3 Reasons Pets are Still Good Bets

October 13, 2022

| Quiz: In Q2, Colgate-Palmolive’s fastest-growing product category was a) toothpaste, b) household cleaners or c) pet food… Those that guessed pet food are correct! (and get a treat). Better known for toothpaste, dish soap, and deodorant, Colgate-Palmolive sells dog and cat food under the Hill’s Science Diet and Hill’s Prescription Diet brands. Together they make up Hill’s Pet Nutrition business which posted 18% organic sales growth last quarter! What about the rest of the business? About 7% organic growth. Hill’s is not a minor piece of Colgate’s business either. It accounts for approximately one-fifth of total sales. This tells us that: |

- The pet industry is becoming an important growth driver for consumer product groups, and

- The $123.6 billion that Americans spent on their furry friends last year was far from a pandemic fad.

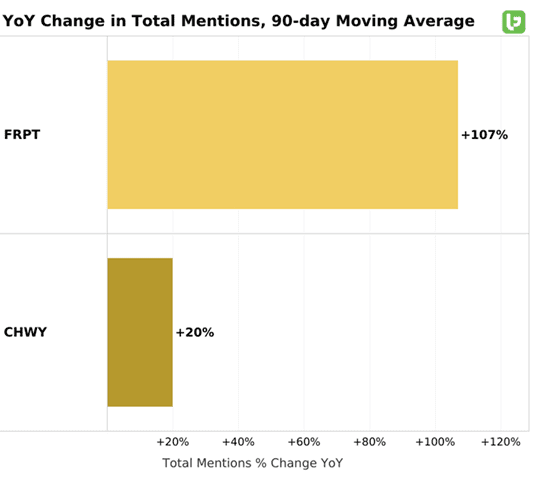

| Two and a half years removed from the start of Covid, LikeFolio data shows that pet trends remain overwhelmingly ‘paws-itive’. And in today’s inflationary environment, companies will continue to lean on this growth market to offset weakness in other consumer spending categories. Here’s why: 1. Dogs and Cats Aren’t Trading Down The 18% growth at Hill’s Pet Nutrition was not just about higher pet food prices, aka ‘petflation’. Price increases accounted for only 12.5% of the growth meaning sales volumes were up 5.5%. (Compare this to FedEx and many others needing to raise prices to offset slowing volumes.) This suggests that pet owners aren’t yet trading down when it comes to feeding their dogs and cats. In fact, they’re only buying more of their trusted pet food brands. Is pet food the ultimate inflation-proof staple? Consumers seem to be particularly loyal to the fresh pet food movement. All-natural chicken and beef-based entrees for dogs and cats are generating a lot of buzz on social media. Mentions of refrigerated pet food company FreshPet have more than doubled since last year. |

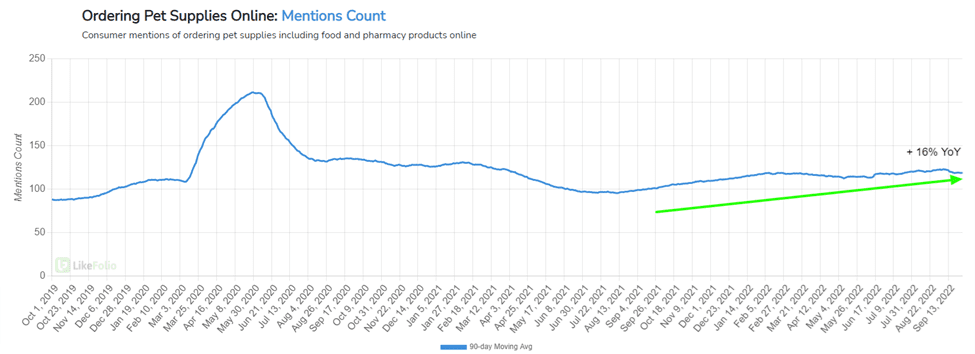

| FreshPet sells its pet food and treats at a range of retailers nationwide. Its customers have also been unfazed by higher prices. Sales at FreshPet were up 38% in the first half of 2022 thanks to better distribution and new product launches. Ok, but what about online pet supply retailers? Surely, demand there must be down. Nope. Consumer mentions of ordering pet supplies online are up +16% YoY. Even Chewy is turning heads lately. Double-digit sales growth and margin expansion in Q2 along with a +20% YoY uptick in comprehensive demand point to a potential inflection for the company. |

