Hilton Worldwide (HLT) In news to no-one, fewer consumers are […]

A Substantial Case For Hotel Stocks

Oh, the travel industry…

It’s been a rough couple of years for it, with the pandemic causing havoc and bringing international travel to an almost standstill at one stage.

But this year, travel looks like its back, and by the looks of LikeFolio data, it’s back big.

So much so that Expedia has labeled 2022 the year of the GOAT, or the “greatest of all trips.”

But, the industry has also seen setbacks this year…think inflation and surging gas prices.

However, according to Destination Analysts, “Americans’ excitement to travel over the next 12 months is the highest it has ever been in the pandemic era.”

And with that in mind, we have to consider travel stocks as having a high growth potential this year.

But, let’s focus specifically on hotels…

Think Hilton, Marriott, and Hyatt.

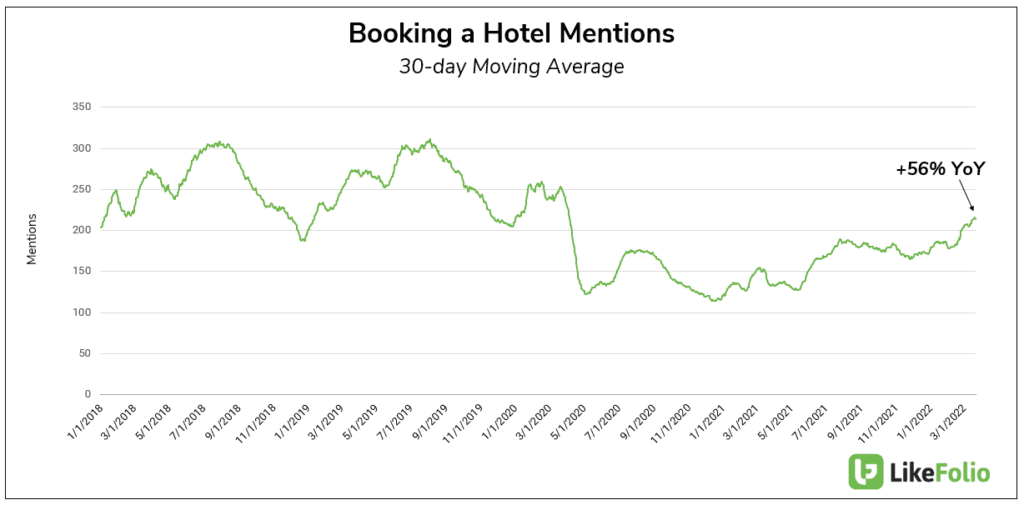

Take a look at Booking a Hotel Mentions…

The demand is clear to see at +56% YoY, but there is still plenty of room to the upside, with it yet to reach pre-pandemic levels.

And with summer yet to even start, we could see demand for hotel bookings surge past those levels in a few months' time.

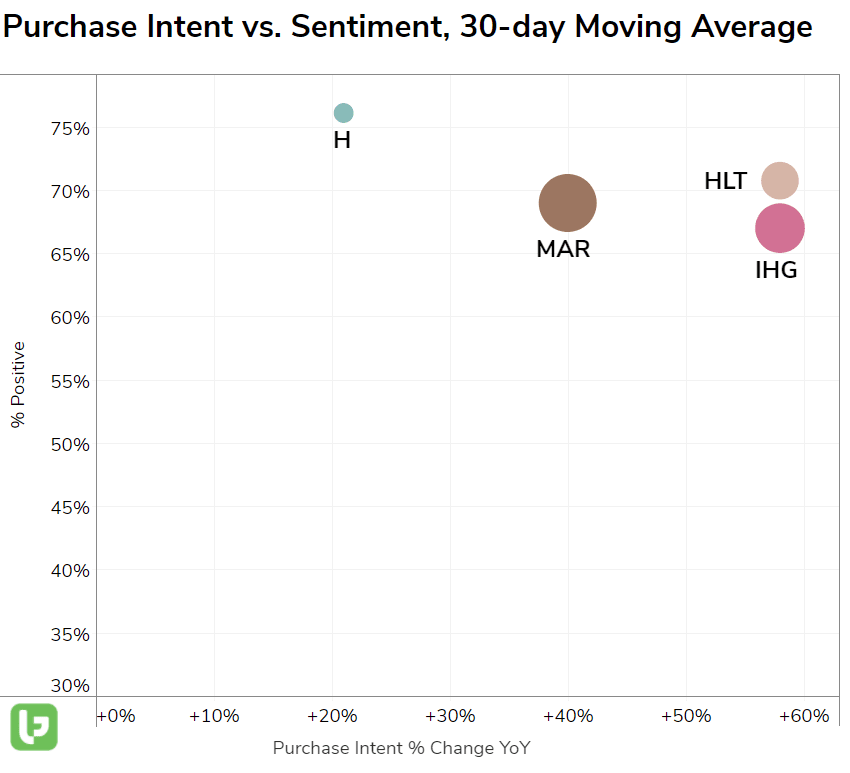

But, out of the three hotels mentioned, which is leading the way?

Well, looking at the plot, you can see it is Hilton with a +58% YoY demand based on a 30-day moving average.

That doesn’t mean other hotel stocks are lagging — far from it.

So it’s clear, the case for hotel stocks is extremely robust…

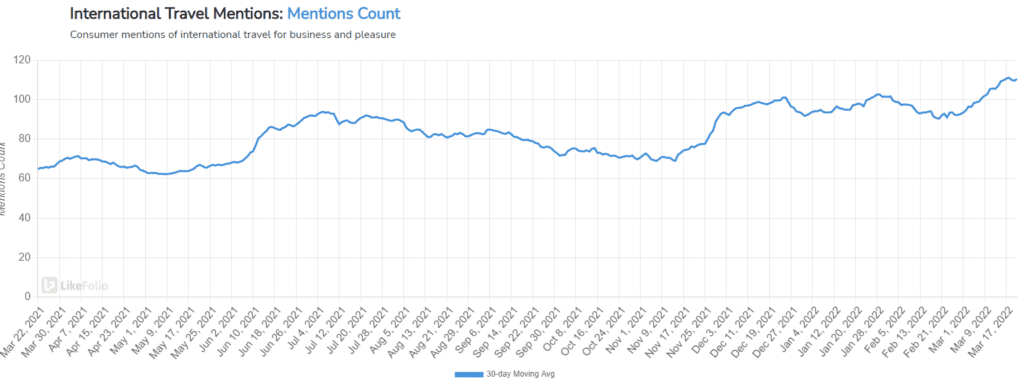

But, before we close out, let’s look at one more chart to add to the bullish thesis for travel and hotel stocks…

Mentions of International Travel for business or vacations are up significantly, +72% YoY to be precise.

And recently, the travel industry urged the White House to form a plan to lift international travel restrictions by May.

So it may be the year of the GOAT after all... Fingers crossed!