United Parcel Service (UPS) After two quarters of explosive demand […]

5 Stocks to Watch this Week ($UPS, $HLT, $ETSY, $AAPL, $UPWK)

July 25, 2022

Here are some key stats and data points on stocks that LikeFolio is watching this week...

UPS (UPS)

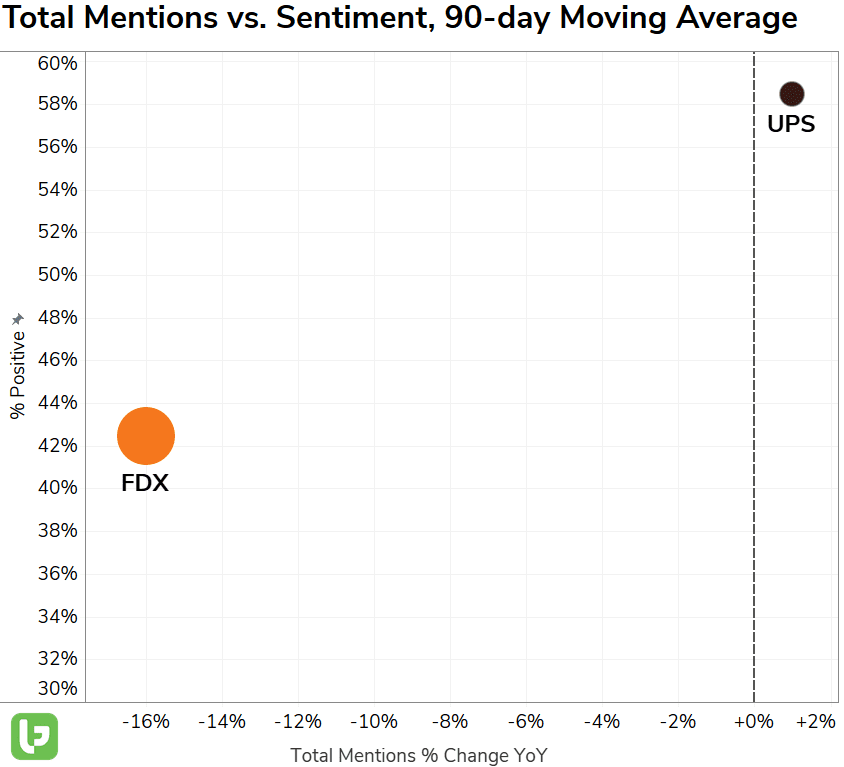

- UPS & FedEx (FDX) combine for more than half of the total market share for package carriers in the United States — Although FDX boasts a higher level of total Mention volume, UPS is outperforming in terms of Mention growth and consumer Happiness.

- UPS is the consumers’ top choice for package delivery, and the stock has also become investors’ preference over the past year: UPS shares rose to a new ATH in February of 2022 and are currently down just -11% YoY…FDX shares are trading more than -25% below the all-time high price in 2021.

- UPS has demonstrated consistent earnings strength, surpassing Wall Street estimates for both EPS and revenue on its last 8 reports.

- LikeFolio data suggests that consumers’ preference for eCommerce remains elevated above pre-COVID levels, a bullish tailwind for this delivery company. Furthermore, UPS is looking to capitalize on eCommerce trends, recently creating a new CTO position to “supercharge” the digital transformation at UPS.

Hilton (HLT)

- Hilton (HLT) reports earnings for Q2’22 (ended 6/30) on Wednesday before the bell. Market expectations are for EPS and revenue to come in at a post-COVID high.

- Underlying Purchase Intent volume confirms a strong recovery underway, with PI Mentions up +19% QoQ and +43% YoY in the reporting period.

- Travel trends are also recovering from the industry-wide lows seen last year, but the landscape has changed. Newcomers like Airbnb (ABNB) are stealing market share from traditional players like Hilton.

- Mentions of Avoiding Hotels: +5% YoY on a 90-day moving average.

- HLT consumer demand is plateauing at a level well below pre-COVID highs, trending -7% QoQ in the ongoing quarter.

Etsy (ETSY)

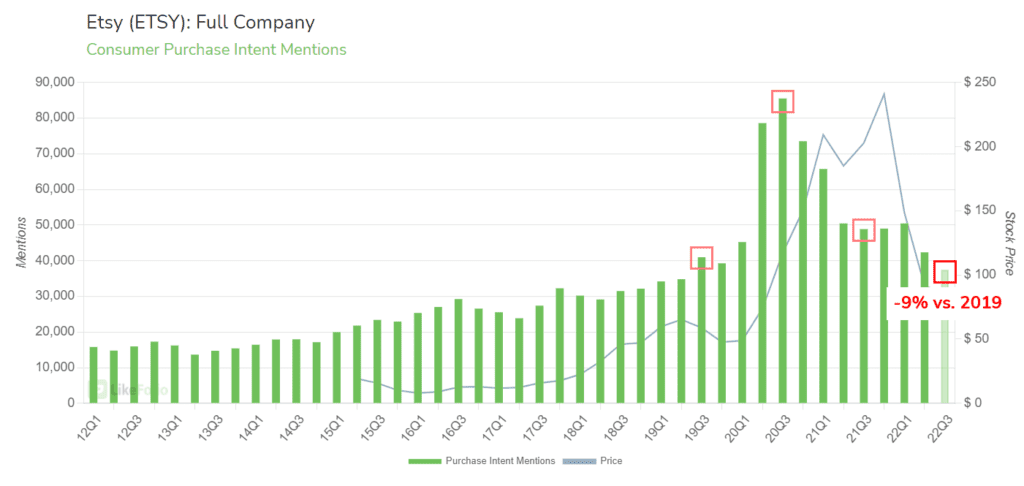

- Last quarter, ETSY’s guidance reflected that the e-commerce sector was still cooling from its Covid-driven hot streak. Etsy projected Q2 revenue between $540-$590 million, well below the expected $628 million.

