Monster Energy (MNST) is Living up to its Name Monster […]

Average-Sized Monster Numbers

Last week, Guggenheim analyst Laurent Grandet said in a note that now would be an ideal time for Monster to be acquired by Coca-Cola.

According to this article from Green Seed Group, Monster is behind only Red Bull when it comes to energy drink market share.

Grandet pointed to competition with Red Bull in the US, new healthier energy brand entrants to the market, and the company losing market share as reasons Monster — which Coca-Cola already has a significant stake in — should sell.

The analyst added that a tie-up between the two is "more of an eventuality than an 'if."

But what does LikeFolio data tell us about Monster's demand and customer happiness? If KO were to acquire the company, would it purchase one that is seeing demand surge or plummet?

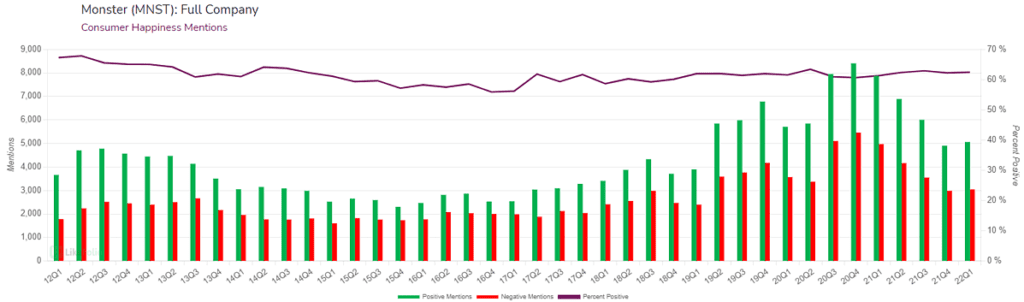

First, Consumer Happiness...

There seems to be little to be concerned about here. Happiness mentions spiked in 20Q4, and while they have since dipped, the company's 62% Happiness Score has been steady for a few years.

However, it is below the 66% Happiness Score of KO.

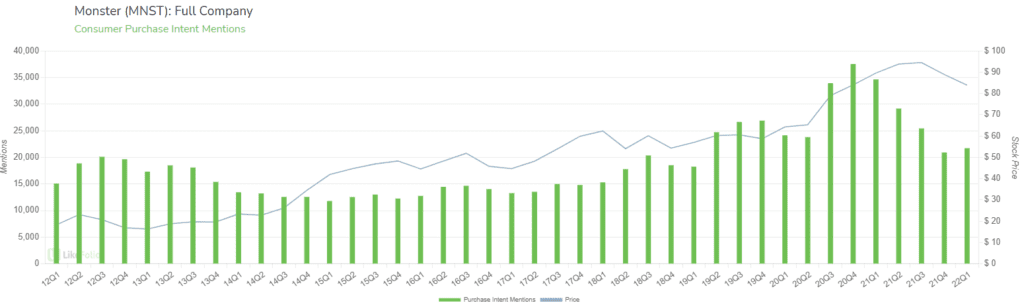

Next, Purchase Intent Mentions.

Consumer Demand shows a similar trend to happiness and is probably nothing to be concerned about…yet.

Consumer Purchase Intent Mentions for Monster began a sharp rise around the end of 2017 before peaking in 20Q4.

They are on course to close at +4% QoQ and -37% YoY in the current quarter.

But, the question now is, has Monster demand bottomed? And can the current leaders steer it back to the levels seen towards the end of 2020?