Roku makes streaming devices that allow its customers to stream […]

5 stocks to watch this week (Earnings!)

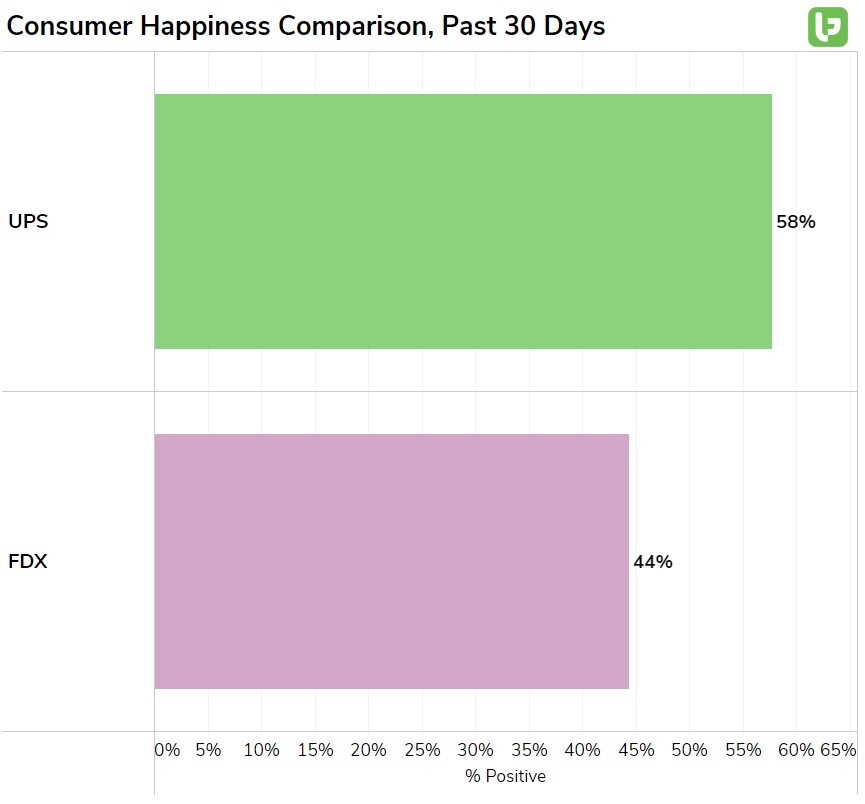

UPS reports before the bell Tuesday.

LikeFolio is currently showing a neutral earnings score on the company, as overall consumer demand mentions have fallen but consumer happiness is up, and significantly higher vs. peer FedEx.

Options are pricing in a $9 move this week.

We think it could move less than this, so a neutral strategy like the Iron Condor could be a good play.

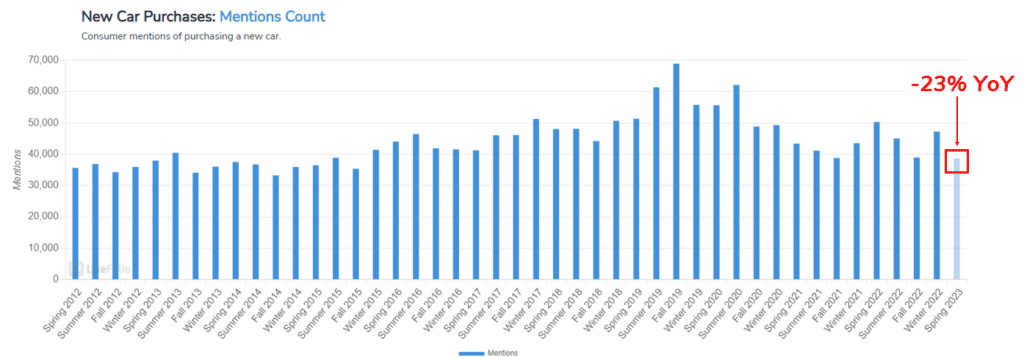

As General Motors (GM) prepares for Tuesday morning’s earnings announcement, several bearish indicators loom.

LikeFolio's predictive consumer demand has dropped 6% YoY, with overall mentions of new car purchases also declining.

Rising auto loan rates, resulting in higher all-in prices, have negatively impacted consumer decisions.

GM's stock has had mixed moves after recent earnings reports, ranging from -4.8% a year ago to +13.3% last quarter.

However, concerns over GM Financial's weaker '23 contribution raise doubts about the upcoming results.

Option prices are predicting a $2.05 per share move, or +/- 5.8%.