- LikeFolio data shows the softening in overall eCommerce is flattening out, only dipping a point lower vs. last quarter. Ecommerce mentions remain significantly higher vs. pre-pandemic levels: +13%.

- Etsy’s growth rate is troubling. Mentions of using Etsy’s retail platform as a buyer or a seller have dipped BELOW 2019 levels.

- Etsy guidance in 22Q3 appears weak. One month into 22Q3, demand mentions are pacing for a -23% YoY decline (worse than the decline recorded in Q2) and a -9% decline vs. 19Q3.

- ETSY shares are trading more than -50% lower on a YoY basis. This stock performance appears justified by consumer mentions.

Apple (AAPL)

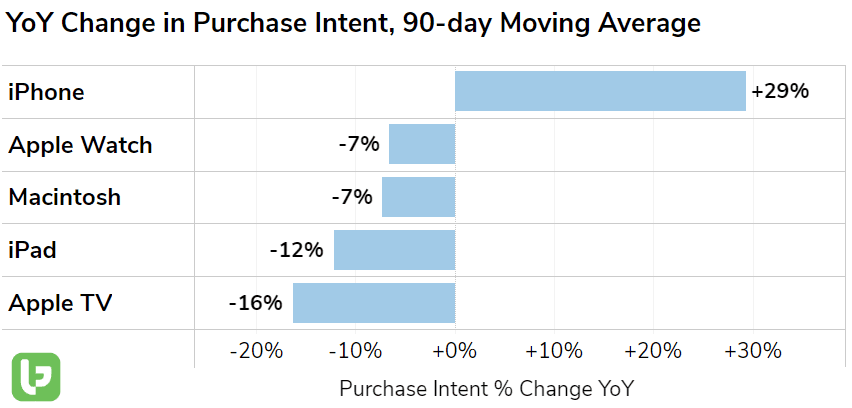

- The iPhone leads Apple device demand strength heading into 22Q3 earnings. Last quarter iPhone revenue increased by +5.5% YoY and LikeFolio data suggest this growth has accelerated.

- iPhone revenue comprises more than half of Apple revenue ($50.57 billion out of $97.28 billion), the largest segment.

- Apple is offering a rare discount on top-tier iPhones in China ahead of the company’s annual Keynote event when it launches its next cycle of devices.

- Apple services revenue continues to grow at a steeper clip vs. all other categories. Last quarter this revenue segment grew by +17% YoY, reaching $19.82 billion. Services include subscriptions like Apple TV+, Fitness+, App Store purchases, and payment services like Apple Wallet.

- Heading into earnings, Apple is expected to report the slowest quarterly sales growth figure in the past 2 years, driven by supply chain issues, inflation, and weakening demand.

- Apple iPhone demand among English speakers is encouraging, and trends suggest more consumers are making the switch to iPhone vs. Androids.

- Historically speaking, 22Q4 is the most predictive of AAPL stock performance for the next 9 months due to the timing of its annual keynote event. Demand mentions are rising ahead of this event (date has not been formally announced): +14% QoQ.

Upwork (UPWK)

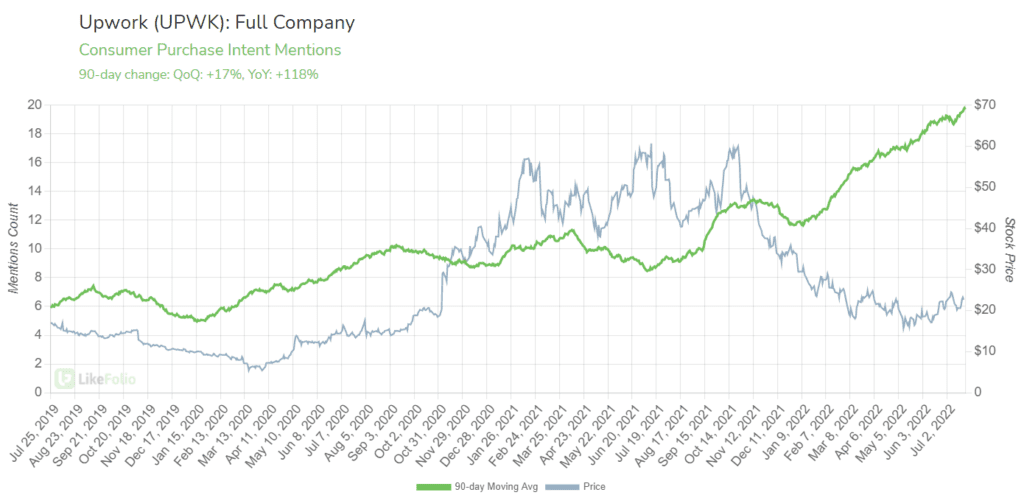

- The adoption of remote work during the pandemic served as an adoption spark for a very specific type of remote work: freelancing.

- Mentions of hiring freelancers have continued higher post-pandemic, currently pacing +44% higher YoY, the highest level LikeFolio has ever recorded.

- These macro trends have propelled Upwork demand mentions through the roof. Upwork usage mentions from business and freelancers have increased by +188% YoY.

- As adoption soars, Upwork happiness remains 83% positive – an impressive feat.

- Upwork has significant exposure to conflict in Ukraine. In 2021, ~10% of revenue stemmed from work where either the talent or client was located in Ukraine, Russia, or Belarus and ~10% of its own team members were located in one of the three countries.

- Last quarter, UPWK shares popped following 22Q1 results that beat analyst expectations across the board. Revenue increased +24% YoY and the company ended the quarter with nearly 800,000 active clients.