Tesla reports earnings after the bell on Wednesday. After last […]

Let's Talk About Tesla (TSLA)

Let's Talk About Tesla (TSLA)

Tesla (TSLA) is a stock we first got bullish on in April of 2018, citing rising consumer demand and happy customers.

It’s been one of our best winners to date, gaining over 1000% since calling the stock “clearly a buy” at a split-adjusted $58/share.

In fact, Tesla stock is the 2nd most researched name on the LikeFolio dashboard, just behind Apple.

So I thought today would be a fantastic opportunity to update you on the key consumer insights that we are watching as we head into the next critical year for Elon Musk’s company.

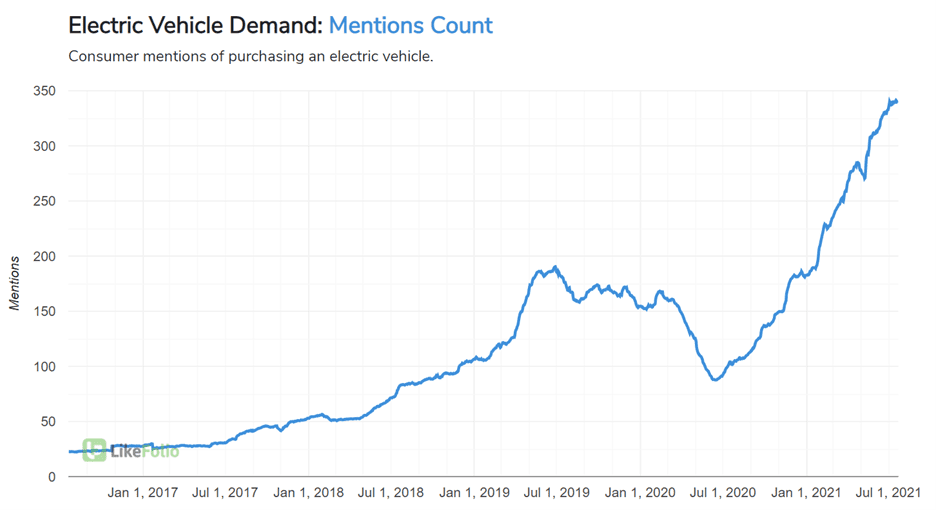

Macro View: Electric Vehicle Demand Is Surging

Not that long ago, people were saying that electric vehicles would never appeal to a mass audience. In fact, I might have been one of those naysayers myself!

But now I drive one every day, and love it.

And it turns out, I’m not alone:

As you can see from the LikeFolio macro trend chart above, demand for electric vehicles has been absolutely surging over the past 18 months.

This surge in demand is happening for several reasons, not least of which is rising fuel costs causing consumers to look for cheaper alternatives.

Of course, rising demand for electric vehicles benefits Tesla greatly, but it also brings something new to the table…

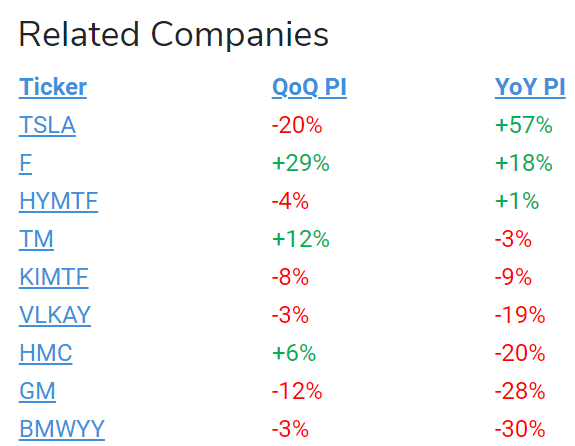

Competitive View: Ford Showing Strength

The truck will boast a powerful motor that can get 300 miles on a charge, has a “frunk” for storage where the gas engine normally is, and can even provide electricity to your house during an emergency.

To prove that consumers are obsessed with this new electric vehicle, just look at trends in Purchase Intent (PI) by company:

That’s right… of all the vehicle manufacturers we follow, Ford is the only one showing consumer demand growth on both a year over year and quarter over quarter basis.

Impressive start.

But as Elon Musk knows so well… there’s a huge difference between impressing consumers on the stage and being able to deliver on their expectations in production.

In any event, we’ll be keeping a very close eye on Ford moving forward, as it seems to be mounting the first serious challenge to Tesla’s EV dominance in some time.

