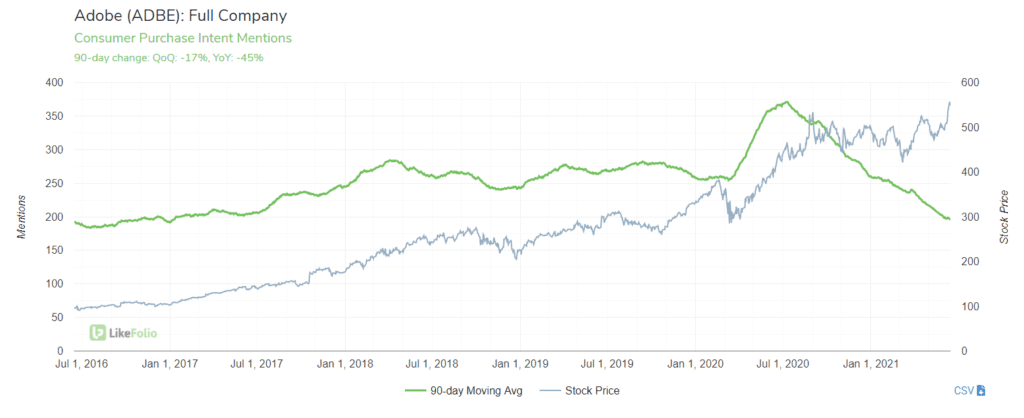

When we look at Adobe's consumer purchase intent (PI) mentions […]

Adobe (ADBE) New User Growth is Slowing

Adobe (ADBE) New User Growth is Slowing

Adobe's had a really nice year. Consumers transitioning to remote work clamored for its software in order to effectively conduct business, digitally. Its Digital Media segment (encompassing its creative cloud and document services) comprises 60-64% of revenue and grew by +32% YoY last quarter. Shares are trading ~+28% higher YoY, and +89% since we featured the company on one of our very first MegaTrends reports. What does Adobe have going for it?

- Unique Software that Consumers Love

- A Powerful Subscription Model

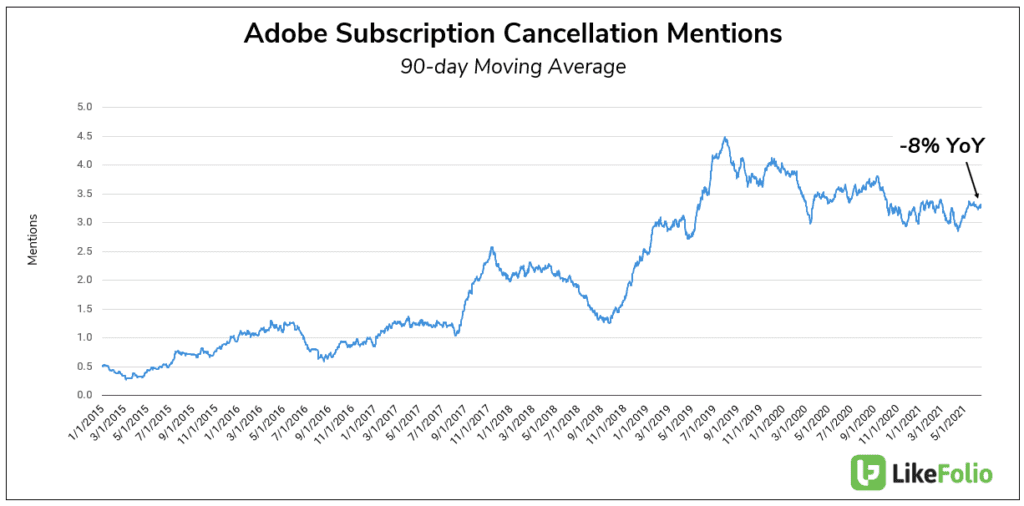

We can't even plot Adobe against another company on our outlier grid because it doesn't have a single clearly defined competitor. ADBE Consumer Happiness has improved by +2% YoY, to more than 81% positive. And its subscription model is more relevant than ever. Last quarter, nearly 92% of sales came from subscription revenue, up from 88.4% a year ago. LikeFolio data shows that Adobe is good at keeping subscribers on board. Not only is its cancellation process...difficult... but cancellation mentions are actually falling: -8% YoY.

The only caveat? New user growth IS slowing. Adobe Purchase Intent Mentions have dipped, falling -45% YoY.

While tough comps are present, the growth level recorded is even lower vs. 2019. We do expect strong levels of retention to help buoy some slow-down in user growth, but expectations are very high. Adobe reports earnings June 17 after market close.