Earnings season has officially kicked off! Here are some key […]

Are the Big Banks in Trouble? ($BAC, $C, $WFC)

Bank stocks and the financial sector at large have handily outperformed the market in 2022 —

- SPDR S&P ETF ($SPY): -1.3% YTD

- Financial Select Sector SPDR Fund ($XLF): +4.4% YTD

Energy takes the top spot for 2022 gains ($XLE +11% YTD) thanks to a bull run in the price of Crude Oil Futures.

That said, the financial sector is being powered higher by banking institutions, many of which are trading at or near all-time high levels.

What does LikeFolio’s consumer data have to say about these banks?

Let’s focus on 3 with considerable consumer-facing businesses: Bank of America ($BAC), Citigroup ($C), and Wells Fargo ($WFC).

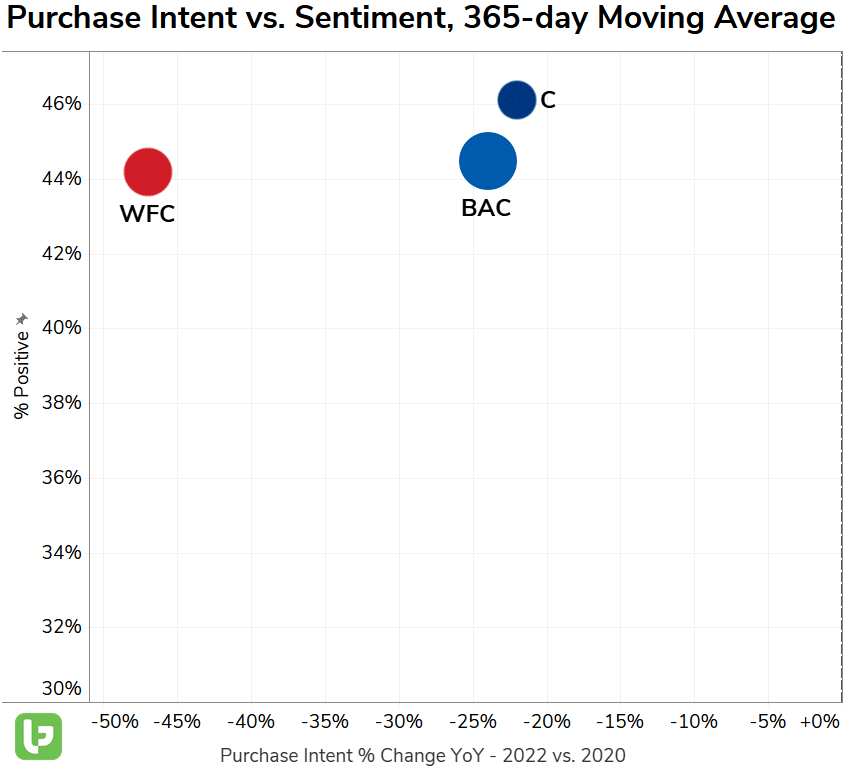

Comparing long-term Purchase Intent growth (2-year change in the 365d MA) versus Consumer Happiness paints an unflattering picture.

Two things are immediately clear for all 3 names:

1. Consumer Happiness is Poor, below 50% positive in the past year.

2. Demand growth is slowing, with WFC showing the most significant decline (-47% vs. 2020).

So, what’s going wrong?

We’ve already elaborated on this phenomenon at length, but it bears repeating:

Traditional financial institutions are losing to new, digital-focused players, in terms of popularity growth and customer satisfaction.

Consumers feel little loyalty towards the banking giants and it’s driving a decline in retail banking revenues:

- Last quarter, Citi reported a -7% decrease in its retail banking segment revenues, with card and mortgage revenues both falling YoY.

- Wells Fargo experienced a similar slide in its consumer-facing business, with segment revenues down -4% YoY in 21Q3 (Home Lending down -20%).

- Bank of America managed to grow its consumer banking revenues last quarter, despite reporting lower mortgage loans and card balances — BAC attributed the revenue boost in part to “higher fee income”, putting its 44% positive Happiness score into perspective.

But, declining revenues don’t matter.

Over the past year, these banks have unilaterally improved their profitability by substantial margins and their institutional businesses are humming along.