Dunkin' Donuts is superior to Starbucks. There is really no […]

We're not betting against SBUX

Starbucks (SBUX)

According to consumer demand, "starbs" is losing its viral status to TikTok-and-GenZ-favorite "dunkie".

Last quarter Starbucks reported that same-store sales decreased -9% YoY (vs. nearly +1% from Dunkin').

What does the LikeFolio data say ahead of Starbucks' 21Q1 Earnings Release?

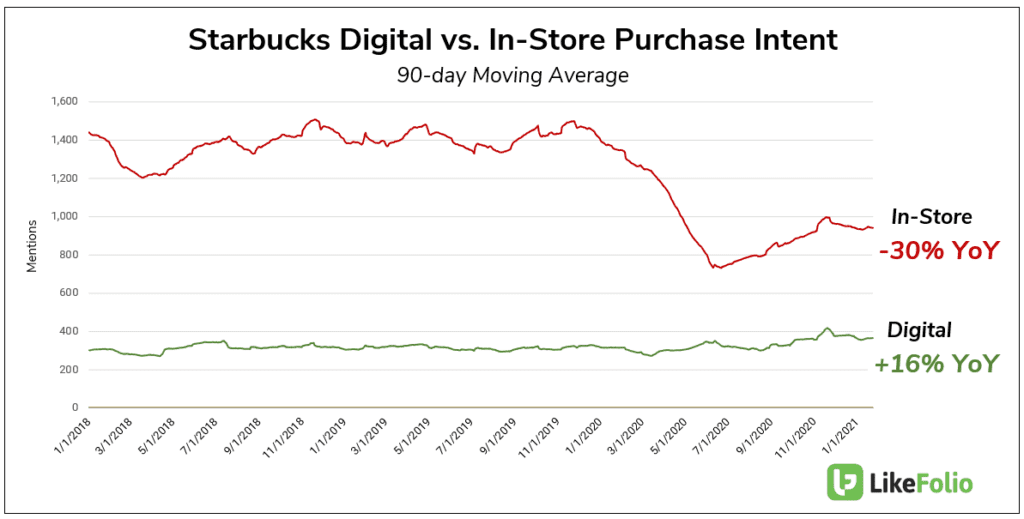

While store visits remained well below 2019 levels, digital Purchase Intent mentions increased +16% YoY (digital mentions include mobile orders and delivery).

Continued mobile adoption is a bright spot for Starbucks moving forward, especially considering in Q4, nearly 25% of U.S. orders were placed on a phone.

This mobile adoption is helping to lever up Starbucks' loyalty program: "Starbucks Rewards drove 47% of US company operated tender for a second consecutive quarter, up from 43% in our fiscal Q1 prior to the onset of COVID-19."

We're on the sidelines for this report. We can think of better names to bet against.

PepsiCo (PEP), Beyond Meat (BYND)

PepsiCo (PEP) and Beyond Meat (BYND) just announced a new joint venture to sell plant-based products, called ‘the PLANeT Partnership.’

The underlying consumer demand reveals one reason both of these companies are searching for new markets and new ways to reach customers...