Hasbro is clearly a cyclical business with high company seasonality. And […]

Barbie Boom? One Stock Winner and One Loser

This film, a property of Mattel (MAT), is expected to be a major hit, with star power in the form of Margot Robbie and Ryan Gosling, a $100 million budget, and the backing of one of the most recognized toy brands in the world.

Wall Street is buzzing with excitement, but here at LikeFolio, we’re more interested in the impact on individual stocks…

Mattel's Moment in the Sun

Mattel's stock has surged by 15% over the past month, fueled by the hype around the upcoming Barbie movie.

The company is betting big on the cultural conversation around Barbie to materialize in strong profit figures. They've even inked a Barbie apparel deal with specialty retailer Gap and fast fashion house Forever 21.

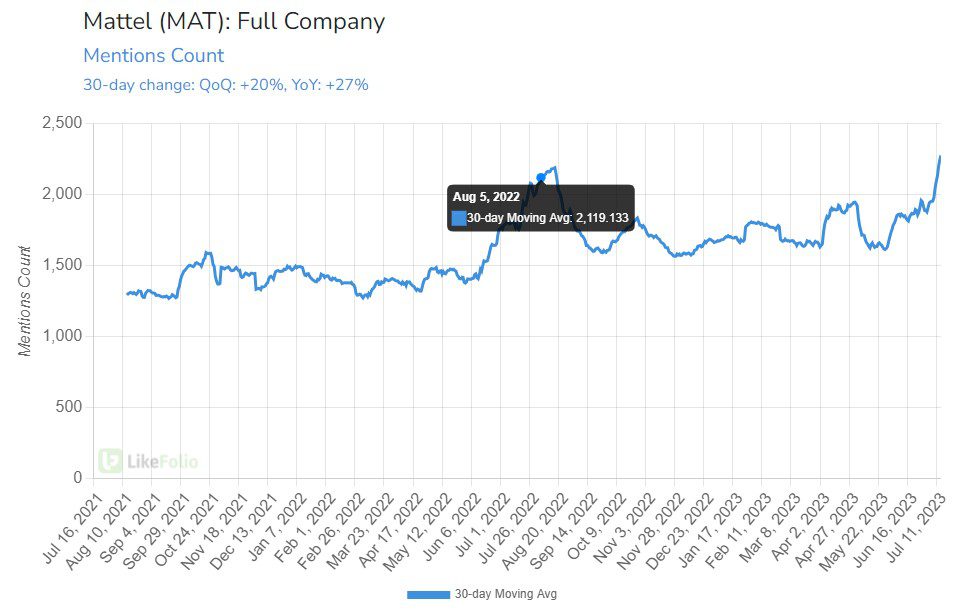

Our LikeFolio data backs up this optimism.

Mentions of Mattel products are up a whopping 27% year over year:

However, consumer happiness for Mattel is down 11% year over year, mostly as a result of some negative reactions to the upcoming Barbie movie.

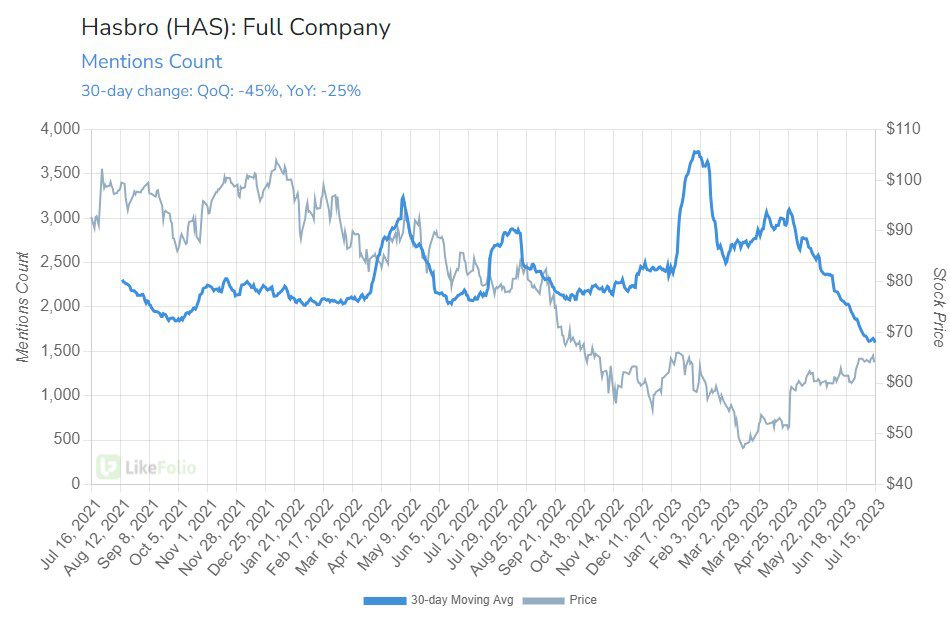

Hasbro's Hype Hangover

On the other side of the toy war, we have Hasbro (HAS). Wall Street's optimism around Hasbro seems to be missing the mark.

While consumer happiness levels are stable at just under 70%, year over year purchase intent mentions of Hasbro products are actually down 25%:

This indicates that the hype around the Barbie movie may not have the positive impact on Hasbro that Wall Street is expecting.

The Bottom Line

In the tale of the Barbie boom, there's one winner and one loser.

Mattel is capitalizing on the Barbie hype, while Hasbro is being left in the dust.

Our data suggests that consumers are actually talking about Hasbro products less, despite Wall Street's optimism…. a potential divergence play if we’ve ever seen one.

As always, LikeFolio members will be the first to know when we spot a major profit opportunity on either of these stocks.