Last September we used Purchase Intent data to predict that […]

Apple service growth is accelerating

Apple (AAPL)

Investor expectations are extremely high ahead of AAPL's 21Q1 report, fueled by speculation of iPhone sales strength.

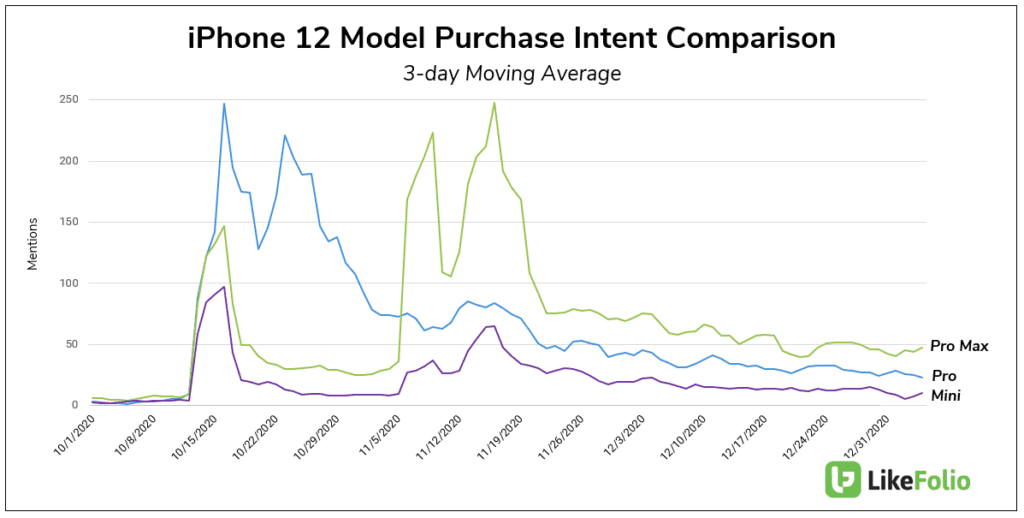

LikeFolio has noted elevated demand for the higher end iPhone 12 models since the pre-order release date in October, and noted the continuation of this trend earlier this month.

A staggered/delayed iPhone 12 release makes a YoY comparison difficult to nail down, but a consumer preference for high-end models bodes well for Apple's bottom line.

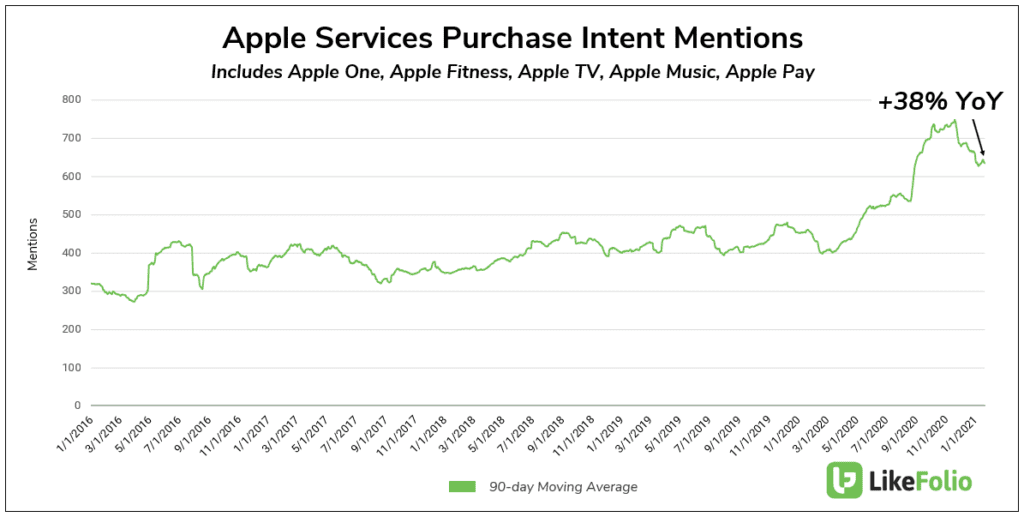

Aside from iPhone sales, consumer data in Apple's Services segment caught our eye.

Apple has effectively expanded this segment from under 7% of net sales to more than 20% over the course of a few years.

LikeFolio data suggests Apple's Services revenue growth is accelerating.

Apple is effectively leveraging devices and services to create an ecosystem that is nearly "consumer staple" status.

Microsoft (MSFT)

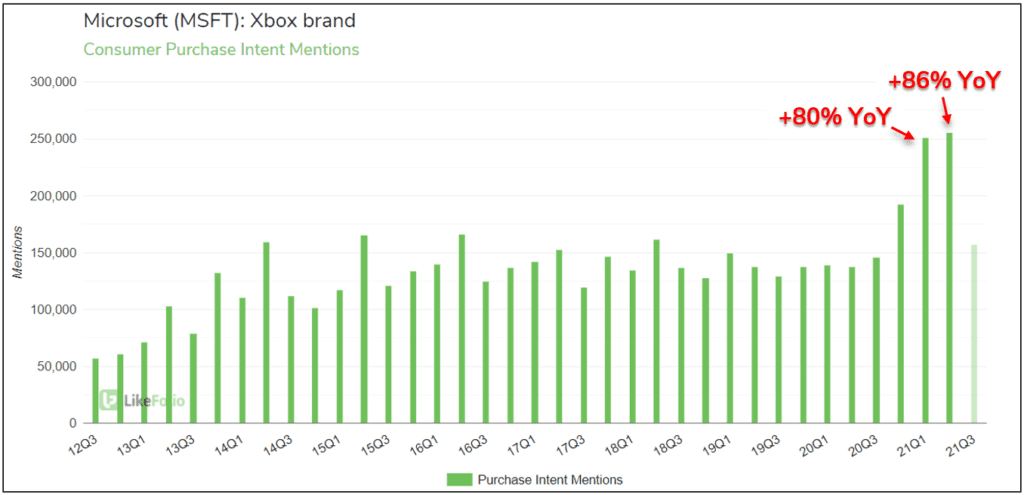

Microsoft (MSFT) just reported phenomenal 21Q2 results, beating top and bottom line estimates as well as raising guidance. We weren’t surprised by this outcome…

LikeFolio data had already touted record levels of consumer demand for the new Xbox console: +86% YoY in the reporting quarter.

Microsoft reported a +40% YoY improvement in Xbox-related revenues –

The Intelligent Cloud business has also continued to impress, with Azure revenue growth up +50% YoY.

Kohl's (KSS)

In early December, we featured KSS as a Holiday Shopping Winner. A few weeks later we doubled downed, releasing a bullish note for Kohl’s (KSS), based on impressive consumer demand growth seen during the holiday shopping season. KSS shares have gained +18% since then and received an upgrade from Citigroup today. Now, LikeFolio data has us leaning...