Costco Demand & Renewal Mentions Show Retention We've been officially Bullish […]

Betting on an American Classic

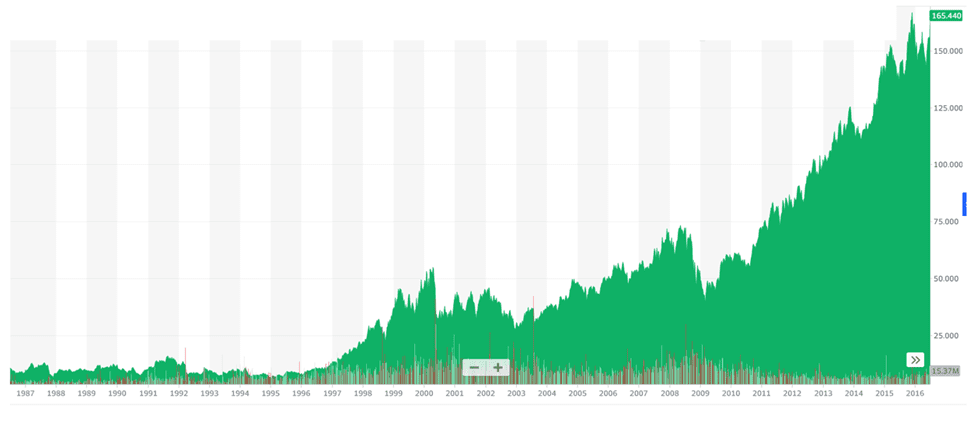

Take a look at this chart.

You might think it's a rising tech star, but it's actually an American classic: Costco (COST).

Shares have rallied ahead of earnings with investors speculating about a potential price increase.

And no, we're not talking about its iconic $1.50 hotdog, but rather a hike in its membership fees.

An anticipated hike would serve as a sort of double punch, building on previous efforts to crack down on membership sharing through an extra ID check at self-checkout.

But we’re confident that most consumers will willingly accept.

Last quarter, Costco's retention rate in its core markets (U.S. and Canada) impressively hit 92.7%, even slightly up from the previous quarter.

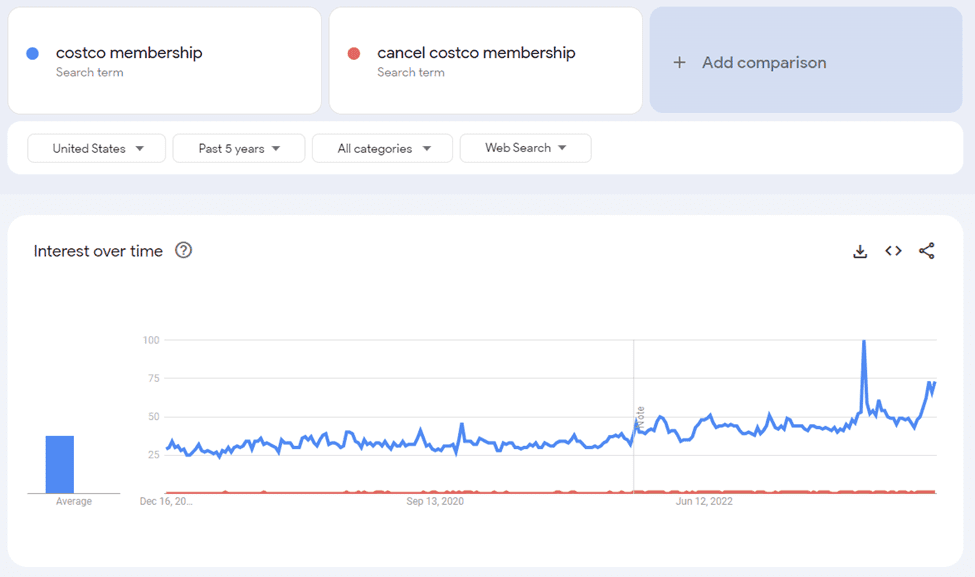

GoogleTrends confirms this retention train is still on the track, even as new membership searches spike:

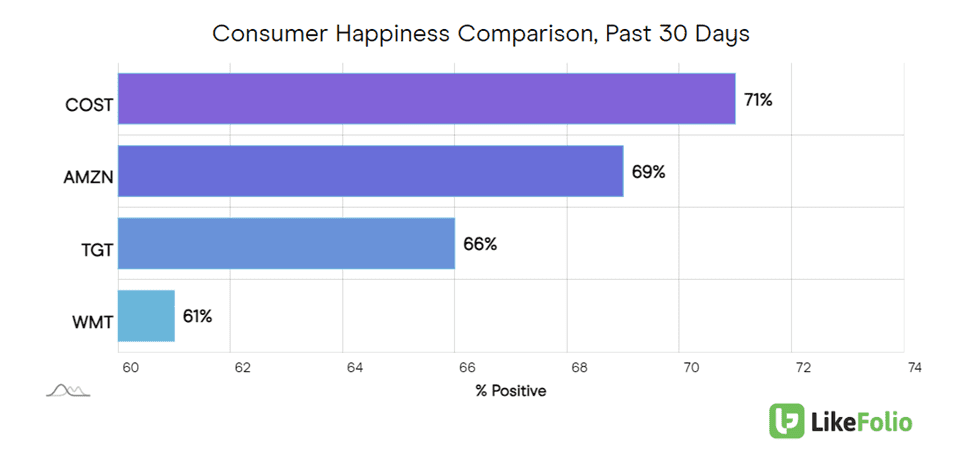

In addition, LikeFolio's data indicates that customer happiness remains strong and superior to peers, suggesting continued pricing power.

Heading into earnings we are sidelined. Costco reports monthly sales updates, removing much of the uncertainty and surprise of quarterly earnings reports…aside from big announcements like membership price increases, of course.

Bottom line: Our data supports the stock's recent upward trend. We anticipate continued growth for Costco in 2024, bolstered by a strong membership offering and happy customers.

For a more detailed analysis, check out my segment today on the Schwab Network: