,000 wireless retail postpaid phone losses. Management cited “elevated churn” partly stemming from price increases. This suggests consumers are fed up with price hikes everywhere else and eager to move to another carrier for a better deal. The consumer shift to value was also apparent in Verizon’s prepaid numbers. Like USM, Verizon had net additions in the prepaid business mainly thanks to the acquisition of TracFone. Where Verizon is struggling, however, is with its old playbook of winning over customers with superior network quality. Continued reliance on this strategy isn’t resonating with consumers as much in an environment where price matters more. As a result, Verizon is being forced to join peers in lowering its rates on unlimited data plans and offering unsubsidized plans. To its credit, though, Verizon’s consumer business is growing despite the churn. Wireless plan upgrades and broadband additions drove 10.8% growth in Q3. Since then, a revamped trade-in deal for a free 5G phone and up to $1,000 in credits is generating a fair amount of buzz among holiday shoppers. Consumers that switch to Verizon also get a smartwatch, tablet, or earbuds as a free gift. With the macro backdrop weakening, Verizon sure is pulling out all stops! |

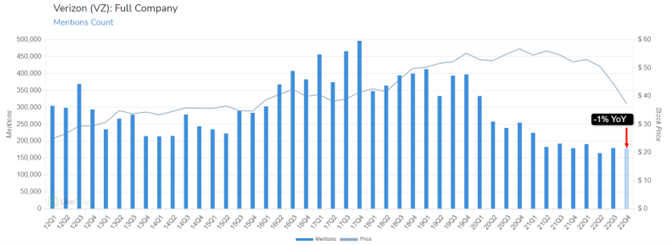

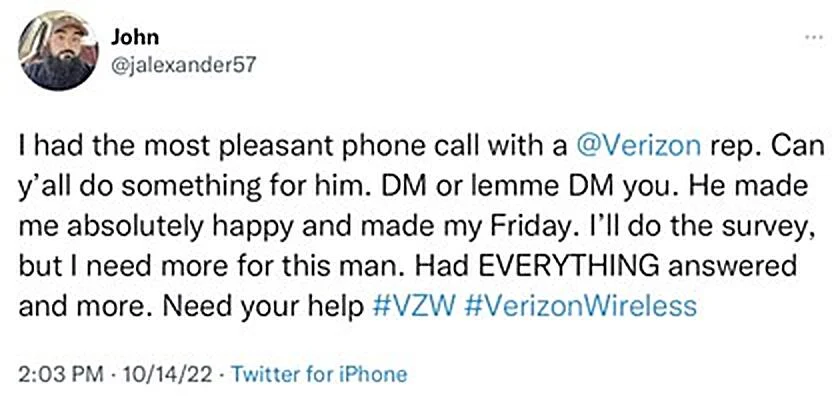

| Just as Verizon’s Q3 results were mixed (sales up, profits down), we are seeing mixed consumer sentiment on social media. Total mentions are basically flat so far in Q4 and struggling to rebound from Q2’s record low. Happiness mentions are also flat YoY. Black Friday deals and customer service are getting relatively high marks. |