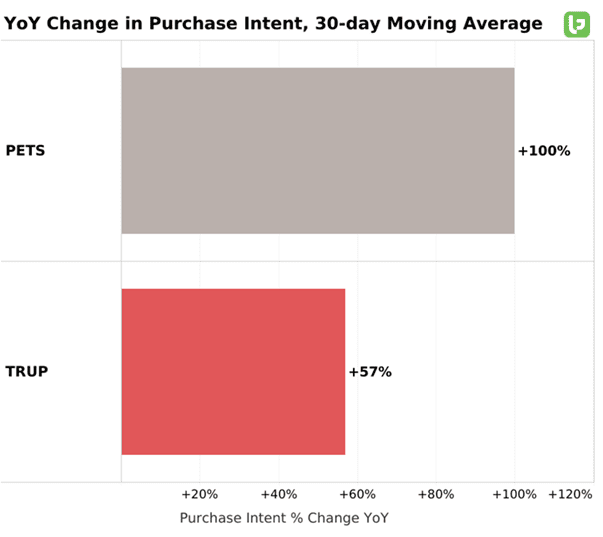

| Yet it’s not just the pure plays benefitting from the resilient pet theme. Pets are running the show at JM Smucker too. In its most recent quarter, profit margins were down in all businesses except one. Yep, it was pets! U.S. pet food profits surged 51% and the margin expanded by 420 basis points. This stuff sells itself! Customer loyalty and trade-down immunity made pets the star segment. Based not on PB&J demand, but on Milk-bone, Meow-Mix, and other pet product demand, JM Smucker raised its guidance. At General Mills, which owns Blue Buffalo, management recently lowered its share buyback outlook because it prefers to use free cash flow to fund its $1.2 billion acquisition of Tyson’s pet treats business. Pets are the growth priority! Bottom line: Demand for pet food and snacks is resilient. Higher costs and lower volumes are creating margin pressures in human food and snack categories. Not so much in pets. And it’s more than just food. 2. Pet Healthcare is Booming August’s 10.1% increase in pet industry inflation was also driven by veterinary care. The only thing pet owners spend more on than food is surgical vet visits. Those prices are up too. Bad news for pet owners, good news for vet practices. Pet healthcare is big business. The pandemic has ushered in a new era of health consciousness, and that includes pets. Like food, visits to the vet and medications are essential goods & services. Procedures and pills that pet owners may have opted to skip in the past are easy yes’s today. PetMed Express (PETS) is a good proxy for consumers’ interest in ordering pet medications online. A +100% YoY jump in PETS Purchase Intent confirms that demand for keeping pets healthy is strong. |

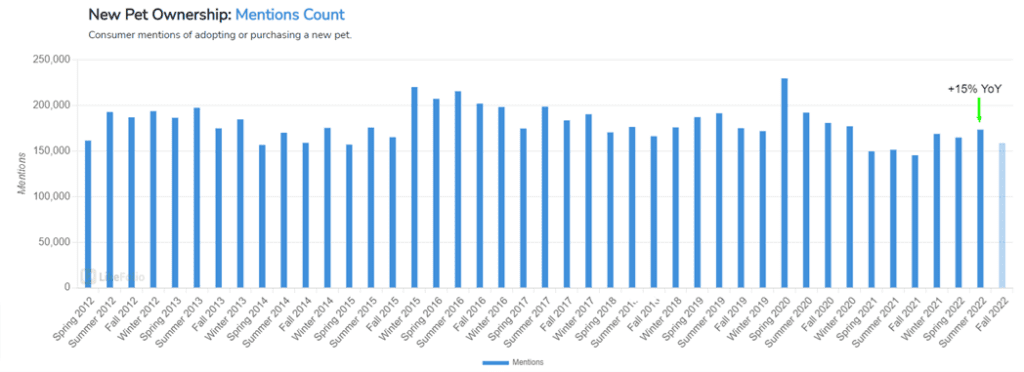

| Higher bills from the vet clinic have spawned another intriguing niche—pet insurance. Sounds new but pet insurance has actually been around for a while. Forty years ago, iconic TV dog Lassie was the recipient of the nation’s first pet insurance policy through Veterinary Pet Insurance (which is now owned by Nationwide). Today there are a bunch of companies clawing at each other for a piece of the North American pet insurance market that more than doubled from 2018 to 2021. A pure play in the space is Trupanion (TRUP). Purchase Intent mentions of TRUP are up +57% YoY, which we find remarkable. American budgets are getting squeezed and yet an ‘optional’ expense like pet insurance is still seeing higher demand. Maybe it's not so optional after all. 3. Pet Ownership is Still on the Rise You’d think that a return to the office and social activities would spell the end of the pet ownership trend. Not the case. Consumer mentions of buying or adopting a pet continue to trend higher. Currently up +15% YoY. |

We think there are a few factors at play here:

- A lot of people are working from home (at least part-time). This affords them the flexibility to own and care for a pet. Rushing home to let the dog out during lunch is less common. Fluffy creatures in the background of Zoom meetings are more common.

- We are attached to our pets and feel bad about boarding them come vacation time. Part of it is the expense, but it’s also about pets being one with the family nowadays. Therefore, a pet’s potential to get in the way of travel is less of a factor.

- The companionship that pets provided during pandemic isolation is as much if not more relevant today. High-stress levels and an increased focus on mental health make pets a must-have.

According to the American Pet Products Association (APPA), 70% of U.S. households own a pet. That means there is a dog, cat, fish, bird, reptile, or horse wandering around at more than 90 million American homes.

It also means that pet food makers, squeaky toy manufacturers, pharmaceutical companies, and pet insurance groups have a large, growing market at their disposal.

Let’s face it. We treat our pets like family and spoil them.

The growth stories in the pet care market are fascinating right now.

With ‘petflation’ clearly a different animal than regular inflation, we expect the consumer buzz to stay elevated.

Our ears are perked up!

Want deeper insights? Get Free Access to The Vault.

Tags: