5 Stocks to Watch This Week (SNAP, PYPL, RIVN, NVDA, PINS)

October 10, 2022

Here are some stocks that LikeFolio is keeping an eye on this week...

PayPal (PYPL)

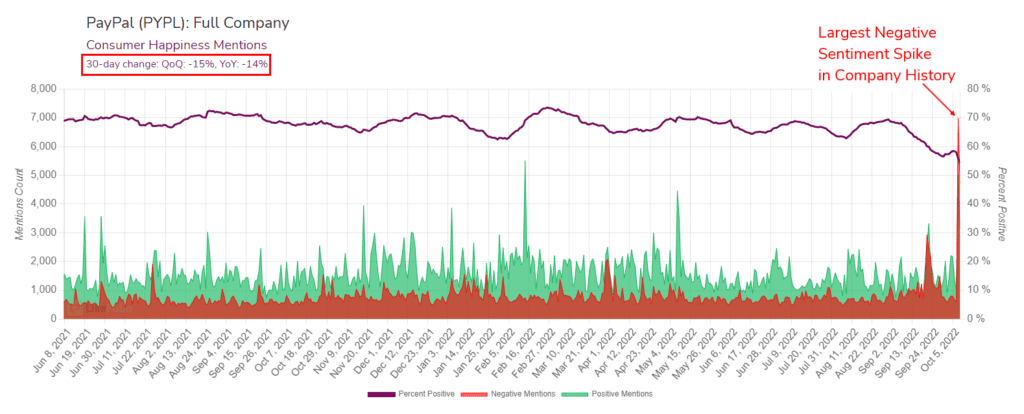

- LikeFolio recorded the largest negative sentiment spike in PayPal’s data history in response to updates in the company’s user agreement. PayPal’s terms of service outlined an imposable fine up to $2,500 on users who use its service to “promote misinformation.” The company has stated this update was sent in error, and the company will not fine users for misinformation.

- The damage may already be done. Not only did sentiment plunge, but the overall mention volume spike on Oct. 8 was the highest in company history, too…by a longshot. We logged more than 84,000 conversations related to PayPal on Oct. 8, when service updates were publicized by the company’s former President.

- Qualitative review reveals many consumers lost trust in PayPal and are actively seeking new service providers. We will be tracking sentiment, cancelation mentions, and “switching” mentions to determine which peers may benefit from PayPal’s total miss.

Rivian (RIVN)

- Rivian announced a recall on Friday that impacts nearly all of the vehicles it has produced (around 13,000). The company will tighten a loose fastener in the vehicle's front suspension that could lead to excess wheel tilt and potential loss of power steering control.

- Rivian has recorded no known injuries to date, and the defect is only believed to impact ~1% of vehicles recalled. This news sent shares down -10% on Monday as investors question the company’s ability to execute on production goals.

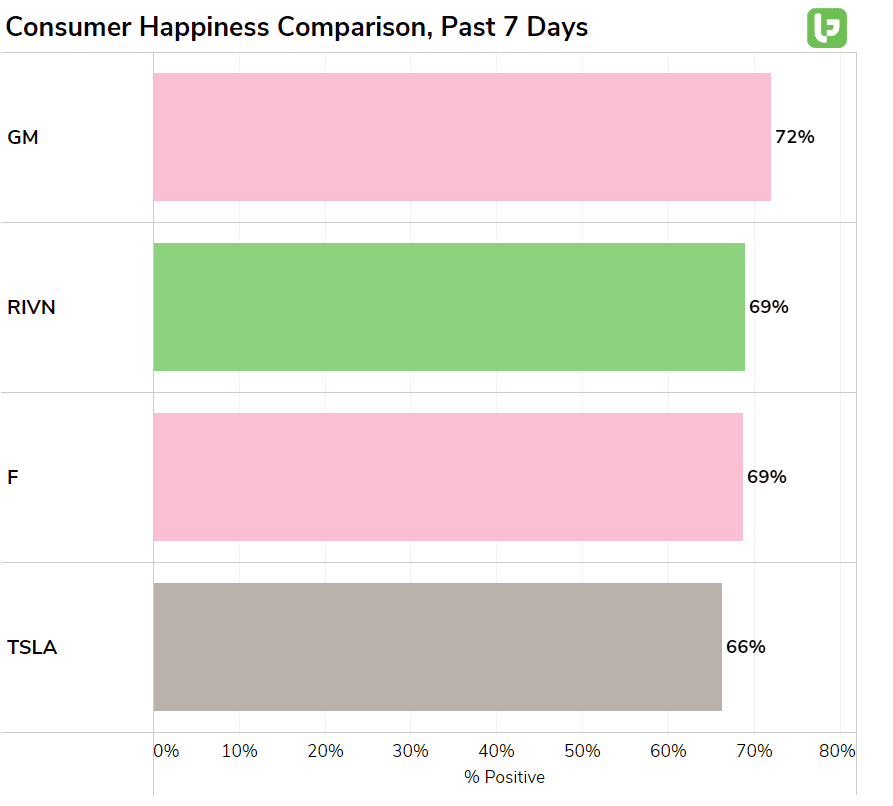

- This news did ding consumer happiness. Rivian happiness levels dropped more than 10 points following the news. Even WITH this sentiment drop, Rivian remains competitive with EV and traditional auto peers. In addition, LikeFolio data shows Rivian happiness is already recovering, suggesting this event may be a flash in the pan.

Snapchat (SNAP)

- SNAP usage mentions are rising. Consumer Purchase Intent mentions for the company have increased by +14% YoY and +8% QoQ (30-day MA).

- Consumer Happiness levels are also moving upward, +5% YoY and +5% QoQ (30-day MA). Qualitative review of mentions show users love Snapchat's filters and stick around for the 1:1 communication (daily chats with friends) and user history (like the app's sentimental "saved memories" functionality).

- Back in August, Snapchat rolled out its first set of parental controls in the US. As of yesterday, these controls were rolled out in India as well. These parental controls are available for parents/guardians with teens between the ages of 13-18. So far we are seeing a positive response from users.

- LikeFolio data suggests a divergence opportunity may be forming in SNAP. The stock is hovering just above $10, down ~78% year to date as usage mentions rise. We'll be monitoring metrics ahead of the company's next earnings event Oct. 20 and will provide updates for members.

Nvidia (NVDA)

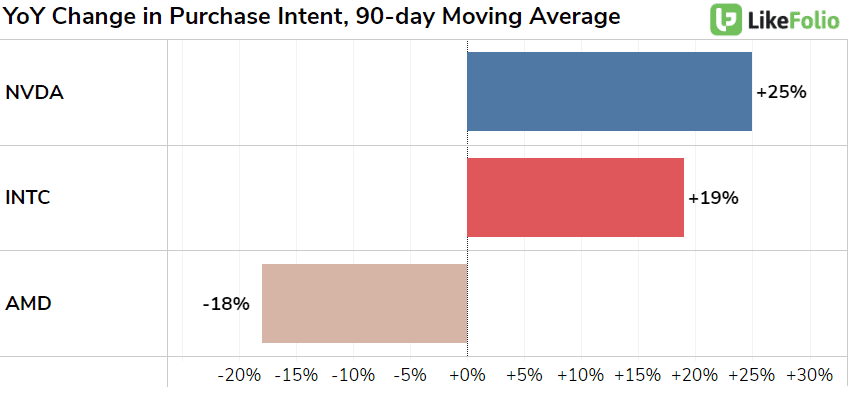

- NVDA shares have fallen more than 57% year-to-date in response to a slow down in growth in historical areas of strength (gaming), geopolitical headwinds, and underperformance from peers (AMD).

- On Monday the U.S. imposed new restrictions on the export of chips and chip-manufacturing equipment featuring license requirements from the Commerce Department. The goal of restrictions is curb China’s access to technology used in advanced artificial intelligence calculations and supercomputing that could advance the company’s military strategy.

- While LikeFolio data can’t capture the impact of regulations on Nvidia’s business is China, it CAN give insight to the company’s consumer-facing business domestically. Data shows Nvidia is outperforming peers in consumer demand, driven by strong reception for the company’s RTX 40 series. This could be an unexpected bright spot moving forward.

Pinterest (PINS)

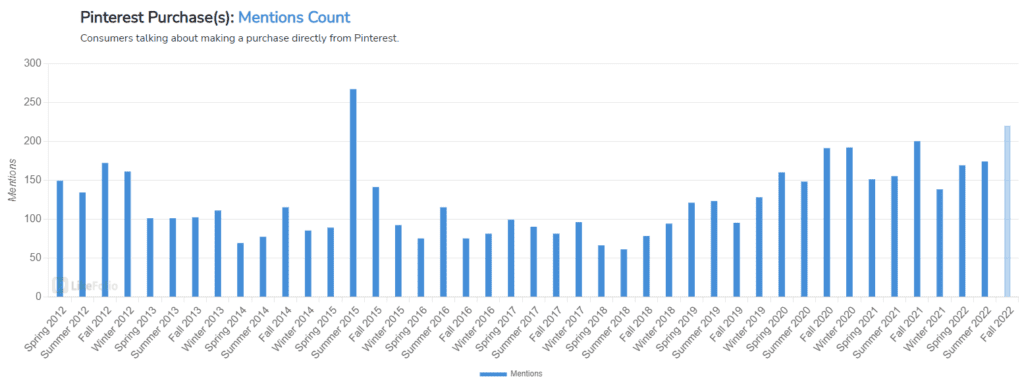

- We first noted an improvement in Pinterest’s underlying consumer metrics ahead of the company’s last earnings report. We doubled down after the report caught investors by surprise (in a good way). PINS shares have gained as much as 28% in value since August.

- LikeFolio data confirms the company continues to gain steam with consumers. Download and usage mentions (purchase intent) have increased +14% on a YoY basis, reversing a multi-quarter trend.

- Pinterest is propelled by several consumer macro trends including social and mobile commerce. Consumer mentions of purchasing a brand or product discovered on Pinterest’s platform have increased by +10% YoY and +26% QoQ. This is a positive indicator for future advertising spend on the eCommerce (er…”social”) platform.