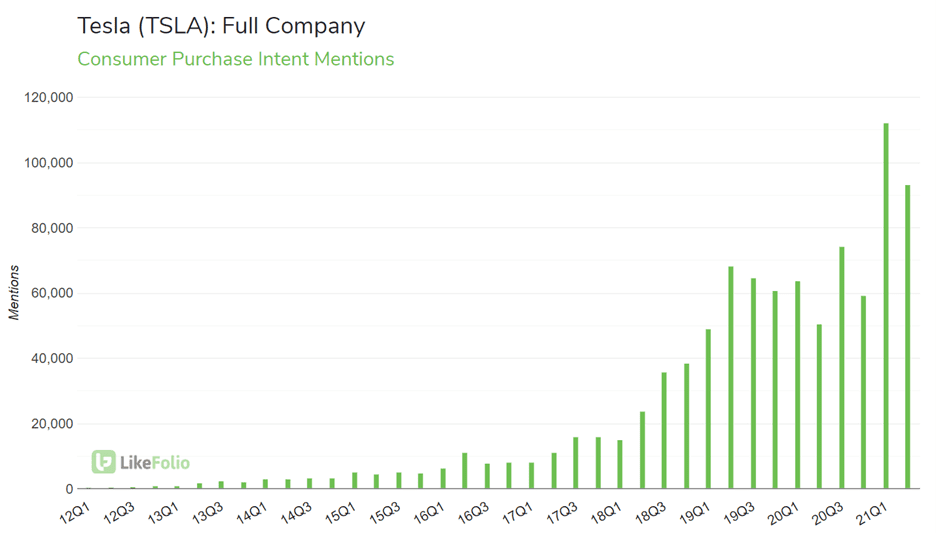

TSLA: Expensive Models Gain Steam via Plaid Refresh

The Tesla Model 3 has transformed the electric vehicle industry. It’s a fun, fast, good-looking electric car that starts at just under $40k.

In fact, the appeal of the Model 3 is what helped take Tesla consumer demand through the roof over the past few years.

As you can see from the chart above, Tesla just keeps going. They’re consistently increasing consumer demand levels, and almost always able to increase the RATE at which that demand increases.

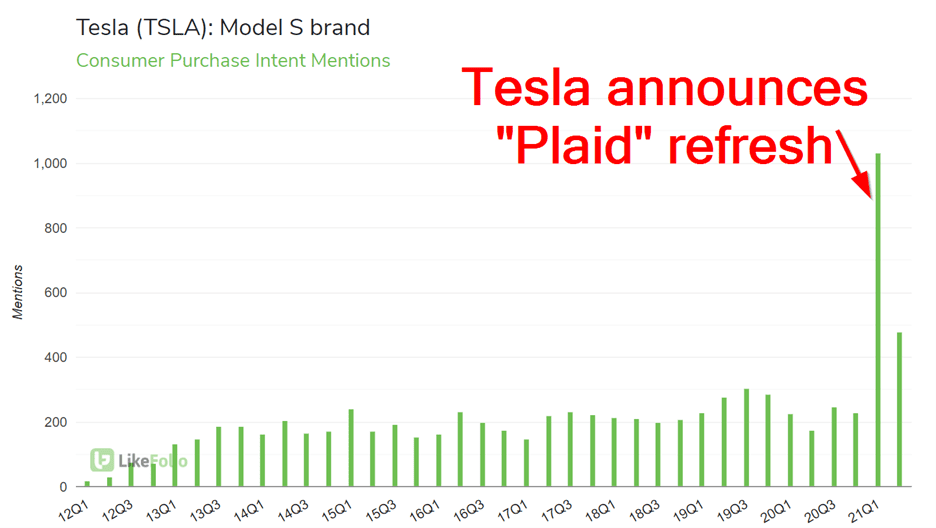

But what’s really interesting right now is that it isn’t the mass-market Model 3 driving demand higher, it’s actually Tesla’s much more expensive (over $100k) Model X and Model S.

The “Plaid” refresh of these two models includes a redesign of the interior and exterior, along with a more powerful motor that can propel the Model S from 0 to 60mph in under two seconds, making it the fastest production car available.

Incredible.

But it’s not just the upgrade that is impressing us about Tesla here.

It’s the consumer reaction. The absolute frenzy of demand it has created.

This response tells us clearly that Tesla has achieved what many thought was impossible – an electric vehicle company that can produce an affordable car for the masses AND maintain its high-performance luxury roots.

Will Tesla stock continue to add profits on top of the 1000%+ gains we’ve seen since our initial bullish opportunity alert?

Time will tell. But for now, the LikeFolio consumer data points to Elon Musk continuing to prove his skeptics wrong.