When social-data and stock price are moving sharply in opposite […]

Battle: DECK vs CROX

At LikeFolio, we don't just analyze market trends; we live and breathe them.

Our watercooler conversations are as insightful as they are interesting, often sparking deeper dives into the stocks we're watching.

This quarter, a casual chat about our earlier CROX call (resulting in +135% gains on a bearish earnings trade) led us down an intriguing path, culminating in a playful yet insightful debate: Do we LIKE DECK or HATE CROX more?

We decided to let the data settle it.

The Tale of Two Charts: DECK's Ascent and CROX's Struggle

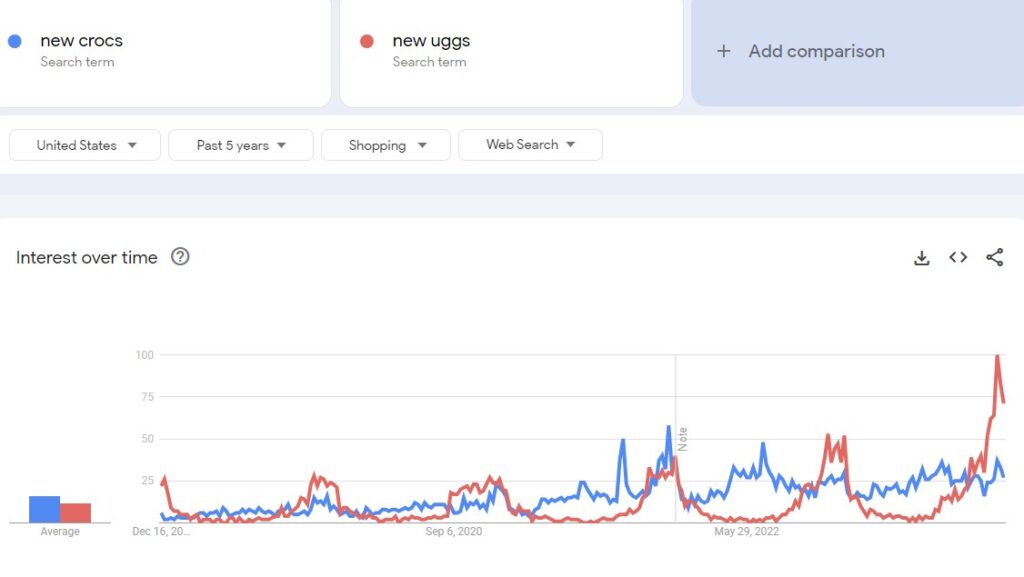

A glance at Google Trends provided the first clue.

The data paints a stark contrast between Deckers Outdoor Corporation (DECK), known for its UGG brand, and Crocs, Inc. (CROX). Searches for “new uggs” are jumping off the chart, bursting through seasonal 5-year highs. While Crocs searches appear to sputter.

The only problem? The market knows it. (Drats!)

The Investment Dilemma: Trading Positions and Market Potential

DECK's stock chart is a sight to behold, trending straight up, a clear indicator of its growing popularity and market strength. In contrast, CROX, despite its unique market position and loyal customer base, is still trailing well below its previous highs.

Considering where each stock is trading, it's tough to make a call. DECK's robust performance is hard to ignore, signaling a company in stride with consumer trends and market demands. On the other hand, CROX's lower trading position could be seen as an opportunity for growth, appealing to investors looking for a potential rebound.

UGGS: The Unlikely Hero of the Season

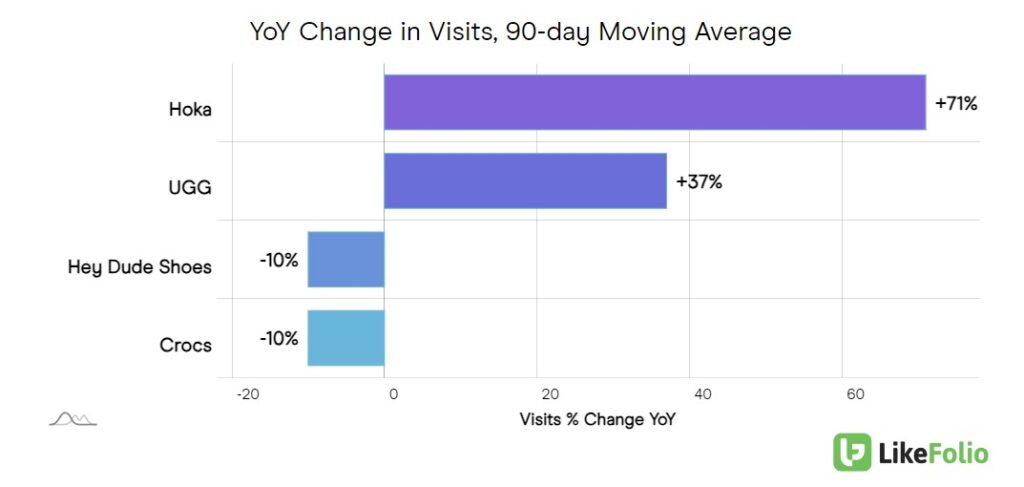

However, if we were forced to choose, the conversation at LikeFolio leans towards declaring UGGS, DECK's flagship product, as the gift of the season. This isn't just a hunch. UGGS have consistently shown resilience in the market, appealing to a broad demographic with their comfort and style. This year, they seem to have captured the consumer's imagination and wallet more than ever.

And UGGS aren’t the only shoe in DECK’s arsenal. It’s HOKA brand is growing as a similar if not steeper clip!

The Final Verdict: A Playful Yet Calculated Analysis

So, do we LIKE DECK or HATE CROX more? It's a playful question with a serious undertone for investors. While DECK shows undeniable strength, CROX's lower trading position might offer a hidden opportunity for those willing to bet on a comeback.

But for now, as the holiday season approaches, data appears MORE compelling for DECK to the upside.

The company’s solid portfolio of trusted brands appear to be the clear winner in the hearts and minds of consumers – and this demand is likely to send shares even higher.

Looking Ahead: Monitoring the Market's Moves

At LikeFolio, we're keeping a close eye on both DECK and CROX. The market is dynamic, and today's winner could be tomorrow's underperformer. But one thing is certain: UGGS have made their mark this season, and we're excited to see how this plays out in the market.