DocuSign is still the Preferred Digital Document Management Tool Last […]

Can DocuSign (DOCU) find the Spark it Needs?

Macro trends are finally starting to tilt in Docusign's favor.

Mortgage loan applications rose +1.6% in the last week of August.

Earlier in the month, refinancing rates surged +35% in a single week -- +118% YoY -- as interest rates hit the lowest level in over a year.

Though mortgage agreements aren't the only contracts Docusign powers, of course. The company's document management technology facilitates remote agreements across the board. And DOCU has been on a multi-year journey to transition from an e-Signature platform to contract lifecycle management.

Last quarter DocuSign touted its business stabilization and improved profitability in the face of persistent inflationary tailwinds, driven by high retention rates for existing customers and strong international growth (double that of its overall revenue growth rate).

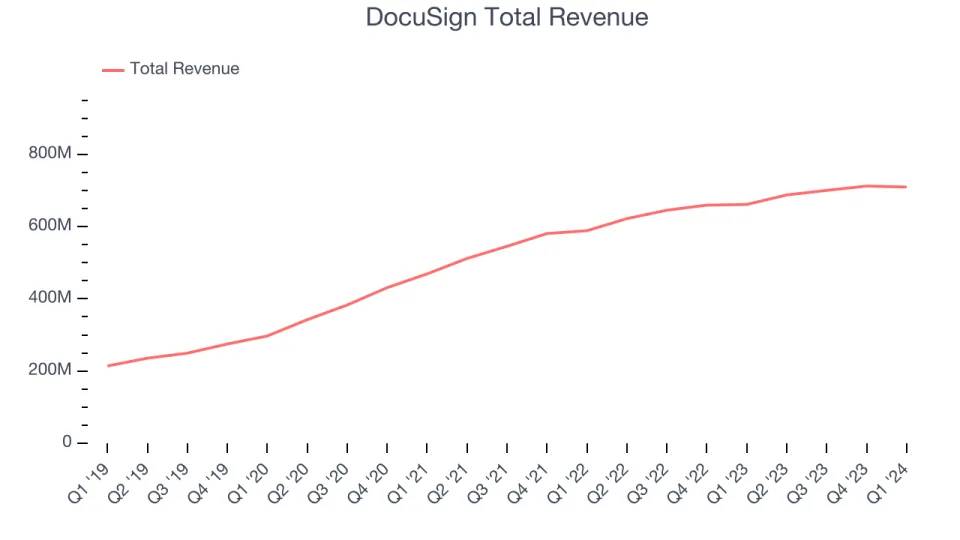

Despite a solid report, DOCU shares sold off. DocuSign simply didn't post the kind of growth investors are looking for. You can see this slowdown on the chart below.

Some questioned DocuSign's recent acquisition of Lexion, an AI-powered contract management startup. DocuSign acquired Lexion for $165 million to enhance its Intelligent Agreement Management (IAM) platform.

This acquisition aims to integrate Lexion’s advanced AI capabilities into DocuSign's offerings, allowing businesses to automate workflows, extract critical information from contracts, and streamline contract reviews and negotiations.

Lexion's technology, including tools like AI Contract Assist and a seamless Q&A experience, helps users quickly locate information in documents and suggests revisions based on AI-driven recommendations, which will significantly enhance the functionality of DocuSign’s IAM platform.

Lexion’s AI-based agreement management solutions have been recognized for their ease of implementation and user-friendliness.

The company's tools support various integrations, such as with Microsoft Word, Slack, and Salesforce, to simplify contract management tasks and provide a more comprehensive understanding of agreement data. With this acquisition, DocuSign is positioned to offer even more robust AI-driven solutions that will help customers accelerate their business processes, reduce risk, and increase operational efficiency.

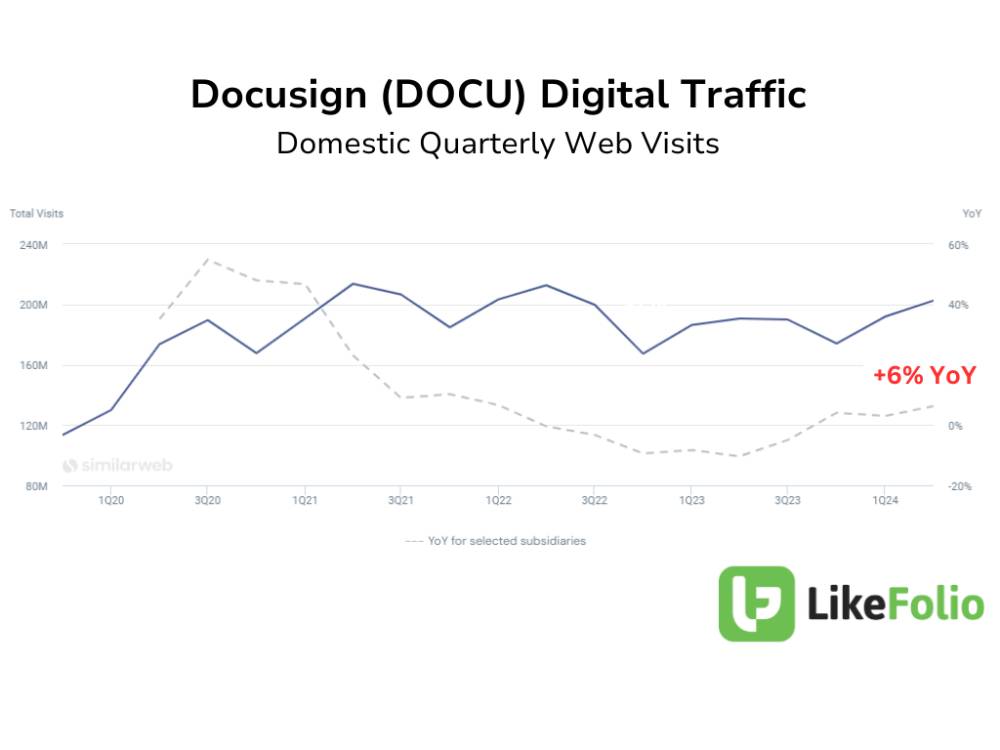

LikeFolio data shows some sign of improvement for DocuSign -- web visits are up +6% YoY, and improvement from +3% YoY last quarter.

And on the competitive front, we don't see signs of major traction. Dropbox Sign, Adobe Sign, and other competitors pale in comparison to DocuSign when it comes to mention volume and web visits.

Playing Earnings

DOCU reports earnings Thursday, Sept. 5 after the bell.

Here's how we are playing this event...

This section is restricted to LikeFolio Pro Members only.