Carvana Demand Approaching All-Time Highs LikeFolio published a Bullish alert for Carvana […]

Carvana's Stock Surge - A Short-Squeeze Mirage?

"In the short run, the market is a voting machine but in the long run, it is a weighing machine." - Benjamin Graham

In the high-stakes game of Wall Street, short-term trends often overshadow long-term fundamentals. Carvana (CVNA), the used car dealer known for its unique car vending machines, has seen its stock rise by a staggering 800% this year.

But is this a genuine comeback or a short-lived illusion?

LikeFolio Data: The Voice of Reason Amidst the Frenzy

LikeFolio's data provides a sobering counterpoint to the short-squeeze frenzy.

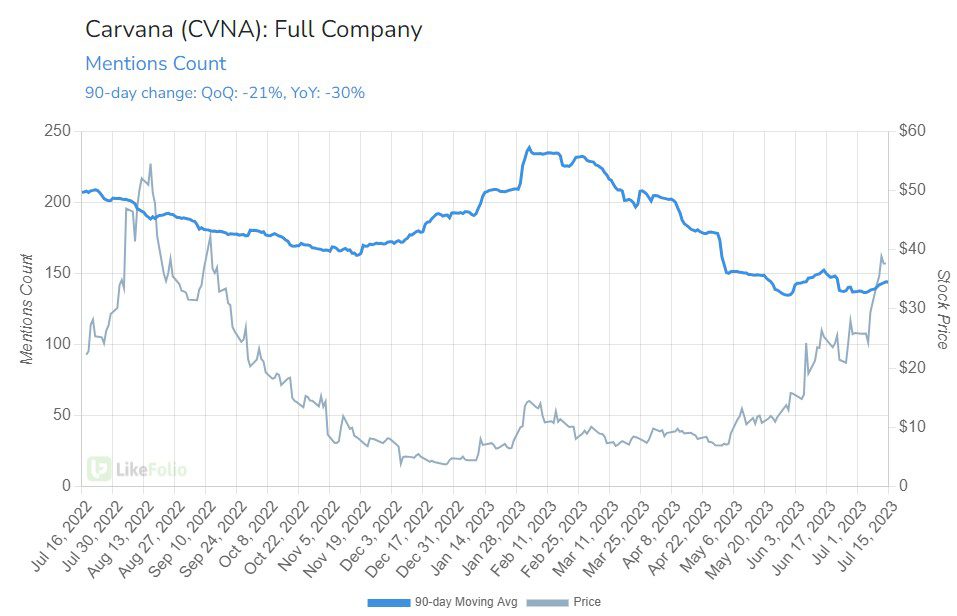

Mentions of using Carvana are down 30% year over year.

Web searches for Carvana have dropped 21% year over year.

This suggests that despite the stock's meteoric rise, consumer interest and engagement with the brand are waning.

The Short-Squeeze Mirage Explained

A short squeeze occurs when a stock's price increases sharply, forcing short sellers to buy it in order to forestall even greater losses. Their scramble to buy only adds to the upward pressure on the stock's price.

Carvana's short interest is close to 41.5 million shares, representing a whopping 55% of the company's total float. This makes it the second most shorted company in the U.S. The stock has risen close to 100% in the last 30 days, likely forcing many short sellers to cover their positions.

But beneath this impressive façade, the company is grappling with a host of issues that are being masked by this short-term rally.

The Used Car Market Quagmire

The used car market in the U.S. is set to face significant pressure in the remainder of the year, potentially compressing Carvana's margins. A sharp decline in used car prices in the U.S. was a major reason behind Carvana's 90%+ decline in market value in 2022.

The Debt Burden Time Bomb

Carvana's large debt burden could potentially lead to bankruptcy. In the first quarter, Carvana's interest expenses totaled $159 million, a significant increase from just $64 million a year ago. This increase was due to a near-doubling of its long-term debt in this period.

The Failed Bond Exchange Warning Sign

Carvana's failed attempt to convince bondholders to exchange existing bonds for longer-dated notes last month is a clear indication of creditors' lack of faith in the company's long-term prospects.

The Shift in Focus Dilemma

Carvana's focus has shifted from growth at any cost to survival. While this might seem like a prudent move, a lack of focus on growth might lead to undesirable outcomes in the future as competitors are aggressively pursuing growth opportunities.

Bottom Line

In conclusion, while Carvana's stock might seem like a tempting investment due to its recent rally, the underlying issues and market realities suggest that this might be a mirage.

As Benjamin Graham wisely noted, the market may vote in the short term, but it weighs in the long term.

Investors would do well to heed this wisdom and tread carefully in the desert of the used car market.