Target (TGT) TGT shares have gained nearly 70% in value […]

A Good Day for OTT Content Providers (FUBO & CURI)

A Good Day for OTT Content Providers (FUBO & CURI)

Yesterday after the bell, 2 of our favorite OTT streaming content providers announced earnings results for the fiscal quarter ended June 30th…Neither company disappointed our expectations.

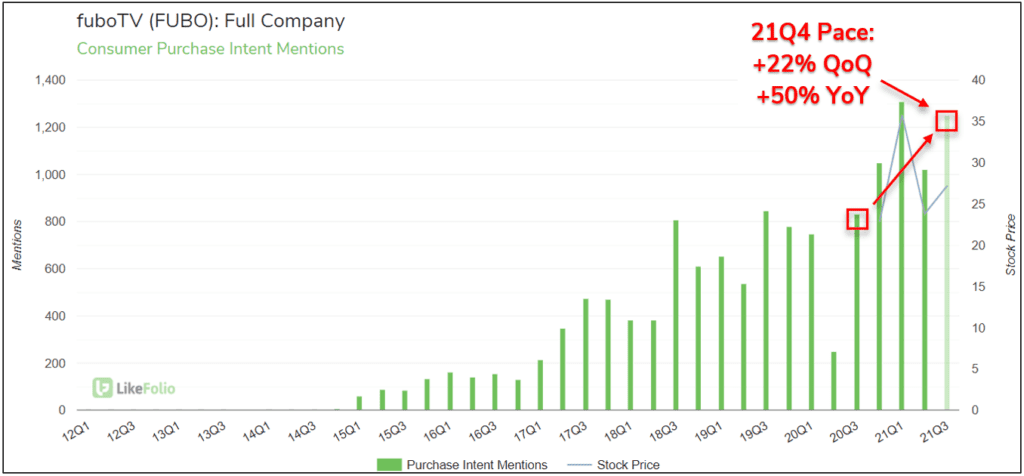

We’ve been pounding the table for the sports-focused streaming service, fuboTV (FUBO), since adding the company to coverage in March 2021.

Underlying demand has shown consistent strength in 2021, with Purchase Intent Mentions trending +22% QoQ and +50% YoY in the current quarter (ending 9/30).

In line with our bullish thesis, FUBO just reported phenomenal 21Q3 results:

- Revenues rose +196% YoY

- Paid subscribers increased +138% YoY

- Content hours streamed improved by +148% YoY

Shares are trading roughly +8% higher today, and our long-term bullish outlook has been strengthened.

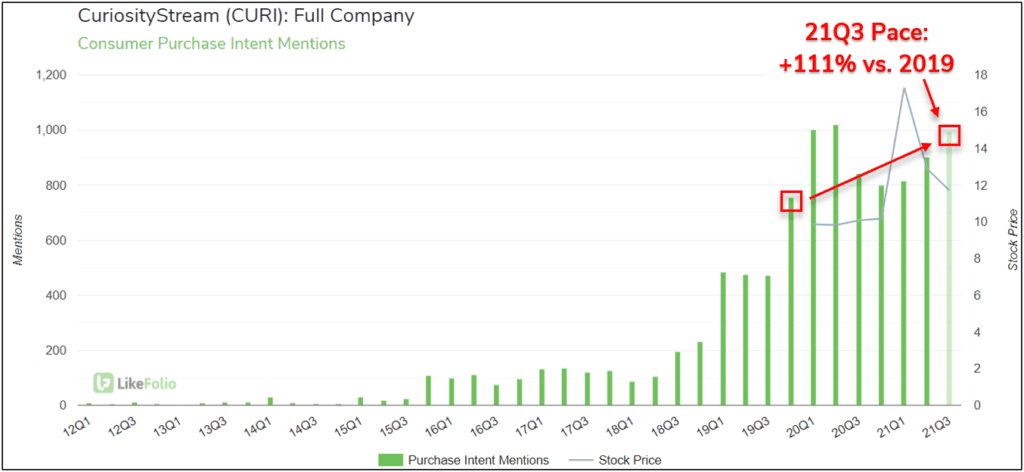

CuriosityStream (CURI) Shares +20%

We also saw impressive quarterly results from a recent coverage addition and bullish pick: CuriosityStream (CURI). CuriosityStream is a OTT streaming content provider focused entirely on educational and documentary content. CURI has shown unusual Demand growth in recent quarters, especially when compared to pre-lockdown volume – Purchase Intent Mentions are on pace to improve +111% vs. 2019 in the current quarter.

CURI reported convincing top and bottom-line improvements yesterday, as well as announcing a strategic partnership with SPIEGEL TV a producer of German-speaking informational content. Although its YoY gains weren't as impressive as those of FUBO, heavily-shorted CURI shares have gained by more than +20% today.