Bed Bath & Beyond is Focusing on Digital Growth Last […]

Can digital growth spur an earnings surprise for Bed Bath & Beyond?

Bed Bath & Beyond (BBBY)

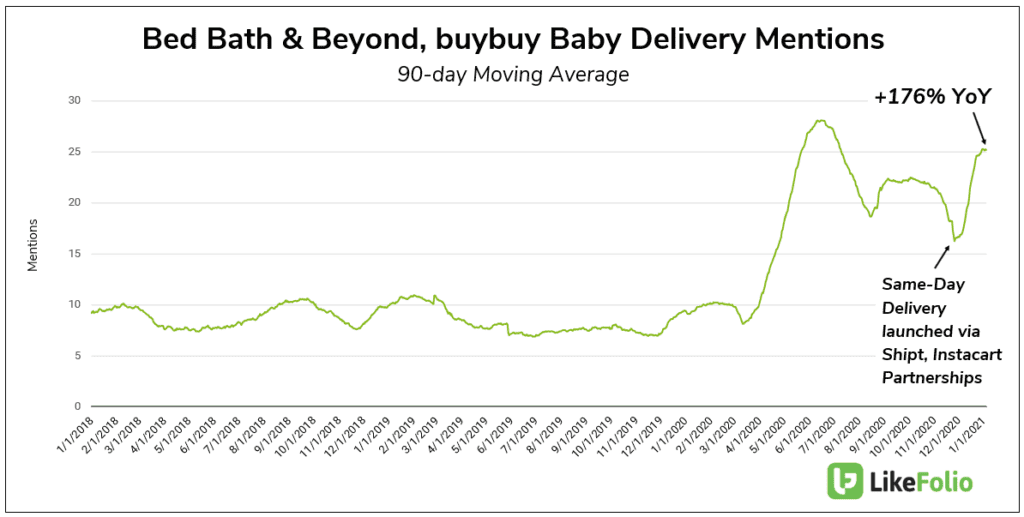

Last quarter BBBY shocked the Street when it posted a same-store sales gain (+6%) for the first time since 2016, attributed to eCommerce strength and trends like home renovation. Shares gained +18% in pre market trading. And this quarter volatility is expected. LikeFolio data shows overall demand is softening due to lackluster consumer enthusiasm for in-store visits. On the bright side, we are seeing continued strength in digital orders. Purchase Intent is currently pacing -13% YoY, but Digital mentions are +176% YoY in the same time frame, boosted by recent partnerships with Shipt and Instacart.

Last quarter, digital execution was enough to offset in-store weakness and move the needle for the street. This quarter, overall Purchase Intent is weaker comparatively, but the digital surge nearly rivals the one recorded at the onset of Covid. We'll be watching to see if digital growth is enough to meet the Street's expectations when BBBY reports Jan. 7 before the bell.

Trend Watch: Dry January

After increasing alcohol consumption during the pandemic, consumers are looking for a reset.

Mentions of trying dry or sober January spike each year (typically the Monday following NYE). This year's "Dry January" peak was...