Black Friday Weekend (leading into Cyber Monday) can make or […]

Target is crushing digital execution

Target (TGT)

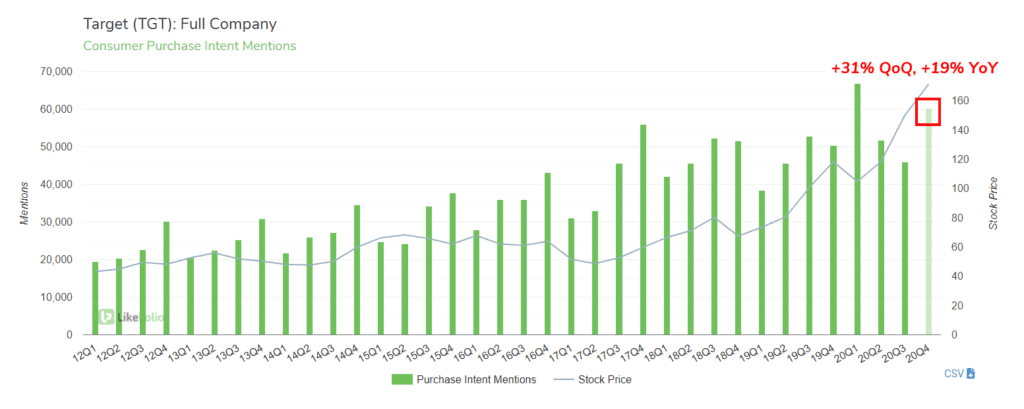

TGT shares have gained nearly 70% in value over the last year and are currently trading near all-time highs. When you look at mentions of consumer demand for Target products and services, this surge in share price makes sense:

Purchase Intent mentions in 20Q4 (ending Jan. 30) are on pace for +19% YoY growth. This YoY growth is a significant improvement from the prior quarter, when Target easily beat market expectations. What is driving success? 1. Robust Omnichannel Execution: Consumer mentions of ordering online, same-day delivery via shipt, and curbside pickup increased 95% YoY in the last quarter. 2. Physical Presence: 75% of the U.S. population lives within 10 miles of a Target store. This is helping to power Target's wide array of order fulfillment options. 3. Happy consumers: Target sentiment is 16 points higher vs. Walmart. Target is improving its positioning with consumers...and the market knows it. Are expectations too high, or is Target poised for another big beat? We'll revisit ahead of Target's next earnings report.

CuriosityStream (CURI)

If you haven’t heard of CuriosityStream (CURI), chances are you will soon.

CuriosityStream is an on-demand streaming service boasting a library of thousands of documentaries and original, non-fiction titles.

LikeFolio data shows the number of consumers downloading or streaming CURI’s media content is...