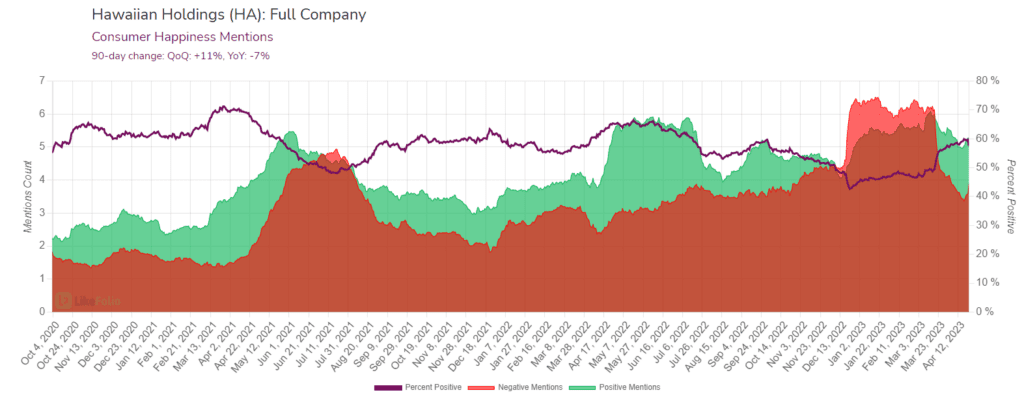

Hawaiian Holdings (HA) reports earnings Tuesday after the market closes, and seems unlikely to break its four quarter losing streak.

HA stock has cratered over 55% in the past year. Unfortunately for investors, LikeFolio continues to see sluggish consumer demand levels and consumer dissatisfaction – especially with baggage handling.

We’re moderately bearish going into the report, but will use a risk-defined strategy like the COIN FLIP BEARISH trade to cap potential losses at a manageable level should the company finally offer a ray of hope.

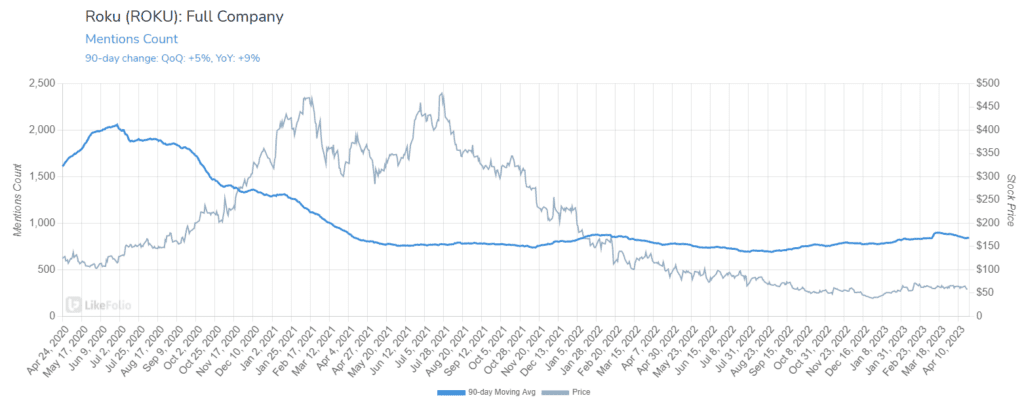

Roku (ROKU) reports Wednesday after the market closes, with options pricing in an enormous +/- 14.3% move on the announcement this week.

The anticipated volatility is high for good reason – ROKU stock has moved by 24% or more in two of its last four earnings reports.

Overall, we think the stock is priced about right here in the short term but could be one of the long-term winners as consumers move from streaming devices like Apple TV and Amazon Fire Sticks to dedicated smart TVs manufactured by Roku itself.

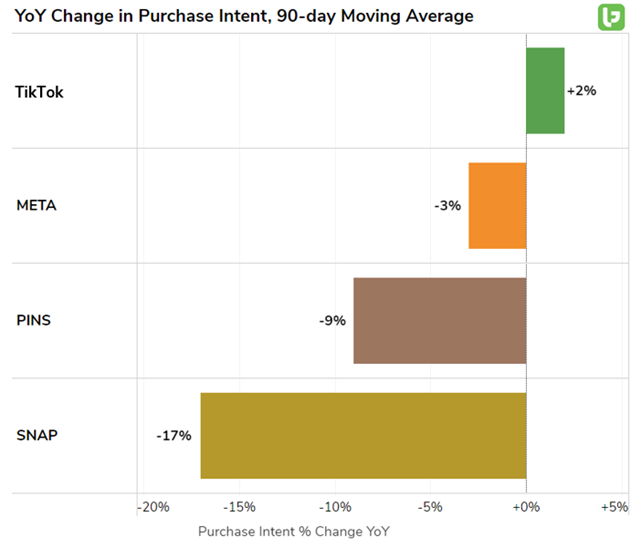

Snapchat (SNAP) gets the dubious honor of our lowest earnings score of the week at -72 (very bearish).

Options are pricing in a 17.1% move after the company has endured four consecutive post-earnings drops… two of which were larger than 25%.

LikeFolio consumer demand levels are down -17% year over year, trailing all peers, and the ad market has proven weak in recent quarters.

Bottom line – SNAP shareholders would be wise to hedge their position into this report.