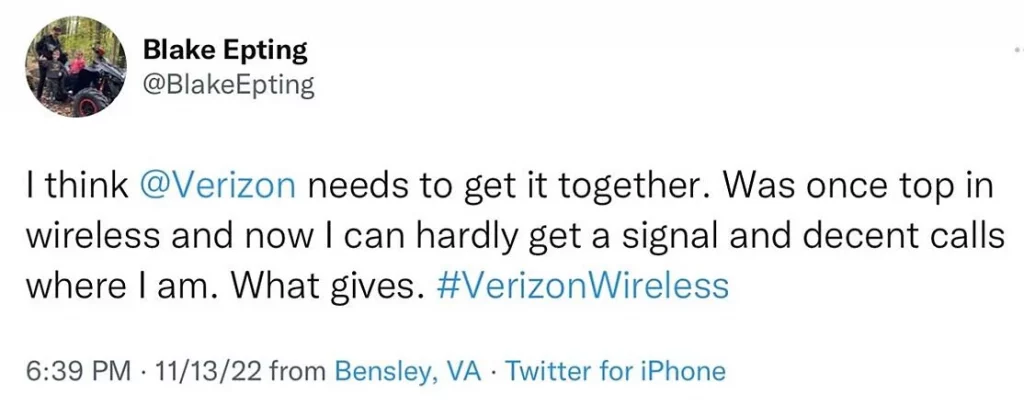

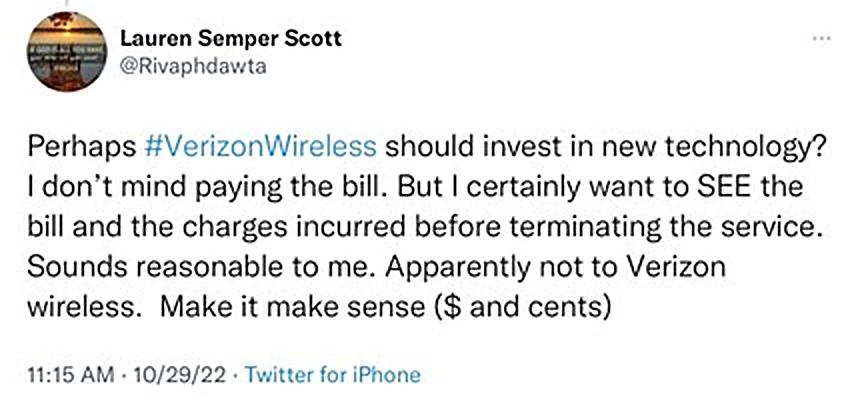

| At the same time, Verizon is losing its edge as a high-quality network. Customers are complaining about poor signals and dropped calls. Mysterious charges and hard-to-get billing information are irritating some. |

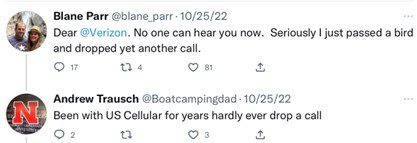

| Interestingly, USM customers are responding by urging unhappy VZ customers to join their team. One guy stated he’s been with U.S. Cellular for 25 years! |

Verizon is being forced into a promotional game that’s not in its DNA. Thus far it is having a tough time luring customers especially as questions about network quality pop up.

It’s two bars from us.

| LikeFolio Strength Signal: |

3. T-Mobile (TMUS)

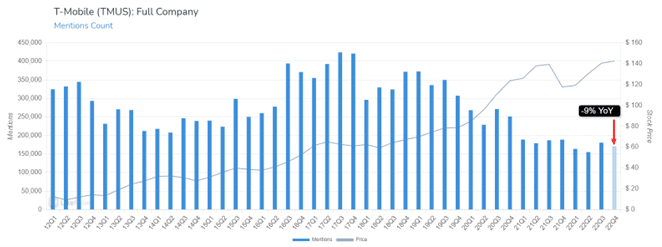

| T-Mobile’s merger with Sprint added a ton of mid-band spectrum to build out its next-gen 5G mobile network. It also broadened its customer base and provided a competitive edge over industry giants like AT&T and Verizon. Unique wireless promos like ‘Disney Plus on us’ and free music streaming are also a differentiator. Granted, promotional activity combined with plan price cuts are squeezing margins. A bigger concern is that consumers aren’t exactly knocking down the doors to get T-Mobile’s latest deals. Even the ‘free iPhone on us’ or a ‘price lock guarantee’ offers have yet to attract much buzz. LikeFolio’s comprehensive TMUS demand is pacing down -9% YoY this quarter. Not a good sign when the holiday shopping period has historically been a key growth catalyst. |

| Of course, the weak macro environment is a big reason for the soft demand. But there’s a bigger challenge here—brand reputation. T-Mobile is still reeling from a series of data breaches that have damaged more than financial results. Consumers may have a lower tolerance for poor customer service at T-Mobile than at other carriers. In Q3, postpaid and prepaid customer churn both increased sequentially. With TMUS already on thin ice, damage control from repeated exposure of customer credit information seems to be shifting resources away from customer service, a key factor in the wireless wars. Our Consumer Happiness reading for TMUS is trending back toward 50% after nearing 60% before the hacks. Frankly, we’re surprised it’s even that high based on the comments we are seeing. Customers are pissed about unexplained charges and getting billed for equipment they never owned or ordered. One person even got a bill despite never being a customer! Unacceptable customer service on the phone and in stores has also been a common theme. Not a good situation when people are already on edge about inflation and economic strain. |

What we aren’t surprised about is that comprehensive demand for TMUS service is hovering near a decade low and down -9% YoY.

CEO John Legere’s tweet that suggested he should run Twitter instead of Elon was an eye-opener.

Come on’ man, focus on T-Mobile, you got 99 problems and Musk ain’t one!

LikeFolio data confirms a serious reputation reboot is needed at T-Mobile.

One bar.

| LikeFolio Strength Signal: |