When social-data and stock price are moving sharply in opposite […]

Will Stagnant User-Growth Knock Netflix?

April 20, 2021

Will Stagnant User-Growth Knock Netflix?

When it comes to Netflix Earnings, it really is a matter of: Choose your Own Adventure.

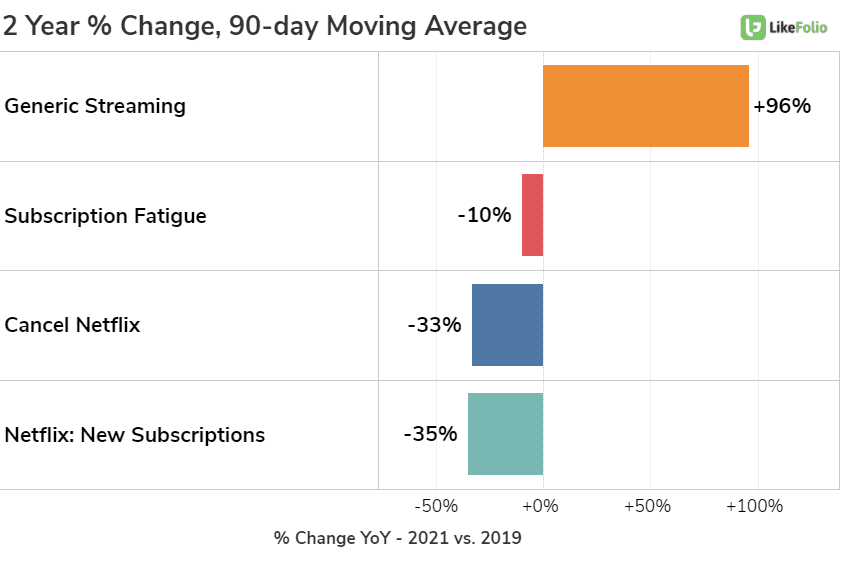

The chart above paints a nice view of the entire picture for Netflix, and sets the stage for Earnings.

- Streaming has exploded since 2019 as consumers cut the cord and multiple players like Disney+ and HBO Max entered the scene. Streaming mentions have increased +96% vs. 2019.

- Netflix user growth is slowing, at least among English-speakers. Netflix New Subscription mentions have fallen -35% vs. 2019. Note this doesn't capture international growth. In 2020, 83% of net additions came from outside the U.S. and Canada, mainly from EMEA (Europe, Middle East, Africa) and APAC (Asia-Pacific) regions.

- Churn is stable: Netflix cancellation mentions have fallen at nearly the same rate as new subscription growth. Outside sources echo that churn is not a concern heading into 21Q1 earnings: this rate is expected to be around 3%, similar to previous years. This is especially impressive considering Netflix raised prices in 21Q1 in the U.S. and will mirror in other markets moving forward.

- Consumers aren't feeling subscription fatigue at the rate they were in 2019. In fact, the average U.S. household has 9 simultaneous subscriptions across streaming media channels (videos, music, games).

What does this all mean?

User growth stagnation is expected. Netflix guidance suggested 209.66 million global paid memberships at the end of March, its weakest growth in years. And LikeFolio data confirms this.

But other factors may come into play, including international growth and stable churn rates amid price hikes.

In addition, Netflix's expansive userbase (more than 200 million paid subscribers) is allowing the company's operating profit to expand: +76% in 2020 vs. 2019.