Here's what LikeFolio data was showing heading into the Walmart earnings report that sent the stock 10% higher.

Can Target's (TGT) Omnichannel Prowess Power Shares Higher?

Can Target's (TGT) Omnichannel Prowess Power Shares Higher?

Today, Walmart posted earnings that beat estimates, led by strength in grocery and back-to-school spending. Shares are flat. We picked up on signs of consumer behavior normalization on Walmart's report:

- Consumers aren't stockpiling amid Delta variant concerns: While mask buying was elevated, runs on supplies (like cleaning, etc.) were not observed.

- The "take fewer trips, spend more" narrative is ending. Transactions increased +6% while average ticket size dropped a point.

Target is well-positioned to capitalize on a return to the store AND has the infrastructure to support continued digital adoption.

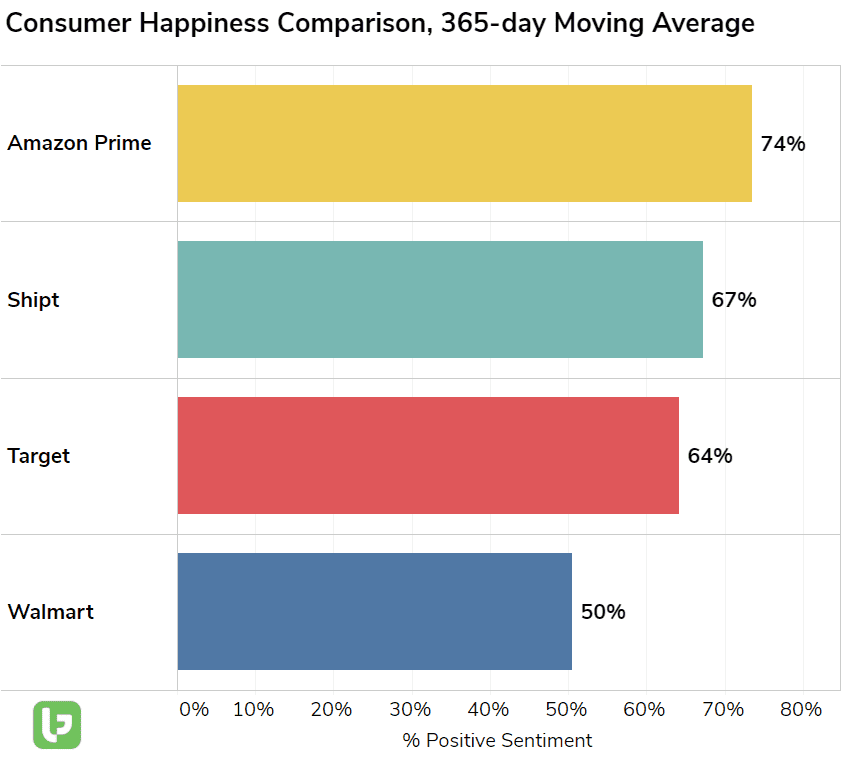

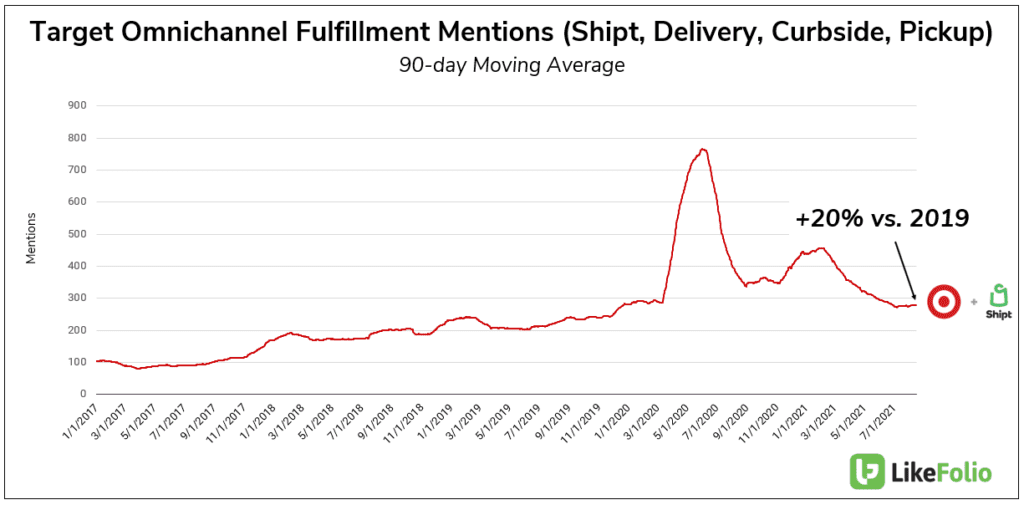

Target Happiness is 14 points higher vs. Walmart, and its Shipt brand bests the Target brand by 3 points. (Amazon Prime remains at the top of this list according to happiness data). Shipt is part of Target's same-day arsenal, also supported by order pickup and drive up services. Last quarter, Target's same-day services comprised more than half of Target's digital sales. This delivery trend continues to be the fastest-growing in the LikeFolio universe: +7% YoY on top of 2020's massive adoption surge. LikeFolio data shows stickiness in these omnichannel fulfillment options in the current quarter: +20% vs. 2019.

Looking ahead, we've got our eye on two categories: Apparel and Beauty.

- Back-to-School shopping mentions have increased +92% YoY vs. a muted 2020 season, and Target is a natural beneficiary from clothes to supplies. Generic "shopping for new clothes" mentions have risen +7% YoY.

- Ulta at Target is now live online, and mini-stores within stores are opening too. Investors expect synergy here, and we'll be monitoring closely.

Target reports 21Q2 Earnings August 18 before the bell.